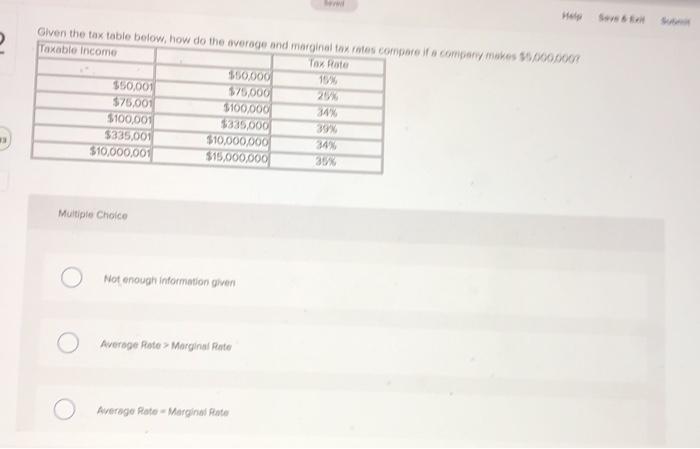

Question: please answer the first question Given the tax table below, how do the average and marginal tax rates compare if a company makes 100.000 Taxable

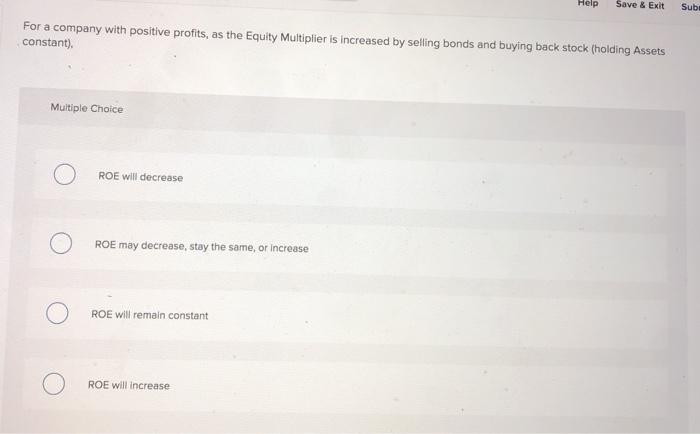

Given the tax table below, how do the average and marginal tax rates compare if a company makes 100.000 Taxable income Tax Rate $50.000 19 550.001 $75,000 $75.000 $100,000 $100,001 $335.000 $335.000 $10,000/000 34% 310,000,00 $15,000,000 30% Multiple Choice Not enough information given Averope Roto > Marginal Rate Average Rate - Marginal Rate Help Save & Exit Sub For a company with positive profits, as the Equity Multiplier is increased by selling bonds and buying back stock (holding Assets constant). Multiple Choice ROE will decrease ROE may decrease, stay the same, or increase ROE will remain constant ROE will increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts