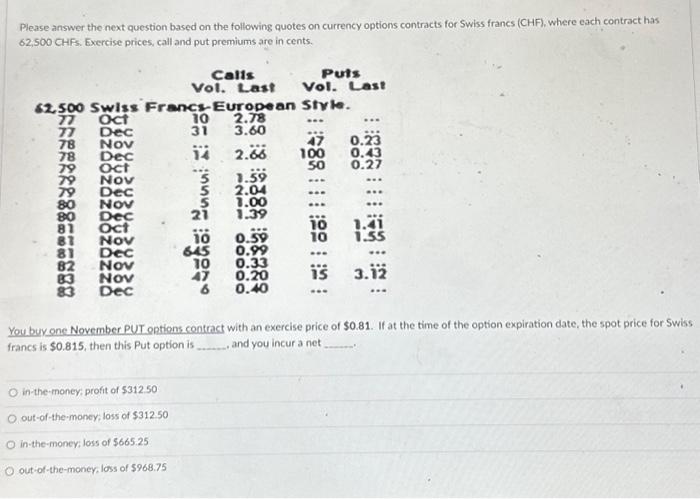

Question: Please answer the next question based on the following quotes on currency options contracts for Swiss francs (CHF), where each contract has 62,500 CHFs. Exercise

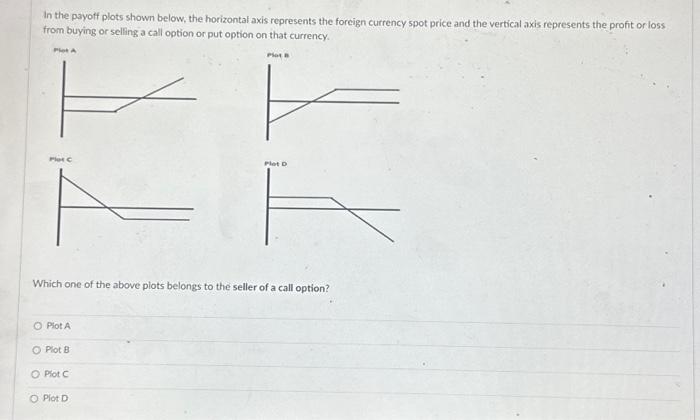

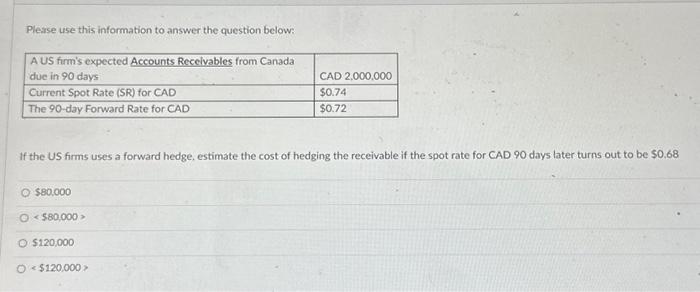

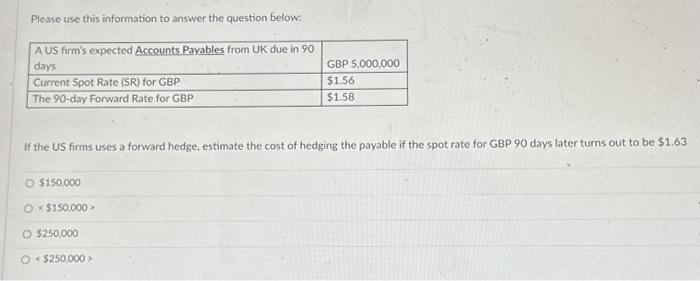

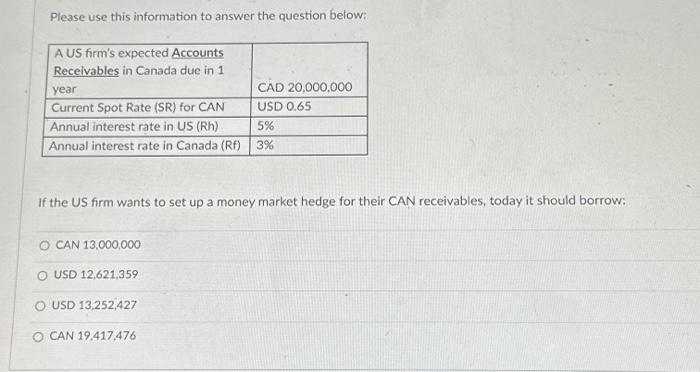

Please answer the next question based on the following quotes on currency options contracts for Swiss francs (CHF), where each contract has 62,500 CHFs. Exercise prices, call and put premiums are in cents. Vou buy one November PUT ontions contract with an exercise price of $0.81. If at the time of the option expiration date, the spot price for Swiss rancs is $0.815, then this Put option is , and you incur a net in the-money, profit of $312.50 out-of the-money, loss of $312.50 in-the-money; loss of \$665.25 out-of-the-moner, lass of $968.75 In the payoff plots shown below, the horizontal axis represents the foreign currency spot price and the vertical axis represents the profit or loss from buying or selling a call option or put option on that currency. Which one of the above plots belongs to the seller of a call option? Piot A Piot B Piot C Piot D Please use this information to answer the question below: If the US firms uses a forward hedge, estimate the cost of hedging the receivable if the spot rate for CAD 90 days later turns out to be S0.68 $80.000 $250,000 \& $250,000 ? Please use this information to answer the question below: If the US firm wants to set up a money market hedge for their CAN receivables, today it should borrow: CAN 13,000,000 USD 12,621,359 USD 13,252,427 CAN 19.417,476

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts