Question: please answer the case study Case 2: 222 The Triangle Property Holdings Ltd is borrowing 750m from the bank in stages to develop a landmark

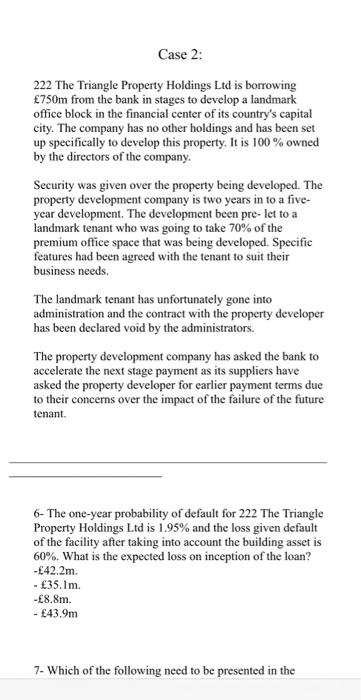

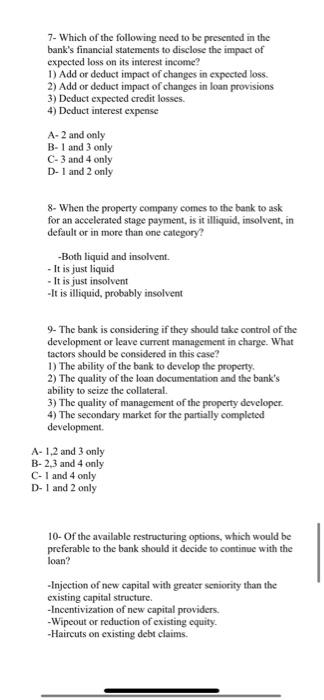

Case 2: 222 The Triangle Property Holdings Ltd is borrowing 750m from the bank in stages to develop a landmark office block in the financial center of its country's capital city. The company has no other holdings and has been set up specifically to develop this property. It is 100% owned by the directors of the company. Security was given over the property being developed. The property development company is two years in to a five- year development. The development been pre- let to a landmark tenant who was going to take 70% of the premium office space that was being developed. Specific features had been agreed with the tenant to suit their business needs. The landmark tenant has unfortunately gone into administration and the contract with the property developer has been declared void by the administrators. The property development company has asked the bank to accelerate the next stage payment as its suppliers have asked the property developer for earlier payment terms due to their concerns over the impact of the failure of the future tenant 6- The one-year probability of default for 222 The Triangle Property Holdings Ltd is 1.95% and the loss given default of the facility after taking into account the building asset is 60%. What is the expected loss on inception of the loan? - 42.2m. - 35.1m. -8.8m. - 43.9m 7- Which of the following need to be presented in the 7. Which of the following need to be presented in the bank's financial statements to disclose the impact of expected loss on its interest income? 1) Add or deduct impact of changes in expected loss. 2) Add or deduct impact of changes in loan provisions 3) Deduct expected credit losses. 4) Deduct interest expense A-2 and only B-1 and 3 only C-3 and 4 only D- 1 and 2 only 8- When the property company comes to the bank to ask for an accelerated stage payment, is it illiquid, insolvent, in default or in more than one category? -Both liquid and insolvent - It is just liquid - It is just insolvent -It is illiquid, probably insolvent 9- The bank is considering if they should take control of the development or leave current management in charge. What factors should be considered in this case? 1) The ability of the bank to develop the property 2) The quality of the loan documentation and the bank's ability to seize the collateral. 3) The quality of management of the property developer 4) The secondary market for the partially completed development. A- 1,2 and 3 only B-2,3 and 4 only C-1 and 4 only D- 1 and 2 only 10- of the available restructuring options, which would be preferable to the bank should it decide to continue with the loan? -Injection of new capital with greater seniority than the existing capital structure, - Incentivization of new capital providers. -Wipeout or reduction of existing cquity -Haircuts on existing debt claims. Case 2: 222 The Triangle Property Holdings Ltd is borrowing 750m from the bank in stages to develop a landmark office block in the financial center of its country's capital city. The company has no other holdings and has been set up specifically to develop this property. It is 100% owned by the directors of the company. Security was given over the property being developed. The property development company is two years in to a five- year development. The development been pre- let to a landmark tenant who was going to take 70% of the premium office space that was being developed. Specific features had been agreed with the tenant to suit their business needs. The landmark tenant has unfortunately gone into administration and the contract with the property developer has been declared void by the administrators. The property development company has asked the bank to accelerate the next stage payment as its suppliers have asked the property developer for earlier payment terms due to their concerns over the impact of the failure of the future tenant 6- The one-year probability of default for 222 The Triangle Property Holdings Ltd is 1.95% and the loss given default of the facility after taking into account the building asset is 60%. What is the expected loss on inception of the loan? - 42.2m. - 35.1m. -8.8m. - 43.9m 7- Which of the following need to be presented in the 7. Which of the following need to be presented in the bank's financial statements to disclose the impact of expected loss on its interest income? 1) Add or deduct impact of changes in expected loss. 2) Add or deduct impact of changes in loan provisions 3) Deduct expected credit losses. 4) Deduct interest expense A-2 and only B-1 and 3 only C-3 and 4 only D- 1 and 2 only 8- When the property company comes to the bank to ask for an accelerated stage payment, is it illiquid, insolvent, in default or in more than one category? -Both liquid and insolvent - It is just liquid - It is just insolvent -It is illiquid, probably insolvent 9- The bank is considering if they should take control of the development or leave current management in charge. What factors should be considered in this case? 1) The ability of the bank to develop the property 2) The quality of the loan documentation and the bank's ability to seize the collateral. 3) The quality of management of the property developer 4) The secondary market for the partially completed development. A- 1,2 and 3 only B-2,3 and 4 only C-1 and 4 only D- 1 and 2 only 10- of the available restructuring options, which would be preferable to the bank should it decide to continue with the loan? -Injection of new capital with greater seniority than the existing capital structure, - Incentivization of new capital providers. -Wipeout or reduction of existing cquity -Haircuts on existing debt claims

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts