Question: Please Answer the following question, No additional graph/data available. Question 1 A construction company is considering replacing one of its tower cranes with a newer

Please Answer the following question, No additional graph/data available.

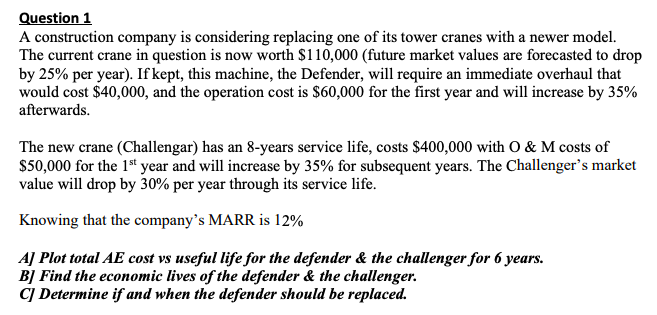

Question 1 A construction company is considering replacing one of its tower cranes with a newer model. The current crane in question is now worth $110,000 (future market values are forecasted to drop by 25% per year). If kept, this machine, the Defender, will require an immediate overhaul that would cost $40,000, and the operation cost is $60,000 for the first year and will increase by 35% afterwards. The new crane (Challengar) has an 8-years service life, costs $400,000 with O & M costs of $50,000 for the 15 year and will increase by 35% for subsequent years. The Challenger's market value will drop by 30% per year through its service life. Knowing that the company's MARR is 12% AJ Plot total AE cost vs useful life for the defender & the challenger for 6 years. BJ Find the economic lives of the defender & the challenger. CJ Determine if and when the defender should be replaced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts