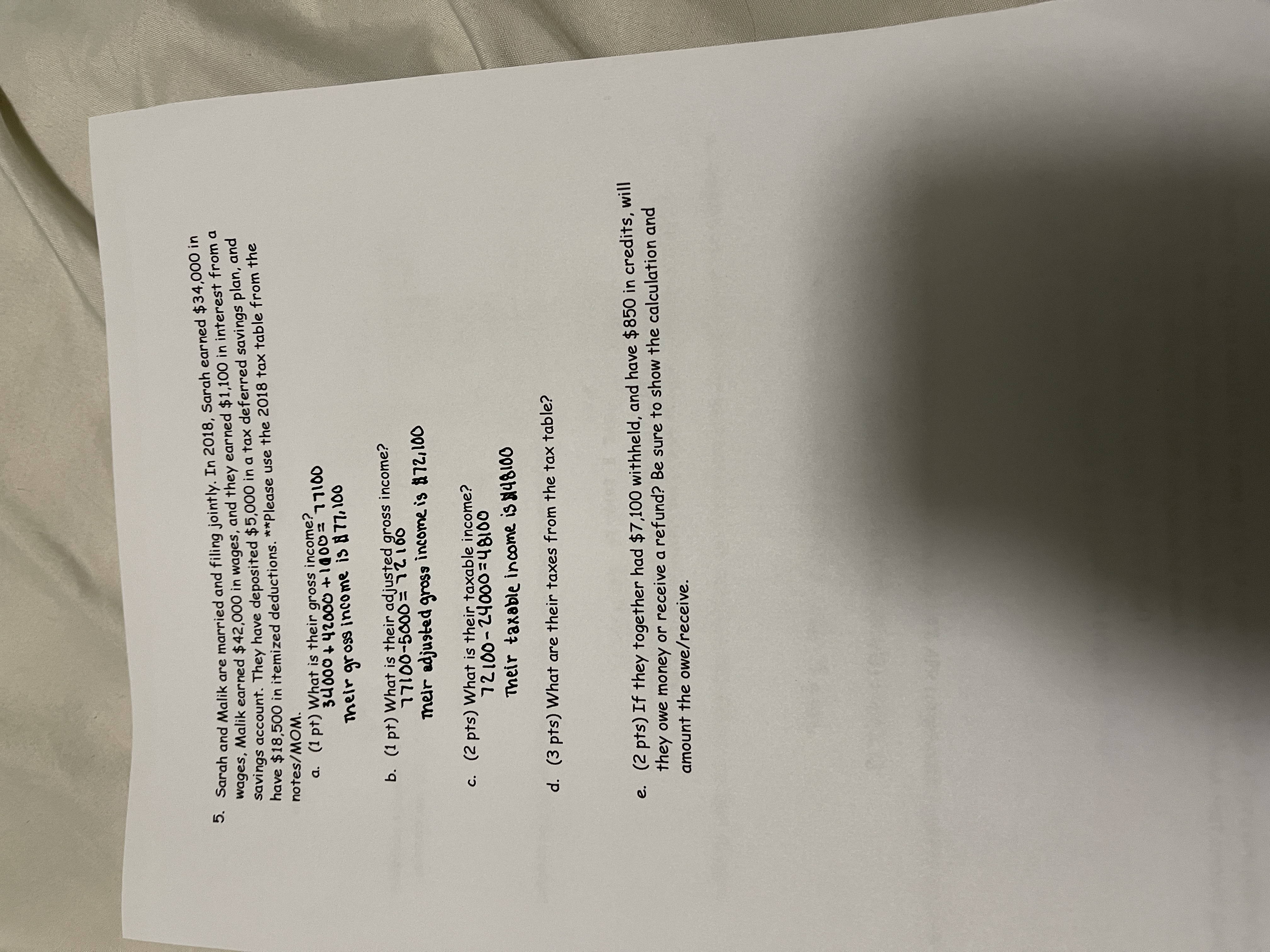

Question: Please answer the last two questions with the attached tax tables f2018 Tax Tables Source: httpswwwaaorg/publlc/pdf/Tax Guldepdf Standard deduction Married ling jointly and surviving spouses

Please answer the last two questions with the attached tax tables

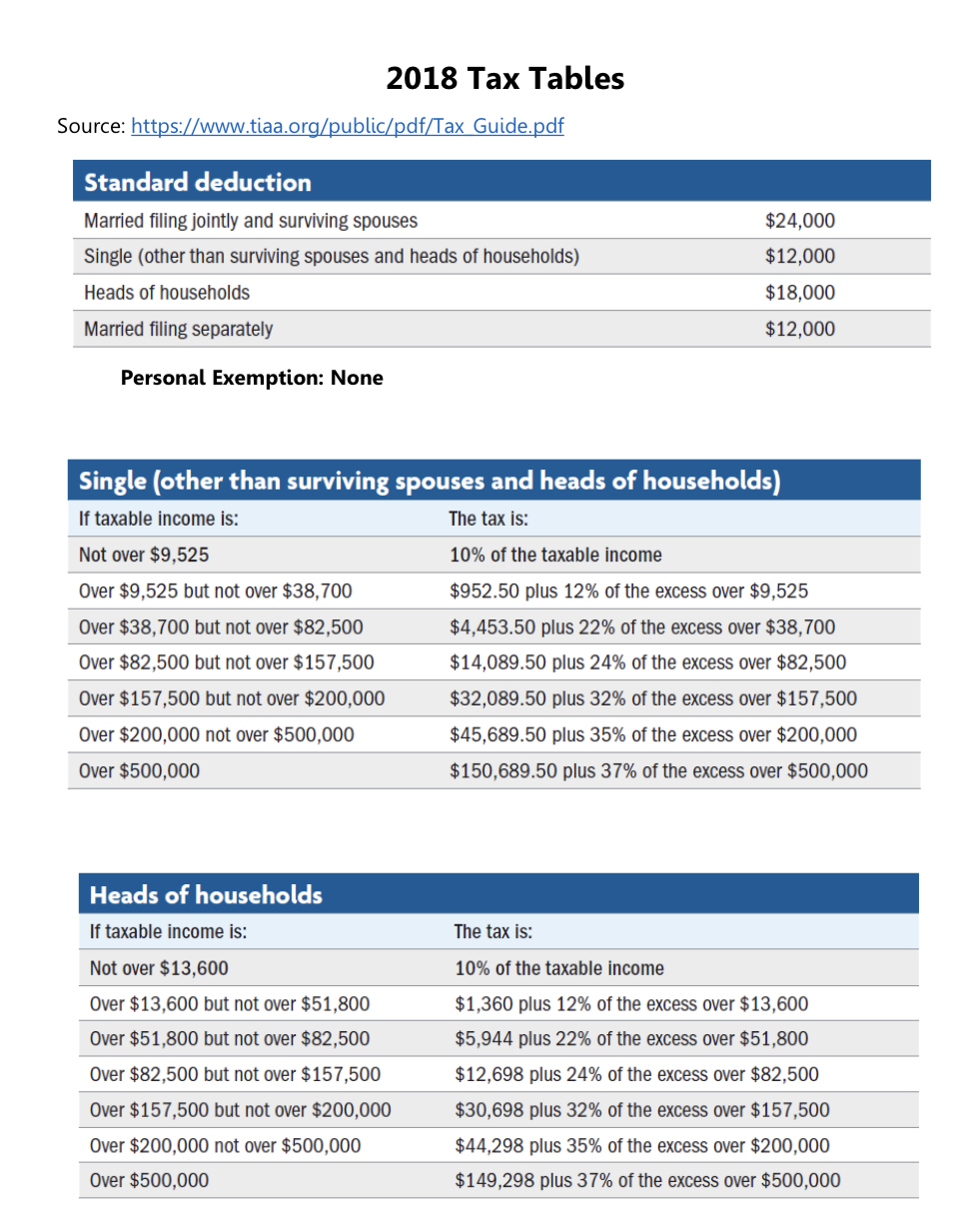

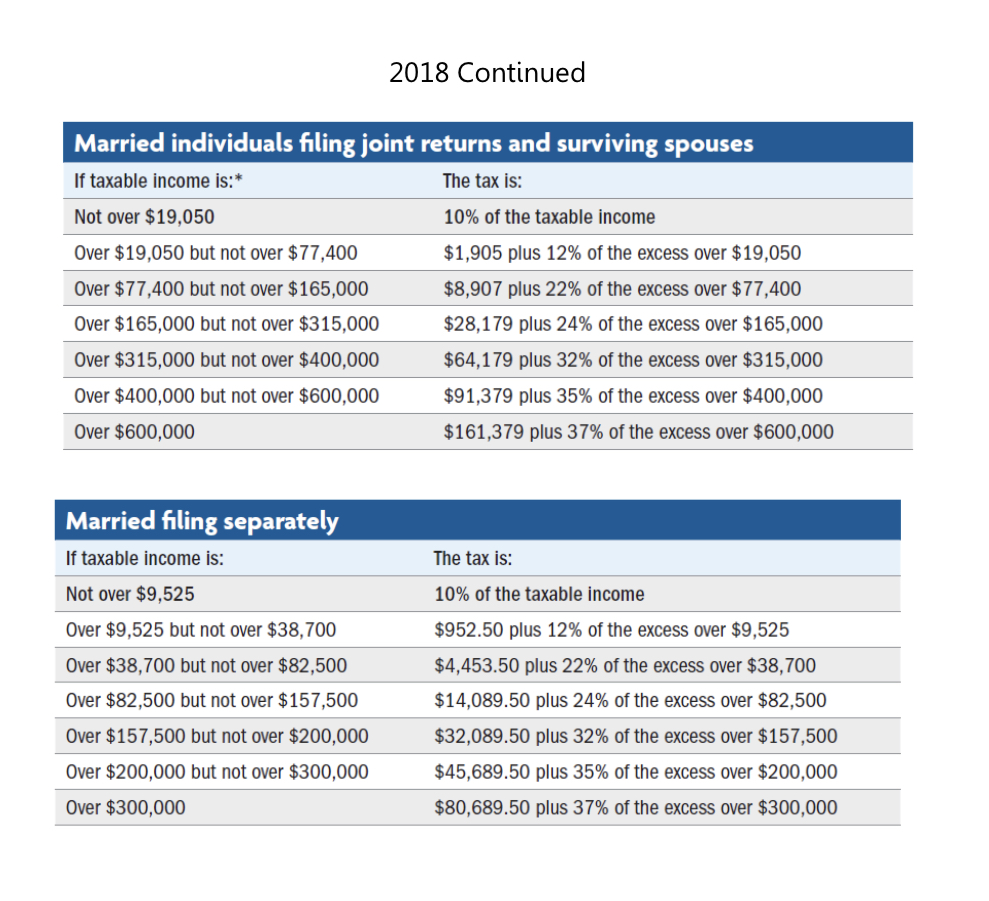

\f2018 Tax Tables Source: httpswwwaaorg/publlc/pdf/Tax Guldepdf Standard deduction Married ling jointly and surviving spouses $24,000 __ Single (other than surviving spouses and heads of households) $12,000 Heads of households $18,000 Married ling separater $12,000 Personal Exemption: None Single (other than surviving spouses and heads of households} If taxable Income Is: Not over $9,525 Over $9,525 but not over $38,700 - Over $38,700 but not over $82,500 The tax Is: 10% or the taxable income $952.50 plus 12% 0f the excess over $9,525 $4,453.50 plus 22% of the excess over $38,700 Over $82,500 but not over $157,500 Over $157,500 but not over $200,000 Over $200,000 not over $500,000 Over $500,000 $14,089.50 plus 24% of the excess over $82,500 $32,089.50 plus 32% 0f the excess over $157,500 $45,689.50 plus 35% 0f the excess over $200,000 $150,689.50 plus 37% of the excess over $500,000 Heads of households If taxable income is: Not over $13,600 The tax is: 10% 0f the taxable income Over $13,600 but not over $51,800 $1,360 plus 12% of the excess over $13,600 Over $51,800 but not over $32,500 Over $82,500 but not over $157,500 $5,944 plus 22% 0f the excess over $51,800 $12,698 plus 24% of the excess over $82,500 Over $15?,500 but not over $200,000 $30,698 plus 32% 0f the excess over $157,500 Over $200,000 not over $500,000 Over $500,000 $44,298 plus 35% of the excess over $200,000 $149,298 plus 37% of the excess over $500,000 2018 Continued Married individuals ling joint returns and surviving spouses If taxable Income is:* The tax is: Not over $19,050 10% of the taxable income Over $19,050 but not over $77,400 $1,905 plus 12% of the excess over $19,050 Over $77,400 but not over $165,000 $8,907 plus 22% of the excess over $77,400 Over $165,000 but not over $315,000 $28,179 plus 24% of the excess over $165,000 Over $315,000 but not over $400,000 $64,179 plus 32% of the excess over $315,000 Over $400,000 but not over $600,000 $91,379 plus 35% of the excess over $400,000 Over $600,000 $161,379 plus 37% of the excess over $600,000 If taxable income is: The tax is: Not over $9,525 10% of the taxable Income Over $9,525 but not over $38,700 $952.50 plus 12% of the excess over $9,525 Over $38,700 but not over $82,500 $4,453.50 plus 22% of the excess over $38,700 Over $82,500 but not over $157,500 $14,089.50 plus 24% oi the excess over $82,500 Over $157,500 but not over $200,000 $32,089.50 plus 32% of the excess over $157,500 Over $200,000 but not over $300,000 $45,689.50 plus 35% of the excess over $200,000 Over $300,000 $80,689.50 plus 3T% Of the excess over $300,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts