Question: Please answer the following questions. 1. The table below presents year end stock prices for Stocks A, B, and C. Stocks B and C do

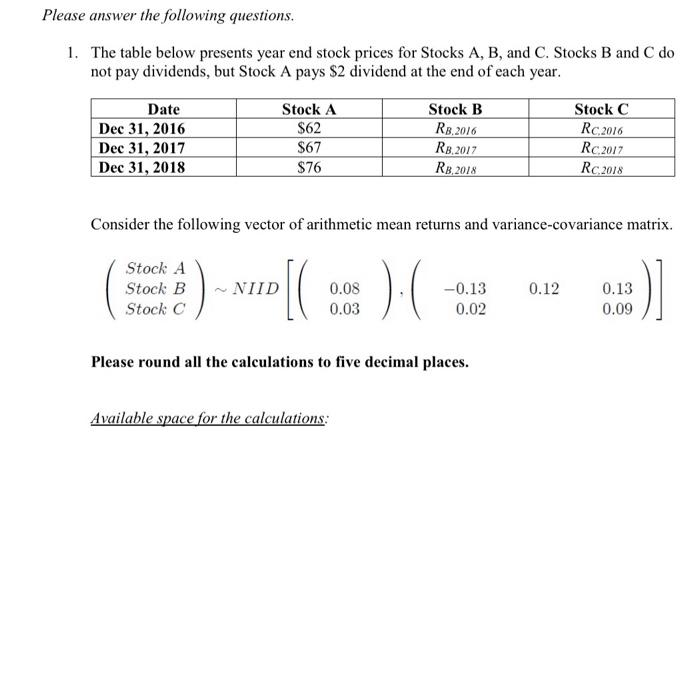

Please answer the following questions. 1. The table below presents year end stock prices for Stocks A, B, and C. Stocks B and C do not pay dividends, but Stock A pays $2 dividend at the end of each year. Date Stock A Stock B Stock C Dec 31, 2016 $62 R8,2016 RC.2016 Dec 31, 2017 $67 R3.2017 RC 2017 Dec 31, 2018 $76 R8,2018 RC 2018 Consider the following vector of arithmetic mean returns and variance-covariance matrix. Stock A Stock B Stock C NIID 0.12 0.08 0.03 -0.13 0.02 0.13 0.09 )] Please round all the calculations to five decimal places. Available space for the calculations. (a) Consider a portfolio of two stocks. Calculate the return and risk of a portfolio that invests 25% of the funds in Stock A and the rest of the funds in Stock C. (3 points) (b) Consider a portfolio of two stocks and the risk-free asset. Calculate the return and risk of a portfolio that invests 65% of the funds in Stock A and 60% of the funds in Stock C. The risk-free interest rate is 4%. (5 points) (c) Which of the above portfolios would be most attractive to a rational risk-averse invester? Explain (2 points) 11 Please answer the following questions. 1. The table below presents year end stock prices for Stocks A, B, and C. Stocks B and C do not pay dividends, but Stock A pays $2 dividend at the end of each year. Date Stock A Stock B Stock C Dec 31, 2016 $62 R8,2016 RC.2016 Dec 31, 2017 $67 R3.2017 RC 2017 Dec 31, 2018 $76 R8,2018 RC 2018 Consider the following vector of arithmetic mean returns and variance-covariance matrix. Stock A Stock B Stock C NIID 0.12 0.08 0.03 -0.13 0.02 0.13 0.09 )] Please round all the calculations to five decimal places. Available space for the calculations. (a) Consider a portfolio of two stocks. Calculate the return and risk of a portfolio that invests 25% of the funds in Stock A and the rest of the funds in Stock C. (3 points) (b) Consider a portfolio of two stocks and the risk-free asset. Calculate the return and risk of a portfolio that invests 65% of the funds in Stock A and 60% of the funds in Stock C. The risk-free interest rate is 4%. (5 points) (c) Which of the above portfolios would be most attractive to a rational risk-averse invester? Explain (2 points) 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts