Question: Please, answer the below question with showing the entire steps very clearly. An interest rate option (CAP) at a 6% with a premium of 0.3%

Please, answer the below question with showing the entire steps very clearly.

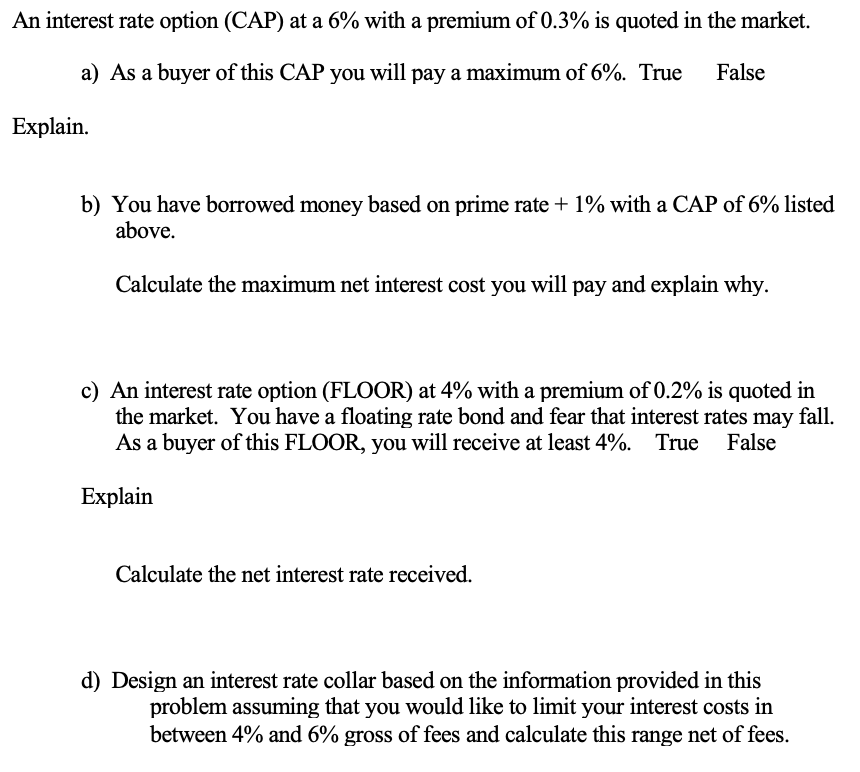

An interest rate option (CAP) at a 6% with a premium of 0.3% is quoted in the market a) As a buyer of this CAP you will pay a maximum of 6%. True False Explain b) You have borrowed money based on prime rate + 1% with a CAP of 6% listed above Calculate the maximum net interest cost you will pay and explain why c) An interest rate option (FLOOR) at 4% with a premium of 0.2% is quoted in the market. You have a floating rate bond and fear that interest rates may fall As a buyer of this FLOOR, you will receive at least 4%. True False Explain Calculate the net interest rate received d) Design an interest rate collar based on the information provided in this problem assuming that you would like to limit your interest costs in between 4% and 6% gross of fees and calculate this range net of fees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts