Question: please answer the last question = - Q6. Firm NILO considers issuing F $10M face value zero-coupon debt. Over each of the two years, the

please answer the last question

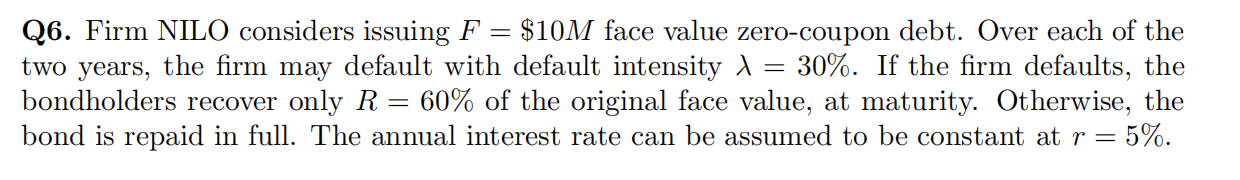

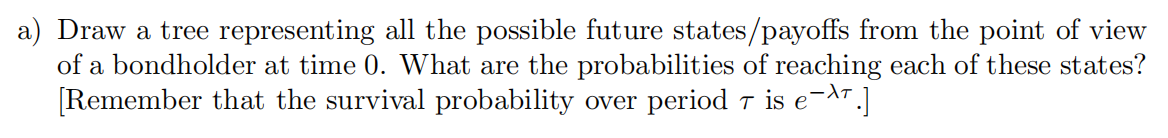

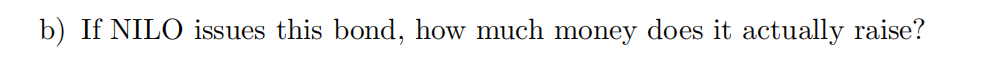

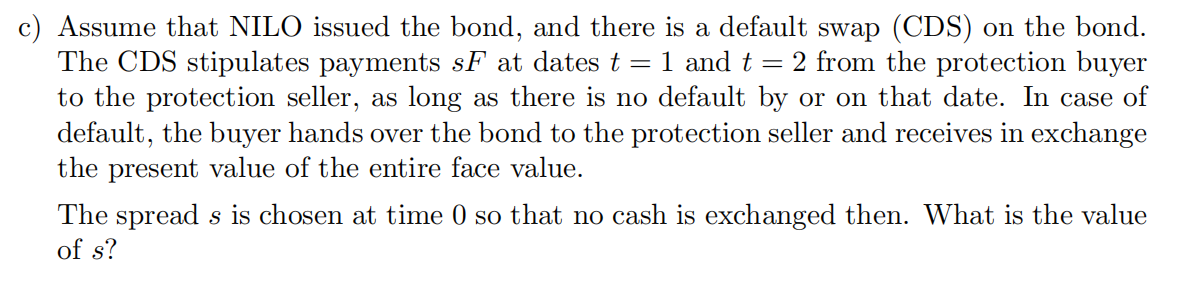

= - Q6. Firm NILO considers issuing F $10M face value zero-coupon debt. Over each of the two years, the firm may default with default intensity / 30%. If the firm defaults, the bondholders recover only R = 60% of the original face value, at maturity. Otherwise, the bond is repaid in full. The annual interest rate can be assumed to be constant at r = 5%. = a) Draw a tree representing all the possible future states/payoffs from the point of view of a bondholder at time 0. What are the probabilities of reaching each of these states? [Remember that the survival probability over period 1 is e-17.] b) If NILO issues this bond, how much money does it actually raise? c) Assume that NILO issued the bond, and there is a default swap (CDS) on the bond. The CDS stipulates payments sF at dates t = 1 and t = 2 from the protection buyer to the protection seller, as long as there is no default by or on that date. In case of default, the buyer hands over the bond to the protection seller and receives in exchange the present value of the entire face value. The spread s is chosen at time 0 so that no cash is exchanged then. What is the value of s? = - Q6. Firm NILO considers issuing F $10M face value zero-coupon debt. Over each of the two years, the firm may default with default intensity / 30%. If the firm defaults, the bondholders recover only R = 60% of the original face value, at maturity. Otherwise, the bond is repaid in full. The annual interest rate can be assumed to be constant at r = 5%. = a) Draw a tree representing all the possible future states/payoffs from the point of view of a bondholder at time 0. What are the probabilities of reaching each of these states? [Remember that the survival probability over period 1 is e-17.] b) If NILO issues this bond, how much money does it actually raise? c) Assume that NILO issued the bond, and there is a default swap (CDS) on the bond. The CDS stipulates payments sF at dates t = 1 and t = 2 from the protection buyer to the protection seller, as long as there is no default by or on that date. In case of default, the buyer hands over the bond to the protection seller and receives in exchange the present value of the entire face value. The spread s is chosen at time 0 so that no cash is exchanged then. What is the value of s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts