Question: please answer the most you can Question 1 For the following, fill in the blanks with the appropriate term(s). For questions that give you two

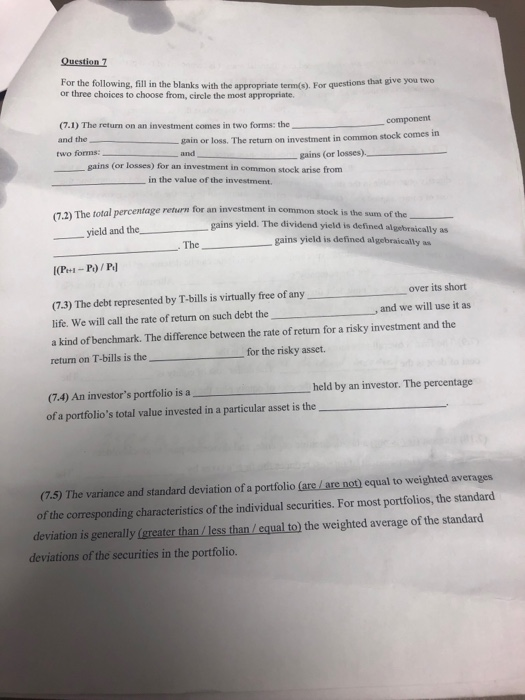

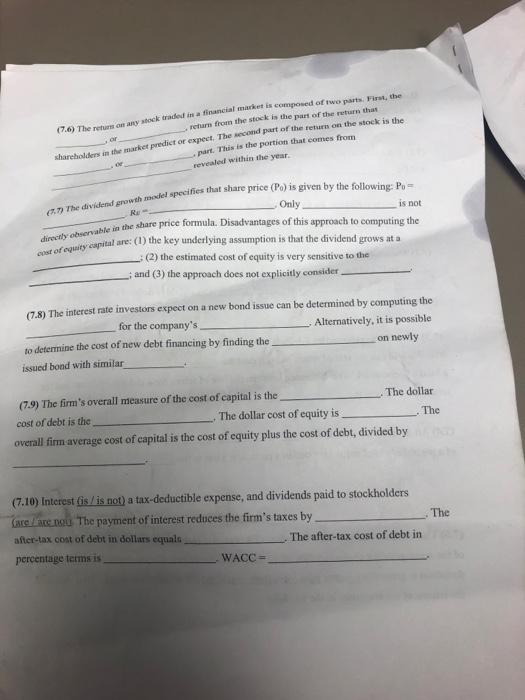

Question 1 For the following, fill in the blanks with the appropriate term(s). For questions that give you two or three choices to choose from, circle the most appropriate (7.1) The return on an investment comes in two forms: the and the component in gain or loss. The return on investment in common stock comes two forms:and gains (or losses) gains (or losses) for an investment in common stock arise from in the value of the investment, (7.2) The total percentage return for an investment in eld. The dividend yield is defined algebraically as gains yi yield and the gains yield is defined algebraically us The IP-P)/ P over its short (7.3) The debt represented by T-bills is virtually free of any life. We will call the rate of return on such debt theand we will use it as a kind of benchmark. The difference between the rate of return for a risky investment and the return on T-bills is the for the risky asset. held by an investor. The percentage (7.4) An investor's portfolio is a of a portfolio's total value invested in a particular asset is the (7.5) The variance and standard deviation of a portfolio (are/are not) equal to weighted averages of the corresponding characteristics of the individual securities. For most portfolios, the standard deviation is generally (greater than/less than /equal to) the weighted average of the standard deviations of the securities in the portfolio. any stock traded in a financial market is composed of two parts. First, the stock market predict or expect (7.6) The return on return from the stock is the part of the return that The second part of the return on the stock is the . part. This is the portion that eomes from revealed within the year shareholders in the model specifies that share price (Po) is given by the following: Po (.) The dividend growth RE Only is not the share price formula. Disadvantages of this approach to computing the al are: (1) the key underlying assumption is that the dividend grows at a : (2) the estimated cost of equity is very sensitive to the ty capital of equity cost ot and (3) the approach does not explicitly consider 7.8) The interest rate investors expect on a new bond issue can be determined by computing the for the company's Alternatively, it is possible to determine the cost of new debt financing by finding the on newly issued bond with similar (7.9) The firm's overall measure of the cost of capital is the cost of debt is the overall firm average cost of capital is the cost of equity plus the cost of debt, divided by . The dollar The dollar cost of equity is (7.10) Interest Gis lis not) a tax-deductible expense, and dividends paid to stockholders The payment of interest reduces the firm's taxes by The after-tax cost of debt in dollars equals The after-tax cost of debt in percentage terms is WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts