Question: PLEASE ANSWER THE FULL QUESTION THEY ARE INTERELATED AND PART OF 1 MAIN QUESTION. IT IS URGENT THANK YOU! 6. a. Explain the differences and

PLEASE ANSWER THE FULL QUESTION THEY ARE INTERELATED AND PART OF 1 MAIN QUESTION.

IT IS URGENT THANK YOU!

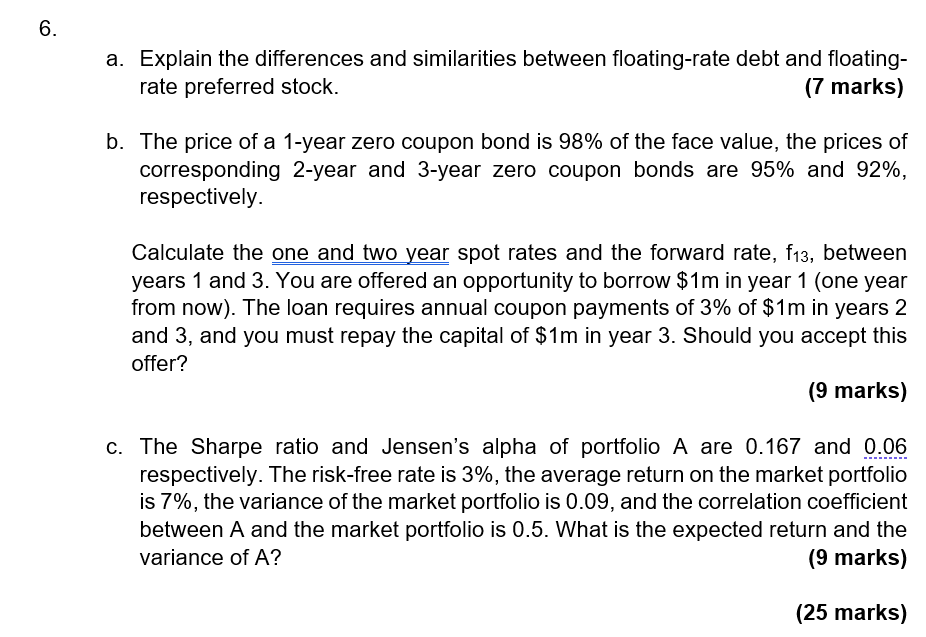

6. a. Explain the differences and similarities between floating-rate debt and floating- rate preferred stock. (7 marks) b. The price of a 1-year zero coupon bond is 98% of the face value, the prices of corresponding 2-year and 3-year zero coupon bonds are 95% and 92%, respectively. Calculate the one and two year spot rates and the forward rate, f13, between years 1 and 3. You are offered an opportunity to borrow $1m in year 1 (one year from now). The loan requires annual coupon payments of 3% of $1m in years 2 and 3, and you must repay the capital of $1m in year 3. Should you accept this offer? (9 marks) c. The Sharpe ratio and Jensen's alpha of portfolio A are 0.167 and 0.06 respectively. The risk-free rate is 3%, the average return on the market portfolio is 7%, the variance of the market portfolio is 0.09, and the correlation coefficient between A and the market portfolio is 0.5. What is the expected return and the variance of A? (9 marks) (25 marks) 6. a. Explain the differences and similarities between floating-rate debt and floating- rate preferred stock. (7 marks) b. The price of a 1-year zero coupon bond is 98% of the face value, the prices of corresponding 2-year and 3-year zero coupon bonds are 95% and 92%, respectively. Calculate the one and two year spot rates and the forward rate, f13, between years 1 and 3. You are offered an opportunity to borrow $1m in year 1 (one year from now). The loan requires annual coupon payments of 3% of $1m in years 2 and 3, and you must repay the capital of $1m in year 3. Should you accept this offer? (9 marks) c. The Sharpe ratio and Jensen's alpha of portfolio A are 0.167 and 0.06 respectively. The risk-free rate is 3%, the average return on the market portfolio is 7%, the variance of the market portfolio is 0.09, and the correlation coefficient between A and the market portfolio is 0.5. What is the expected return and the variance of A? (9 marks) (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts