Question: Please, answer the below question with showing the entire steps very clearly. You expect the price of the stock to fall, but in a limited

Please, answer the below question with showing the entire steps very clearly.

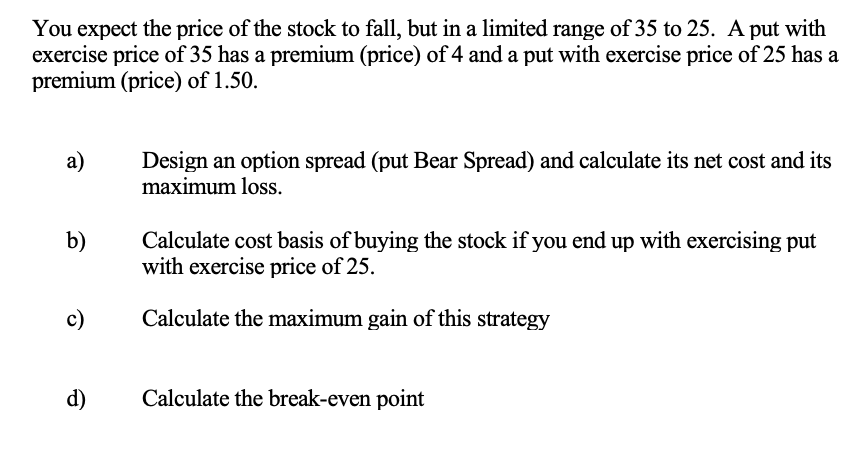

You expect the price of the stock to fall, but in a limited range of 35 to 25. A put with exercise price of 35 has a premium (price) of 4 and a put with exercise price of 25 has a premium (price) of 1.50. a) Design an option spread (put Bear Spread) and calculate its net cost and its maximum loss. Calculate cost basis of buying the stock if you end up with exercising put with exercise price of 25. Calculate the maximum gain of this strategy Calculate the break-even point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts