Question: Please answer the following problems in the photos. 15. While checking the cash accounts of Gabu Company on December 31, 2020, the following information is

Please answer the following problems in the photos.

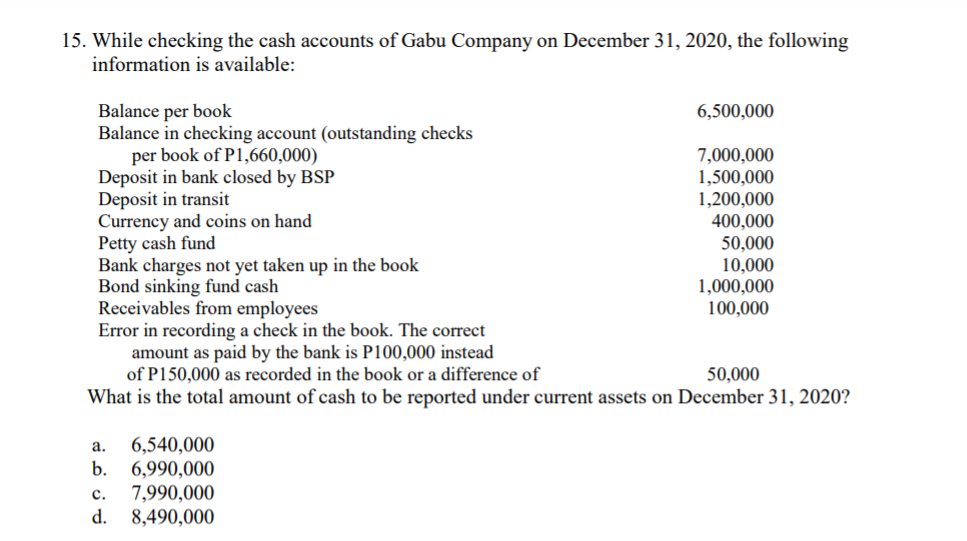

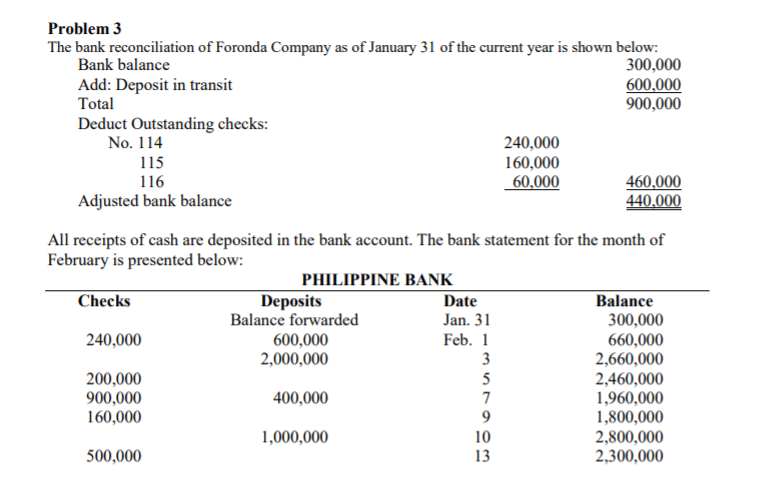

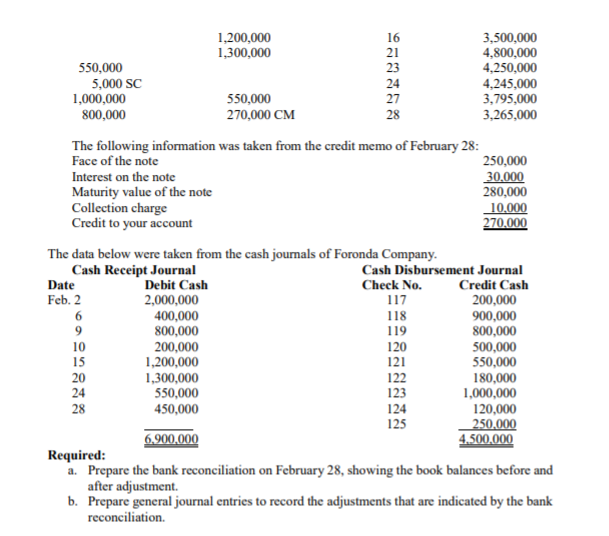

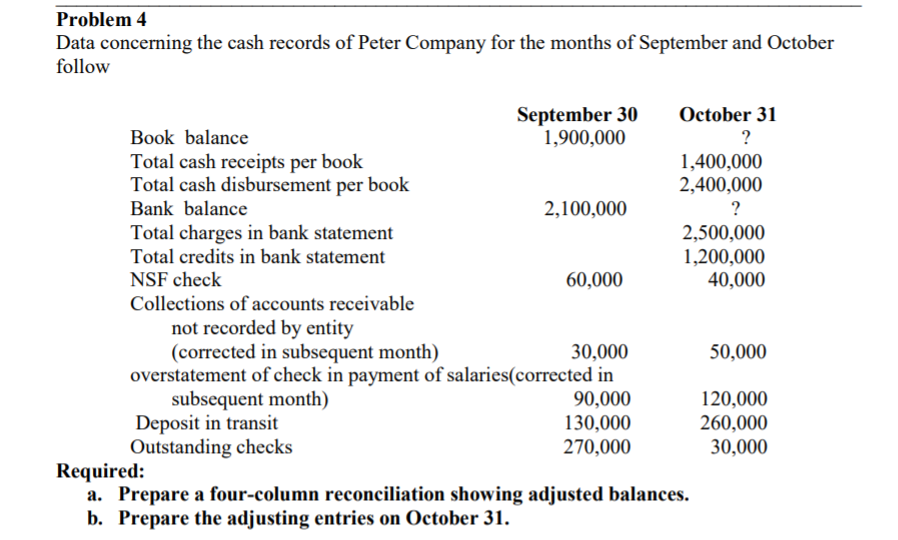

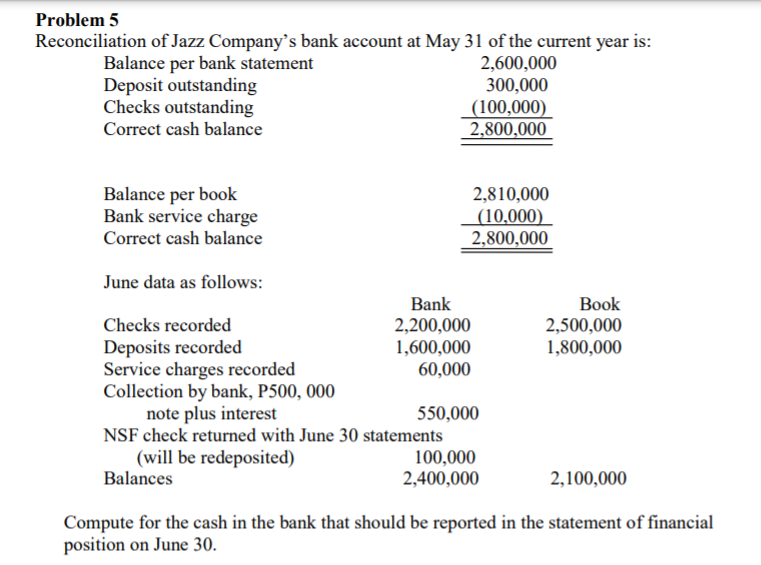

15. While checking the cash accounts of Gabu Company on December 31, 2020, the following information is available: Balance per book 6,500,000 Balance in checking account [outstanding checks per book of P1,660,000) ?,000,000 Deposit in bank closed by BSP 1,500,000 Deposit in transit 1,200,000 Currency and coins on hand 400,000 Petty cash md 50,000 Bank charges not yet taken up in the book 10,000 Bond sinking fund cash 1,000,000 Receivables from employees 100,000 Error in recording a check in the book. The correct amount as paid by the bank is P100.000 instead of P1 50,000 as recorded in the book or a difference of 50,000 What is the total amount of cash to be reported under current assets or: December 31, 2020? 3. 6,540,000 b. 6,990,000 c. 1,990,000 (1. 3,490, 000 Problem 3 The bank reconciliation of Foronda Company as of January 31 of the current year is shown below: Bank balance 300,000 Add: Deposit in transit 600,000 Total 900,000 Deduct Outstanding checks: No. 114 240,000 115 160,000 116 60.000 460,000 Adjusted bank balance 440.000 All receipts of cash are deposited in the bank account. The bank statement for the month of February is presented below: PHILIPPINE BANK Checks Deposits Date Balance Balance forwarded Jan. 31 300,000 240,000 600,000 Feb. 1 660,000 2,000,000 2,660,000 200,000 2,460,000 900,000 400,000 WODJUWE 1,960,000 160,000 1,800,000 1,000,000 2,800,000 500,000 2,300,0001,200,000 16 3,500,000 1,300,000 21 4.800,000 550,000 23 4.250,000 5,000 SC 24 4.245,000 1,000,000 550,000 27 3,795,000 800,000 270,000 CM 28 3,265,000 The following information was taken from the credit memo of February 28: Face of the note 250,000 Interest on the note 30.000 Maturity value of the note 280,000 Collection charge 10.000 Credit to your account 270.000 The data below were taken from the cash journals of Foronda Company. Cash Receipt Journal Cash Disbursement Journal Date Debit Cash Check No. Credit Cash Feb. 2 2,000,000 117 200,000 6 400,000 118 900,000 9 800,000 119 800,000 10 200,000 120 500,000 15 1,200,000 121 550,000 20 1,300,000 122 180,000 24 550,000 123 1,000,000 28 450,000 124 120,000 125 250.000 6,900,000 4,500,000 Required: a. Prepare the bank reconciliation on February 28, showing the book balances before and after adjustment. b. Prepare general journal entries to record the adjustments that are indicated by the bank reconciliation.Problem 4 Data concerning the cash records of Peter Company for the months of September and October follow September 30 October 3] Book balance 1,900,000 '3' Total cash receipts per book 1,400,000 Total cash disbursement per book 2,400,000 Bank balance 2,100,000 '3' Total charges in bank statement 2,500,000 Total credits in bank statement 1,200,000 NSF check 60,000 40,000 Collections of accounts receivable not recorded by entity (corrected in subsequent month) 30,000 50,000 overstatement of check in payment of salaries(eorrected in subsequent month) 90,000 120,000 Deposit in transit 130,000 260,000 Outstanding checks 210,000 30,000 Required: a. Prepare a four-column reconciliation showing adjusted balances. b. Prepare the adjusting entries on October 31. Problem 5 Reconciliation of Jazz Company's bank account at May 31 of the current year is: Balance per bank statement 2,600,000 Deposit outstanding 300,000 Checks outstanding g 100,000! Correct cash balance 2 800 000 Balance per book 2,810,000 Bank service charge [10,01]]: Correct cash balance 2,800,000 June data as follows: Bank Book Checks recorded 2,200,000 2,500,000 Deposits recorded 1,600,000 1,300,000 Service charges recorded 60,000 Collection by bank, P500, 000 note plus interest 550,000 NSF check returned with lune 30 statements (will be redeposited) 100,000 Balances 2,400,000 2,100,000 Compute for the cash in the bank that should be reported in the statement of nancial position on June 30