Question: Sony Corporation paid $350,000 cash for 42% of the voting common stock of Micro Inc. on January 1, 2021. Book value and fair value information

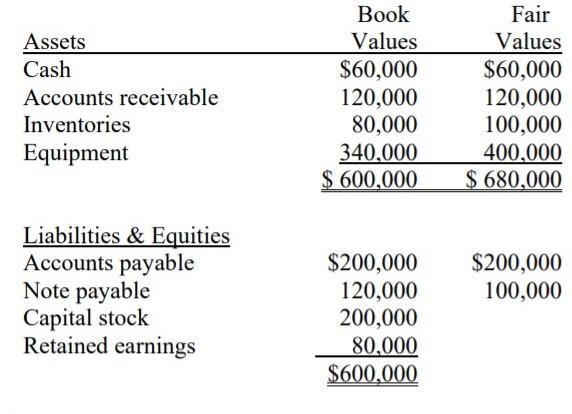

Sony Corporation paid $350,000 cash for 42% of the voting common stock of Micro Inc. on January 1, 2021. Book value and fair value information for Inc. in this date is as follows:

Instructions:

1. Prepare the journal entries for purchased investment.

2. Prepare the analysis of the cost versus the book value of the net assets of the investment bought in Micro Inc by Sony Corporation.

3. Prepare the schedule with the differences between the book value and the fair value of the identifiable net assets of Micro Inc.

4. At the end of the year, Micro Inc was:

a. Net Income for $300,000

b. Paid dividends at Dec 31, 2021 for $35,000

Prepare the journal entries related with net income and dividends received Sony Corporation for Micro Inc.

Book Fair Values $60,000 120,000 80,000 340,000 $ 600,000 Values $60,000 120,000 100,000 400,000 $680,000 Assets Cash Accounts receivable Inventories Equipment Liabilities & Equities Accounts payable Note payable Capital stock Retained earnings $200,000 120,000 200,000 80,000 $600,000 $200,000 100,000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

ANSWER Dade bebit credit 2021 Imvestment io Associted Sony Inc 350000 cash 350000 Ped ... View full answer

Get step-by-step solutions from verified subject matter experts