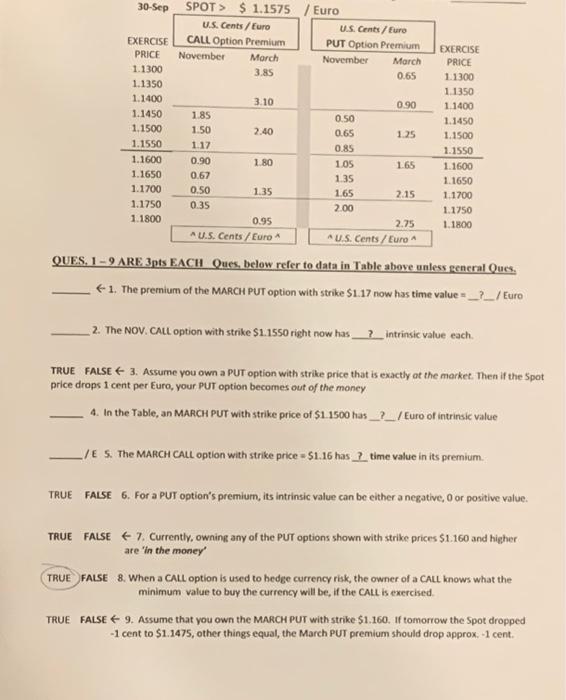

Question: Please answer the first 3 questions. I'll be sure to leave a thumbs up! 30-Sep SPOT> $ 1.1575 / Euro US. Cents / Euro US

30-Sep SPOT> $ 1.1575 / Euro US. Cents / Euro US Cents / Euro EXERCISE CALL Option Premium PUT Option Premium EXERCISE PRICE November Morch November March PRICE 1.1300 3.85 0.65 1.1300 1.1350 1.1350 1.1400 3.10 0.90 1.1400 1.1450 1.85 0.50 1.1450 1.1500 1.50 2.40 0.65 1.25 1.1500 1.1550 1.17 0.85 1.1550 1.1600 0.90 1.80 1.05 1.65 1.1600 1.1650 0.62 135 1.1650 1.1700 0.50 1.35 165 2.15 1.1700 1.1750 0.35 2.00 1.1750 1.1800 0.95 2.75 1.1800 A U.S. Cents / Euro A U.S. Cents / Euro ^ QUES. 1 - 9 ARE 3pts EACH Ques, below refer to data in Table above unless general Ques, 41. The premium of the MARCH PUT option with strike $1.17 now has time value = _?_/ Euro _2. The NOV. CALL option with strike $1.1550 right now has _?_intrinsie value each TRUE FALSE 3. Assume you own a PUT option with strike price that is exactly at the market. Then if the Spot price drops 1 cent per Euro, your PUT option becomes out of the money 4. In the Table, an MARCH PUT with strike price of $1. 1500 hus _?_/ Euro of intrinsic value VE S. The MARCH CALL option with strike price = 51.16 has 2 time value in its premium. TRUE FALSE 6. For a PUT option's premium, its intrinsic value can be either a negative, Oor positive value. TRUE FALSE 7. Currently, owning any of the PUT options shown with strike prices $1.160 and higher are 'in the money TRUE FALSE 8. When a CALL option is used to hedge currency risk, the owner of a CALL knows what the minimum value to buy the currency will be, if the CALL i exercised TRUE FALSE 9. Assume that you own the MARCH PUT with strike $1.160. If tomorrow the Spot dropped -1 cent to $1.1475, other things equal, the March PUT premium should drop approx. 1 cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts