Question: please answer the second question = - Q6. Firm NILO considers issuing F $10M face value zero-coupon debt. Over each of the two years, the

please answer the second question

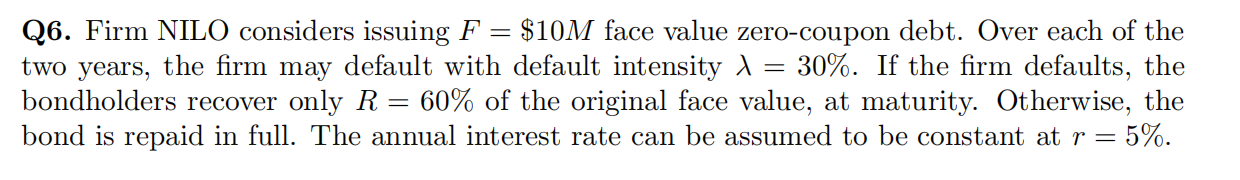

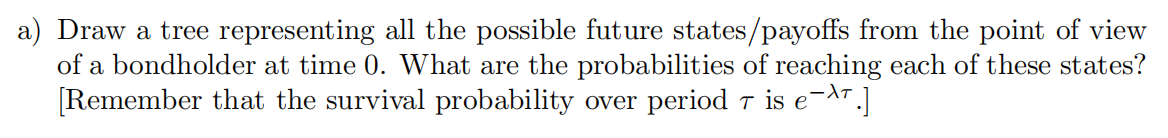

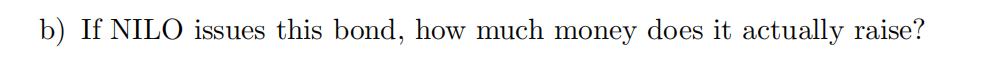

= - Q6. Firm NILO considers issuing F $10M face value zero-coupon debt. Over each of the two years, the firm may default with default intensity / 30%. If the firm defaults, the bondholders recover only R = 60% of the original face value, at maturity. Otherwise, the bond is repaid in full. The annual interest rate can be assumed to be constant at r = 5%. = a) Draw a tree representing all the possible future states/payoffs from the point of view of a bondholder at time 0. What are the probabilities of reaching each of these states? [Remember that the survival probability over period 1 is e-17.] b) If NILO issues this bond, how much money does it actually raise? = - Q6. Firm NILO considers issuing F $10M face value zero-coupon debt. Over each of the two years, the firm may default with default intensity / 30%. If the firm defaults, the bondholders recover only R = 60% of the original face value, at maturity. Otherwise, the bond is repaid in full. The annual interest rate can be assumed to be constant at r = 5%. = a) Draw a tree representing all the possible future states/payoffs from the point of view of a bondholder at time 0. What are the probabilities of reaching each of these states? [Remember that the survival probability over period 1 is e-17.] b) If NILO issues this bond, how much money does it actually raise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts