Question: Please answer the following questions: 1. 2. 3. 4. 5. Which of the following is NOT deductibleon ScheduleA? SELECTONE Home mortgage interest. b Charitable cash

Please answer the following questions:

1.

2.

3.

4.

5.

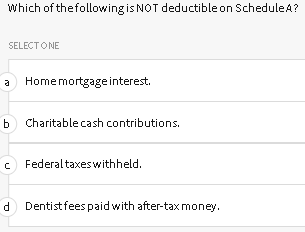

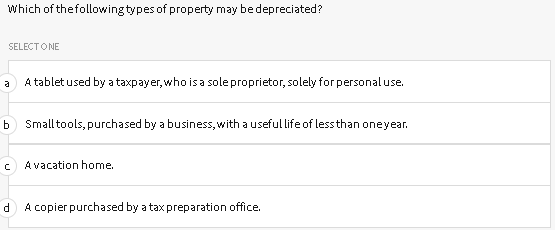

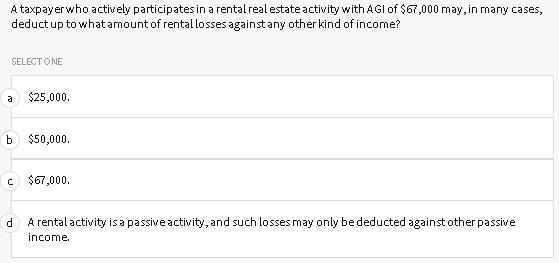

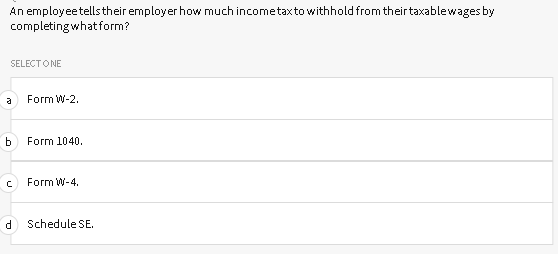

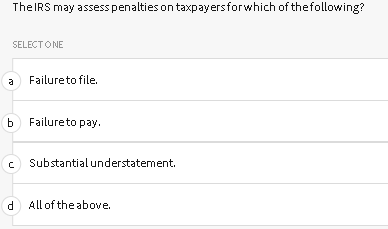

Which of the following is NOT deductibleon ScheduleA? SELECTONE Home mortgage interest. b Charitable cash contributions. . Federal taxes withheld. . d . Dentist fees paid with after-tax money, Which of the following types of property may be depreciated? SELECT ONE a A tablet used by a taxpayer, who is a sole proprietor, solely for personal use. b Smalltools, purchased by a business, with a useful life of less than one year. C A vacation home. d A copier purchased by a tax preparation office. A taxpayer who actively participates in a rental real estate activity with AGI of $67,000 may, in many cases, deduct up to what amount of rental losses against any other kind of income? SELECTONE a $25,000 b $50,000. c $67,000. d A rental activity is a passive activity, and such losses may only be deducted against other passive income. An employee tells their employer how much incometax to withhold from their taxablewages by completing whatform? SELECTONE Form W-2. b Form 1040 C Form W-4. d Schedule SE. The IRS may assess penalties on taxpayersforwhich of the following? SELECT ONE a Failure to file. b Failure to pay Substantialunderstatement. d All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts