Question: Please answer the following questions on paper making it clear your answer to each part: The current price of an underlying asset is $51 and

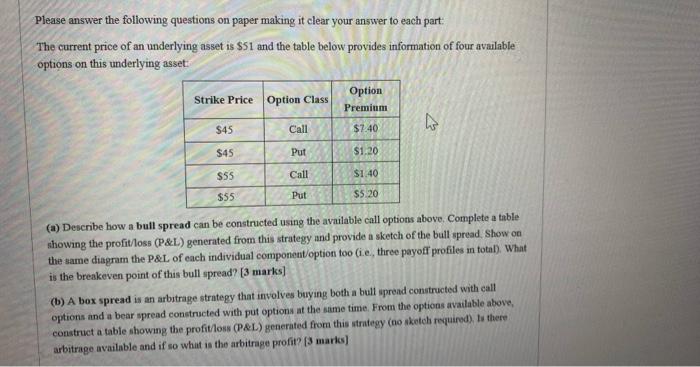

Please answer the following questions on paper making it clear your answer to each part: The current price of an underlying asset is $51 and the table below provides information of four available options on this underlying asset: (a) Describe how a bull spread can be constructed using the available call options above. Complete a table showing the profit/loss (P\&L) generated from this strategy and provide a sketch of the bull spread Show on the same diagram the P\&L of each individual component/option too (i.e., three payoff profiles in total). What is the breakeven point of this bull spread? [ 3 marks] (b) A box spread is an arbitrage strategy that involves buying both a bull iprend constructed with call options and a bear spread constructed with put options at the sume time. From the options available above, construct a table showing the profit/loss (PeL) generated from this atrategy (no sketeli requirod). 1i there arbitrage available and if so whit is the arbitrage profit? [3 mariss]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts