Question: Please answer the following question. Please provide any formulas or explanation needed. 4. Starry Night Caf is considering the purchase of new equipment that would

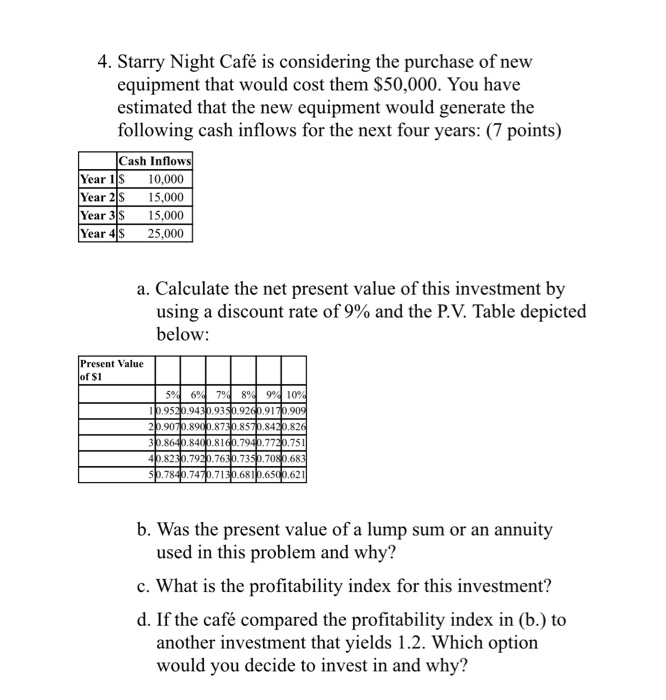

4. Starry Night Caf is considering the purchase of new equipment that would cost them $50,000. You have estimated that the new equipment would generate the following cash inflows for the next four years: (7 points) Cash Inflows Year 1 $ 10,000 Year 2$ 15,000 Year 3 $ 15,000 Year 4 $ 25,000 a. Calculate the net present value of this investment by using a discount rate of 9% and the P.V. Table depicted below: Present Value of $1 59 6% 7 8% 9% 10% 10.9520.943.9350.9260.9179.909 20.9070.8900.8730.8570.8420.826 30.8640.8400.8160.7940.7720.751 40.8230.7920.7630.7350.7080.683 50.7840.747.7130.6810.6500.621 b. Was the present value of a lump sum or an annuity used in this problem and why? c. What is the profitability index for this investment? d. If the caf compared the profitability index in (b.) to another investment that yields 1.2. Which option would you decide to invest in and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts