Question: Please answer the following question: A. A tax levied with the intention of discouraging consumption of the taxed item. B. The total tax paid divided

Please answer the following question:

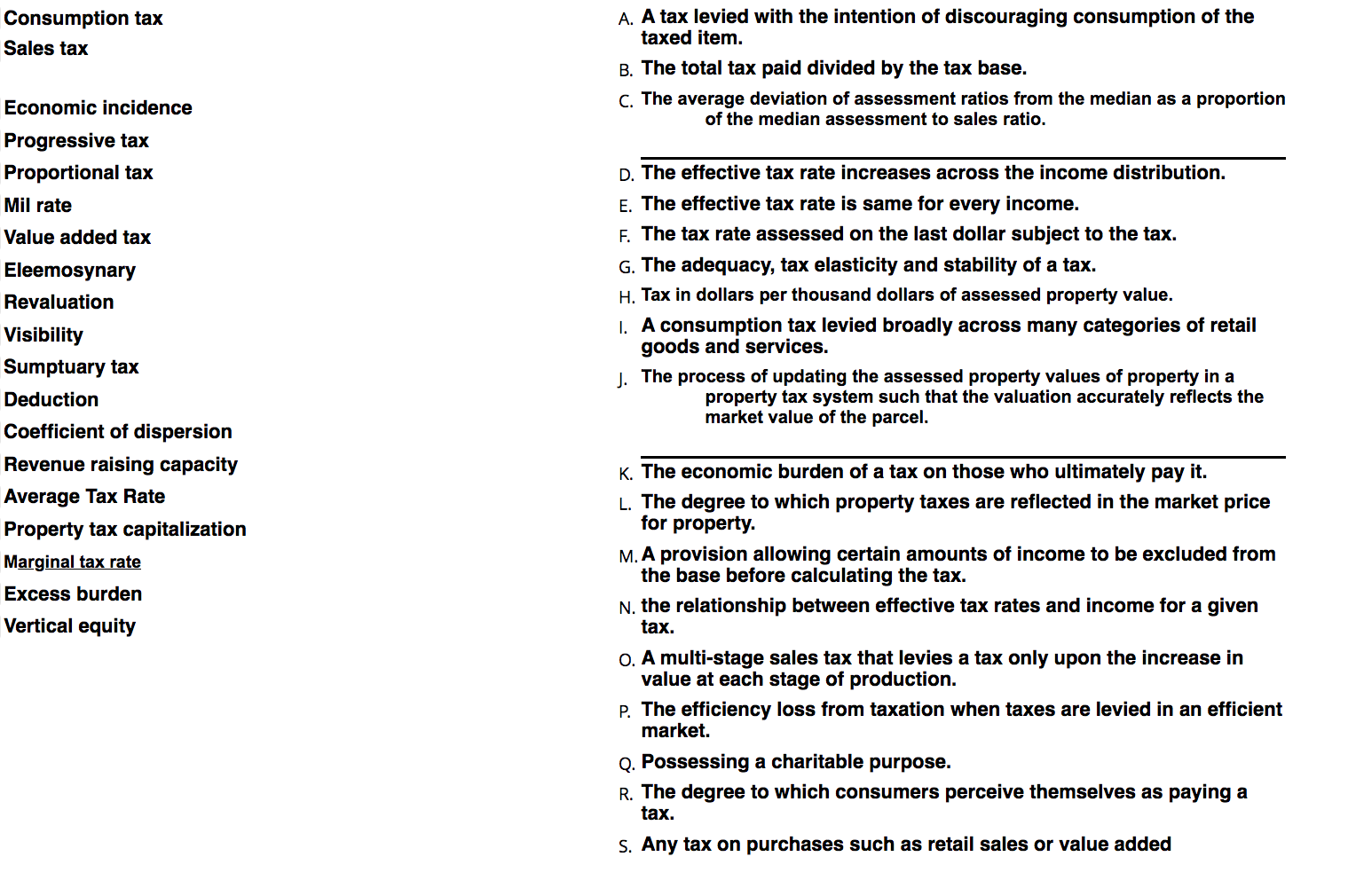

A. A tax levied with the intention of discouraging consumption of the taxed item. B. The total tax paid divided by the tax base. C. The average deviation of assessment ratios from the median as a proportion of the median assessment to sales ratio. D. The effective tax rate increases across the income distribution. E. The effective tax rate is same for every income. F. The tax rate assessed on the last dollar subject to the tax. G. The adequacy, tax elasticity and stability of a tax. H. Tax in dollars per thousand dollars of assessed property value. I. A consumption tax levied broadly across many categories of retail goods and services. J. The process of updating the assessed property values of property in a property tax system such that the valuation accurately reflects the market value of the parcel. K. The economic burden of a tax on those who ultimately pay it. L. The degree to which property taxes are reflected in the market price for property. M. A provision allowing certain amounts of income to be excluded from the base before calculating the tax. N. the relationship between effective tax rates and income for a given tax. O. A multi-stage sales tax that levies a tax only upon the increase in value at each stage of production. P. The efficiency loss from taxation when taxes are levied in an efficient market. Q. Possessing a charitable purpose. R. The degree to which consumers perceive themselves as paying a tax. S. Any tax on purchases such as retail sales or value added

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts