Question: please answer the following for studying purposes III. Problems. Work the following problems in the space provided. Show your work for partial credit (even a

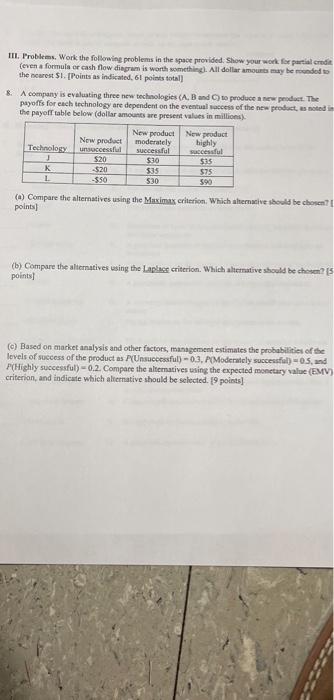

III. Problems. Work the following problems in the space provided. Show your work for partial credit (even a formula or cash flow diagram is worth something. All dollar amounts may be monded to the nearest $1. [Points as indicated, 61 points total] 8. A company is evaluating three new technologies (A, B and to produce a new product. The payoffs for each technology are dependent on the eventual scess of the new product, as noted in the payoff table below (dollar amounts are present values in millions) New product New product New product moderately highly Technology unsuccessful successful successful $20 $30 $35 $20 $35 $75 L -350 $30 590 (a) Compare the alternatives using the Maximas criterion. Which sherative should be chosen points) (b) Compare the alternatives using the Laplace criterion. Which alternative should be chosen points) () Based on market analysis and other factors, management estimates the probabilities of the levels of success of the product us P Unsuccessful)-0.3. PModerately successful)-0.5, and (Highly successful) -0.2. Compare the alternatives using the expected monetary value (EMV) criterion, and indicate which alternative should be selected. 19 points) III. Problems. Work the following problems in the space provided. Show your work for partial credit (even a formula or cash flow diagram is worth something. All dollar amounts may be monded to the nearest $1. [Points as indicated, 61 points total] 8. A company is evaluating three new technologies (A, B and to produce a new product. The payoffs for each technology are dependent on the eventual scess of the new product, as noted in the payoff table below (dollar amounts are present values in millions) New product New product New product moderately highly Technology unsuccessful successful successful $20 $30 $35 $20 $35 $75 L -350 $30 590 (a) Compare the alternatives using the Maximas criterion. Which sherative should be chosen points) (b) Compare the alternatives using the Laplace criterion. Which alternative should be chosen points) () Based on market analysis and other factors, management estimates the probabilities of the levels of success of the product us P Unsuccessful)-0.3. PModerately successful)-0.5, and (Highly successful) -0.2. Compare the alternatives using the expected monetary value (EMV) criterion, and indicate which alternative should be selected. 19 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts