Question: PLEASE ANSWER THE ENTIRE QUESTION. It is not helpful if you only answer part of it! 10. Applications of option pricing to corporate finance Grotesque

PLEASE ANSWER THE ENTIRE QUESTION. It is not helpful if you only answer part of it!

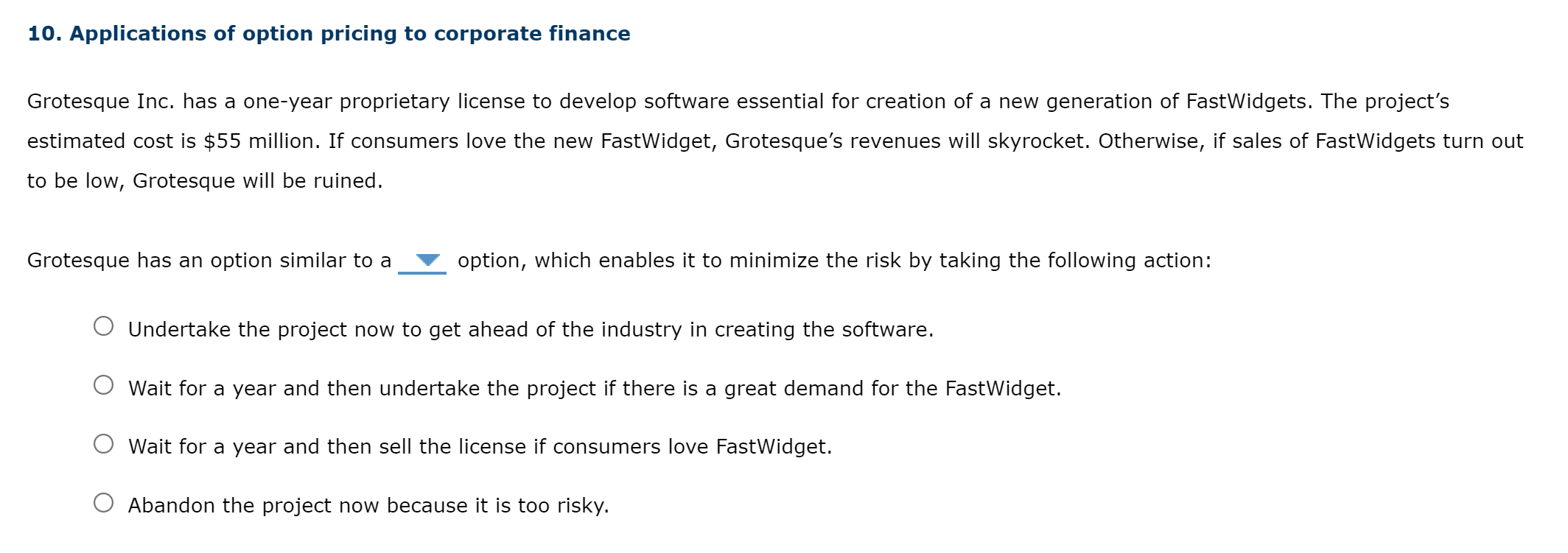

10. Applications of option pricing to corporate finance Grotesque Inc. has a one-year proprietary license to develop software essential for creation of a new generation of FastWidgets. The project's estimated cost is $55 million. If consumers love the new FastWidget, Grotesque's revenues will skyrocket. Otherwise, if sales of FastWidgets turn out to be low, Grotesque will be ruined. Grotesque has an option similar to a option, which enables it to minimize the risk by taking the following action: O Undertake the project now to get ahead of the industry in creating the software. Wait for a year and then undertake the project if there is a great demand for the FastWidget. Wait for a year and then sell the license if consumers love FastWidget. O Abandon the project now because it is too risky

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts