Question: Please answer the following question, would rate after received the answer, thank you! Suppose that there is a credit market with a fraction q of

Please answer the following question, would rate after received the answer, thank you!

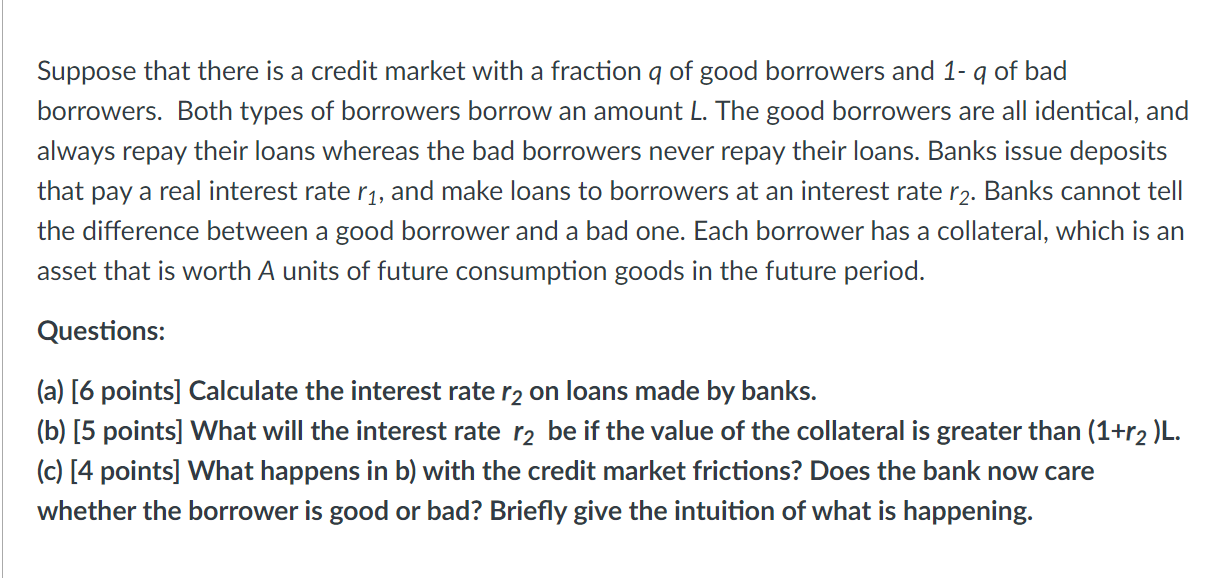

Suppose that there is a credit market with a fraction q of good borrowers and 1- q of bad borrowers. Both types of borrowers borrow an amount L. The good borrowers are all identical, and always repay their loans whereas the bad borrowers never repay their loans. Banks issue deposits that pay a real interest rate r1, and make loans to borrowers at an interest rate r2. Banks cannot tell the difference between a good borrower and a bad one. Each borrower has a collateral, which is an asset that is worth A units of future consumption goods in the future period. Questions: (a) [6 points] Calculate the interest rate r2 on loans made by banks. (b) [5 points] What will the interest rate r2 be if the value of the collateral is greater than (1+r2 )L. (c) [4 points] What happens in b) with the credit market frictions? Does the bank now care whether the borrower is good or bad? Briey give the intuition of what is happening

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts