Question: Please, answer the below question with showing the entire steps very clearly You are managing the $60 million equity portion of a mutual fund which

Please, answer the below question with showing the entire steps very clearly

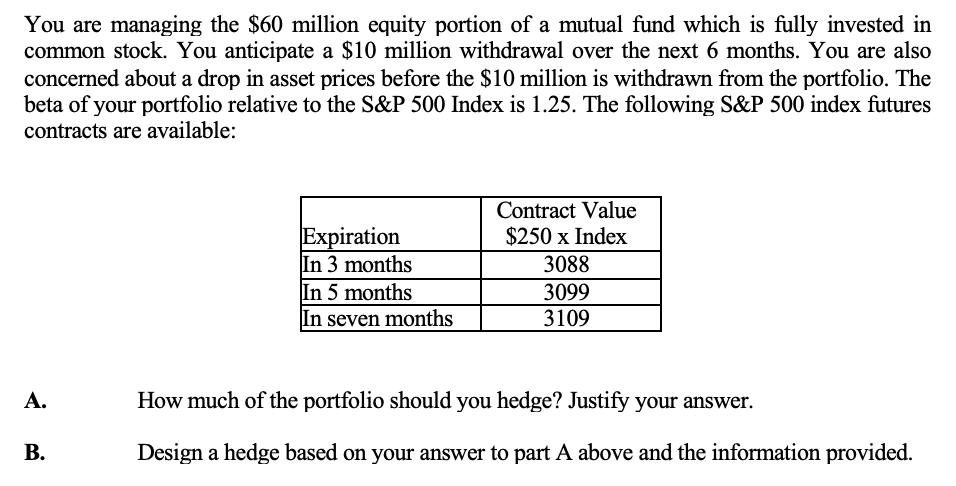

You are managing the $60 million equity portion of a mutual fund which is fully invested in common stock. You anticipate a $10 million withdrawal over the next 6 months. You are also concerned about a drop in asset prices before the $10 million is withdrawn from the portfolio. The beta of your portfolio relative to the S&P 500 Index is 1.25. The following S&P 500 index futures contracts are available: Expiration In 3 months In 5 months In seven months Contract Value $250 x Index 3088 3099 3109 How much of the portfolio should you hedge? Justify your answer. Design a hedge based on your answer to part A above and the information provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts