Question: please answer the case study 108 Rectorsgate Property Holdings Ltd are looking to develop a landmark office block in the financial center of the capital

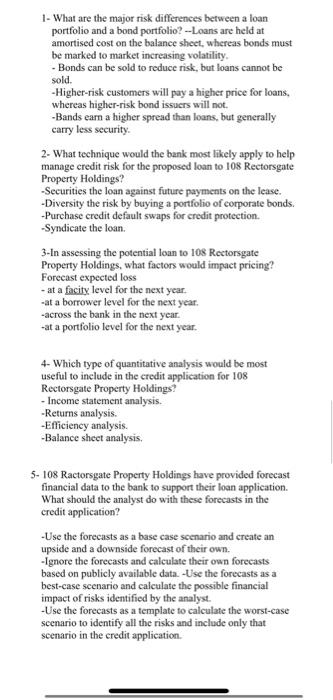

108 Rectorsgate Property Holdings Ltd are looking to develop a landmark office block in the financial center of the capital city. They will need to borrow 500m in stages as development takes place and intend to lease the property on completion. The lease income will be used to repay the loan. Security will be offered over the property being developed. Completion is expected in five years' time. The company has no other holdings and has been set up specifically to develop this property. The company has provided forecast financial statements in support of their application. 1- What are the major risk differences between a loan portfolio and a bond portfolio? --Loans are held at amortised cost on the balance sheet, whereas bonds must be marked to market increasing volatility. - Bonds can be sold to reduce risk, but loans cannot be sold. -Higher-risk customers will pay a higher price for loans, whereas higher-risk bond issuers will not -Bands earn a higher spread than loans, but generally carry less security. 2- What technique would the bank most likely apply to help manage credit risk for the proposed loan to 108 Rectorsgate Property Holdings? -Securities the loan against future payments on the lease. -Diversity the risk by buying a portfolio of corporate bonds. -Purchase credit default swaps for credit protection -Syndicate the loan 3-In assessing the potential loan to 108 Rectorsgate Property Holdings, what factors would impact pricing? Forecast expected loss - at a facity level for the next year. -at a borrower level for the next year. -across the bank in the next year. -at a portfolio level for the next year. 4- Which type of quantitative analysis would be most useful to include in the credit application for 108 Rectorsgate Property Holdings? -Income statement analysis. -Returns analysis. -Efficiency analysis - Balance sheet analysis 5- 108 Ractorsgate Property Holdings have provided forecast financial data to the bank to support their loan application. What should the analyst do with these forecasts in the credit application? - Use the forecasts as a base case scenario and create an upside and a downside forecast of their own. -ignore the forecasts and calculate their own forecasts based on publicly available data. - Use the forecasts as a best-case scenario and calculate the possible financial impact of risks identified by the analyst. - Use the forecasts as a template to calculate the worst-case scenario to identify all the risks and include only that scenario in the credit application. 108 Rectorsgate Property Holdings Ltd are looking to develop a landmark office block in the financial center of the capital city. They will need to borrow 500m in stages as development takes place and intend to lease the property on completion. The lease income will be used to repay the loan. Security will be offered over the property being developed. Completion is expected in five years' time. The company has no other holdings and has been set up specifically to develop this property. The company has provided forecast financial statements in support of their application. 1- What are the major risk differences between a loan portfolio and a bond portfolio? --Loans are held at amortised cost on the balance sheet, whereas bonds must be marked to market increasing volatility. - Bonds can be sold to reduce risk, but loans cannot be sold. -Higher-risk customers will pay a higher price for loans, whereas higher-risk bond issuers will not -Bands earn a higher spread than loans, but generally carry less security. 2- What technique would the bank most likely apply to help manage credit risk for the proposed loan to 108 Rectorsgate Property Holdings? -Securities the loan against future payments on the lease. -Diversity the risk by buying a portfolio of corporate bonds. -Purchase credit default swaps for credit protection -Syndicate the loan 3-In assessing the potential loan to 108 Rectorsgate Property Holdings, what factors would impact pricing? Forecast expected loss - at a facity level for the next year. -at a borrower level for the next year. -across the bank in the next year. -at a portfolio level for the next year. 4- Which type of quantitative analysis would be most useful to include in the credit application for 108 Rectorsgate Property Holdings? -Income statement analysis. -Returns analysis. -Efficiency analysis - Balance sheet analysis 5- 108 Ractorsgate Property Holdings have provided forecast financial data to the bank to support their loan application. What should the analyst do with these forecasts in the credit application? - Use the forecasts as a base case scenario and create an upside and a downside forecast of their own. -ignore the forecasts and calculate their own forecasts based on publicly available data. - Use the forecasts as a best-case scenario and calculate the possible financial impact of risks identified by the analyst. - Use the forecasts as a template to calculate the worst-case scenario to identify all the risks and include only that scenario in the credit application

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts