Question: Please, answer the below question with showing the entire steps very clearly. Interest Rate Collar: A corporate treasurer is issuing a floating rate bond offering

Please, answer the below question with showing the entire steps very clearly.

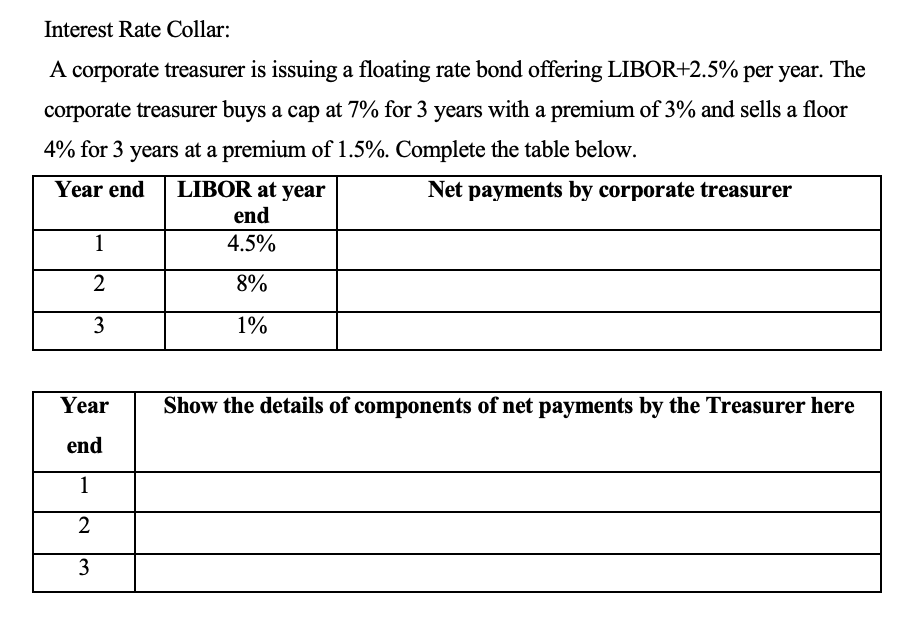

Interest Rate Collar: A corporate treasurer is issuing a floating rate bond offering LIBOR+2.5% per year. The corporate treasurer buys a cap at 7% for 3 years with a premium of 3% and sells a floor 4% for 3 years at a premium of 1.5%. Complete the table below. Year end | LIBOR at year | Net payments by corporate treasurer end 4.5% 8% 1% Year Show the details of components of net payments by the Treasurer here end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts