Question: Please answer the next question based on the closing July futures contract prices for EUR for four consecutive days in March 20XX. You sold two

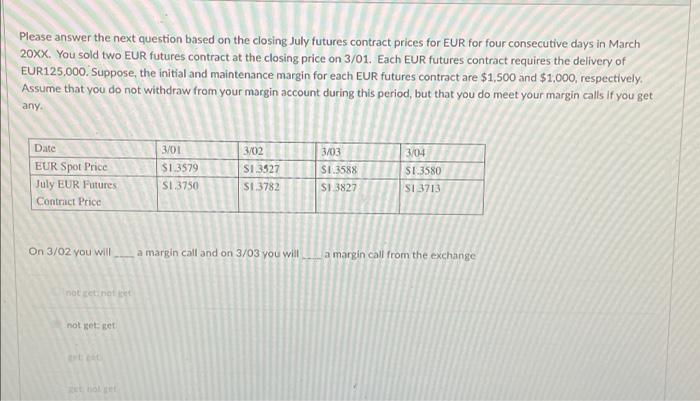

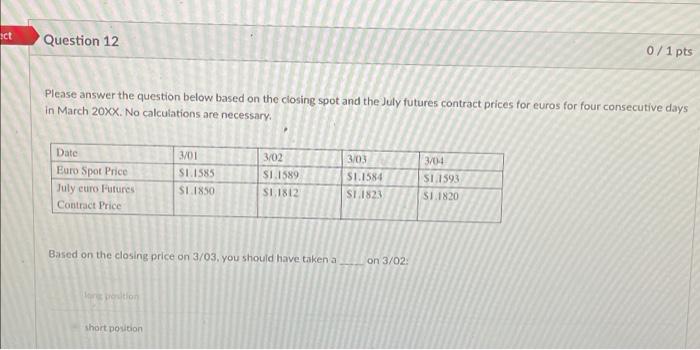

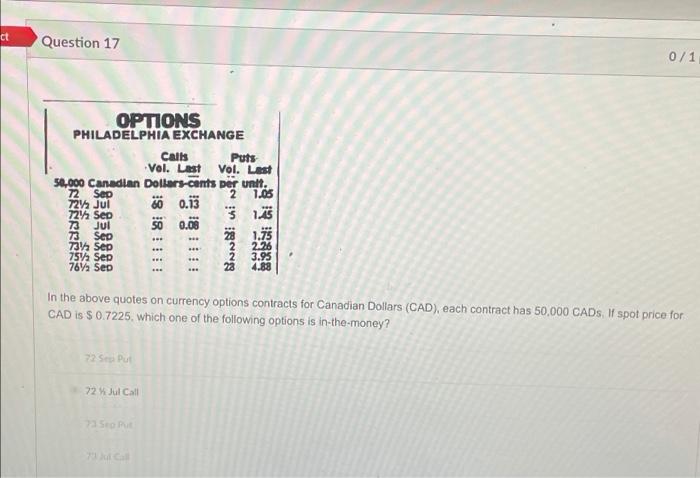

Please answer the next question based on the closing July futures contract prices for EUR for four consecutive days in March 20XX. You sold two EUR futures contract at the closing price on 3/01. Each EUR futures contract requires the delivery of EUR125,000. Suppose the initial and maintenance margin for each EUR futures contract are $1,500 and $1,000, respectively. Assume that you do not withdraw from your margin account during this period, but that you do meet your margin calls if you get any 3/01 3/02 S1.3927 Date EUR Spot Price July EUR Futures Contract Price $1.3579 S1,3750 3/03 SI.3588 SI 3827 304 SE3580 S13713 SI.3782 On 3/02 you will a margin call and on 3/03 you will a margin call from the exchange not get mot et not get set ict Question 12 0/1 pts Please answer the question below based on the closing spot and the July futures contract prices for euros for four consecutive days in March 20XX. No calculations are necessary. Date Euro Spot Price July euro Futures Contract Price 3701 S1.1585 SL 1850 3/02 SI.1589 SI 1812 3/03 S1.1584 S11823 3/04 SL1593 S1.1820 Based on the closing price on 3/03, you should have taken a on 3/02 ro short position ct Question 17 0/1 OPTIONS PHILADELPHIA EXCHANGE Calls Puts Vol. Last Vol. Les 50,000 Canadian Dollars-cents per unit. 72 Sep 1.05 7219 Jul 721) Sep 1.45 73 JUI SO 0.08 73 Sep 73 Sep 2 7572 Sep 2 3.95 767 Sep 4.88 60 0.13 118 8 In the above quotes on currency options contracts for Canadian Dollars (CAD), each contract has 50,000 CADs If spot price for CAD is $ 0.7225, which one of the following options is in-the-money? 72 scopul 22 Jul Call 23 Seo Pue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts