Question: Please answer the following questions through formulas(calculations) and explain if possible. Refrain from using Excel functions. Note that Part(d) is in the next image and

Please answer the following questions through formulas(calculations) and explain if possible. Refrain from using Excel functions. Note that Part(d) is in the next image and i need the calculations. So do not miss it. Thanks!

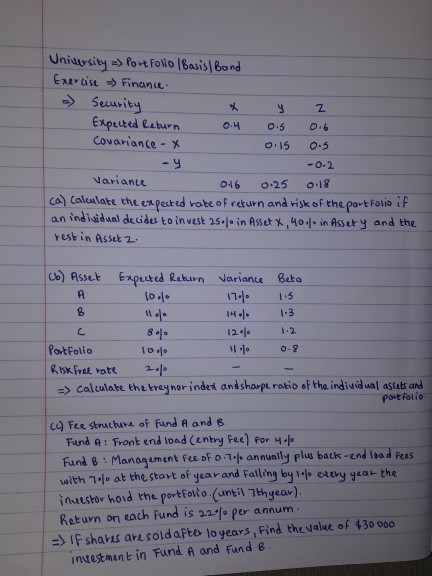

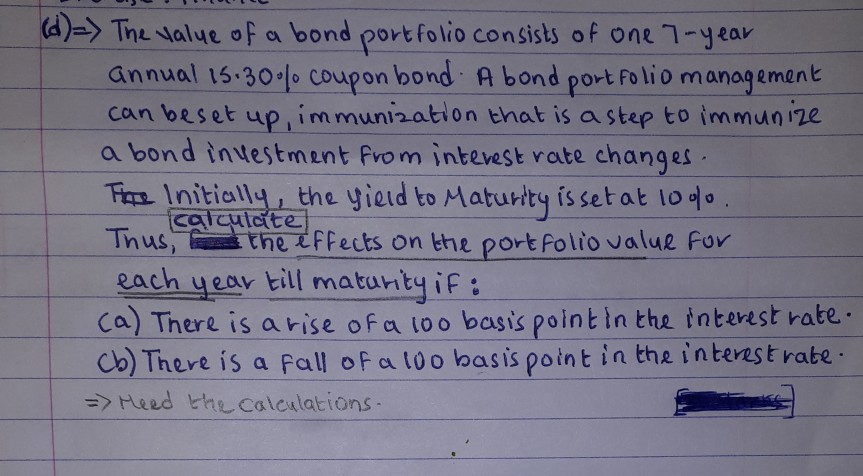

University => Portfolio Basis Bond Exercise Finance a) Security Expected Return 0.4 0.5 0.6 Covariance - x 0.15 0.5 -y -0.2 Variante 046 0-25 0.18 ca) Calculate the expected vote of return and visk of the portfolio it an individual decides to invest 25. in Asset x 40.1 in Astry and the Yest in Assut 2 Cb) Asset A Expected Return 10.10 Variante 17.00 Beta ls C 80% 12% 1.2 Portfolio 10. 1.1 0.9 Risk free rate 20% => calculate the treynor index and sharp ratio of the individual assets and portfolio C Fee Strutture of Fund A and B Fund : Front end load (entry fee for . Fund Management Fee DFD.7. annually plus back-end load Peas with 70 at the start of year and Falling by lo every year the investor hold the portfolio Cuntil 7th year). Return on each fund is 22.1. per annum. =) If shares are sold after lo years, Find the value of 430 000 intestment in Fund A and Fund B. (d)=) The value of a bond portfolio consists of one 7-year annual 15.30/ coupon bond. A bond portfolio management can be set up, immunization that is a step to immunize a bond investment from interest rate changes Time Initially, the yield to Maturity issetat to do I calculate on Thus, the effects on the portfolio value for each year till maturity if: (a) There is a rise of a 100 basis point in the interest rate.. Cb) There is a fall of a 100 basis point in the interest rate. => Head the calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts