Question: Please answer the next question based on the closing July futures contract prices for EUR for four consecutive days in March 20XX. You sold two

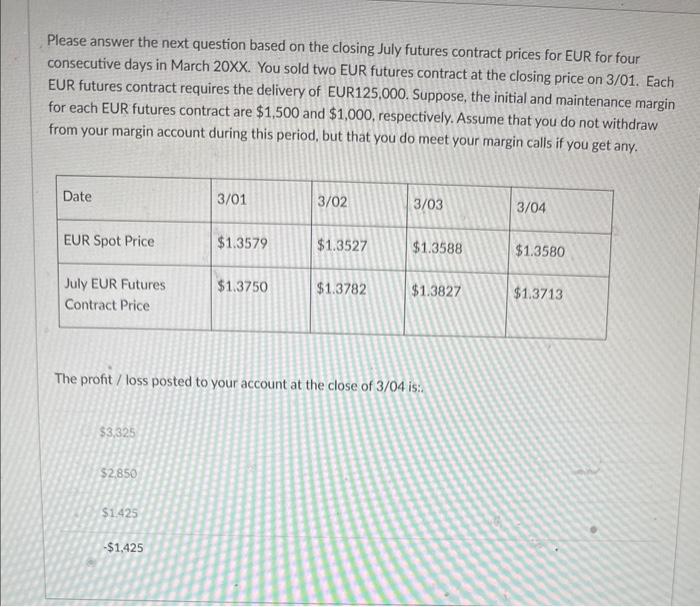

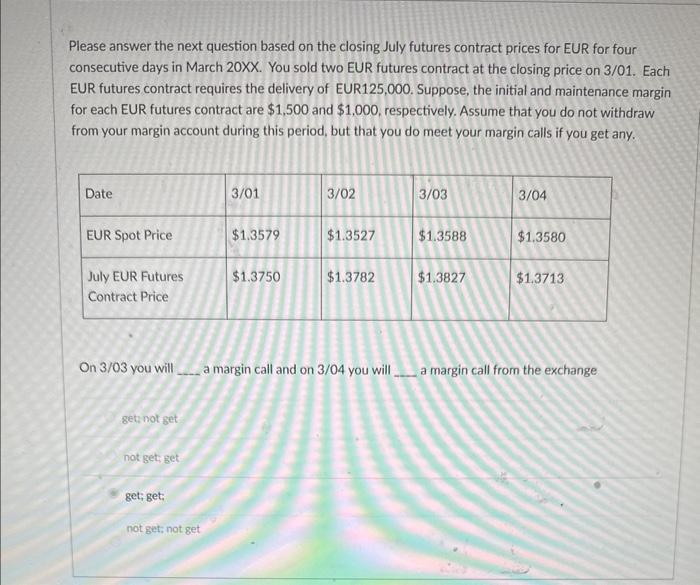

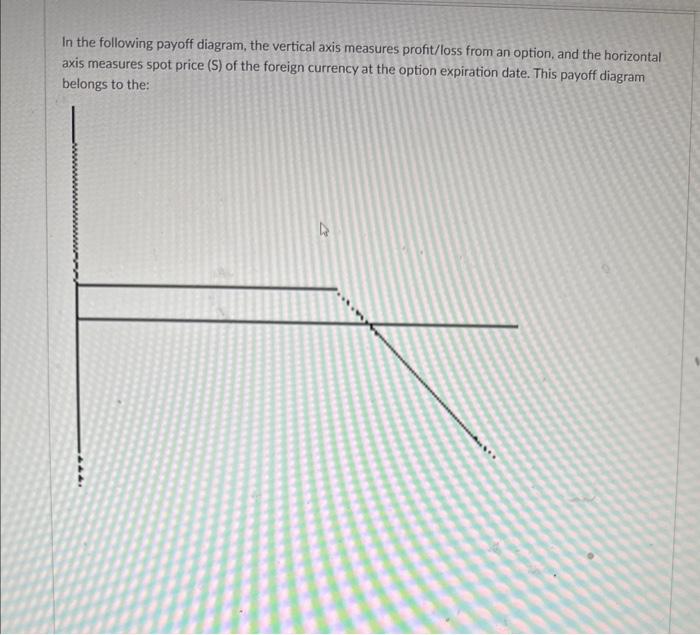

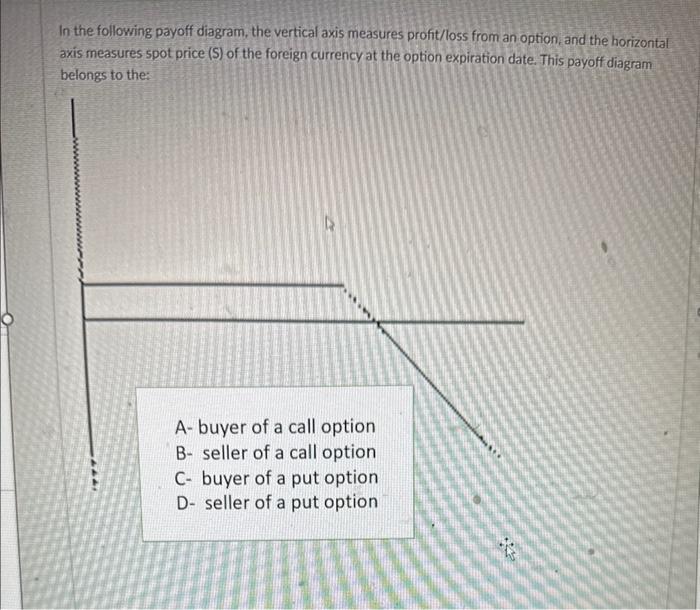

Please answer the next question based on the closing July futures contract prices for EUR for four consecutive days in March 20XX. You sold two EUR futures contract at the closing price on 3/01. Each EUR futures contract requires the delivery of EUR125,000. Suppose, the initial and maintenance margin for each EUR futures contract are $1,500 and $1,000, respectively. Assume that you do not withdraw from your margin account during this period, but that you do meet your margin calls if you get any. The profit / loss posted to your account at the close of 3/04 is:. $3,325 $2,850 $1.425 $1,425 Please answer the next question based on the closing July futures contract prices for EUR for four consecutive days in March 20XX. You sold two EUR futures contract at the closing price on 3/01. Each EUR futures contract requires the delivery of EUR125,000. Suppose, the initial and maintenance margin for each EUR futures contract are $1,500 and $1,000, respectively. Assume that you do not withdraw from your margin account during this period, but that you do meet your margin calls if you get any. On 3/03 you will a margin call and on 3/04 you will a margin call from the exchange gete not get not get get get; get: not get, not get In the following payoff diagram, the vertical axis measures profit/loss from an option, and the horizontal axis measures spot price (S) of the foreign currency at the option expiration date. This payoff diagram belongs to the: In the following payoff diagram, the vertical axis measures profit/loss from an option, and the horizontal axis measures spot price (S) of the foreign currency at the option expiration date. This payoff diagram belongs to the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts