Question: Please answer the question above. Thank you! 18. Maxwell & Sylvia plan to set aside funds for their son's college education in an account earning

Please answer the question above. Thank you!

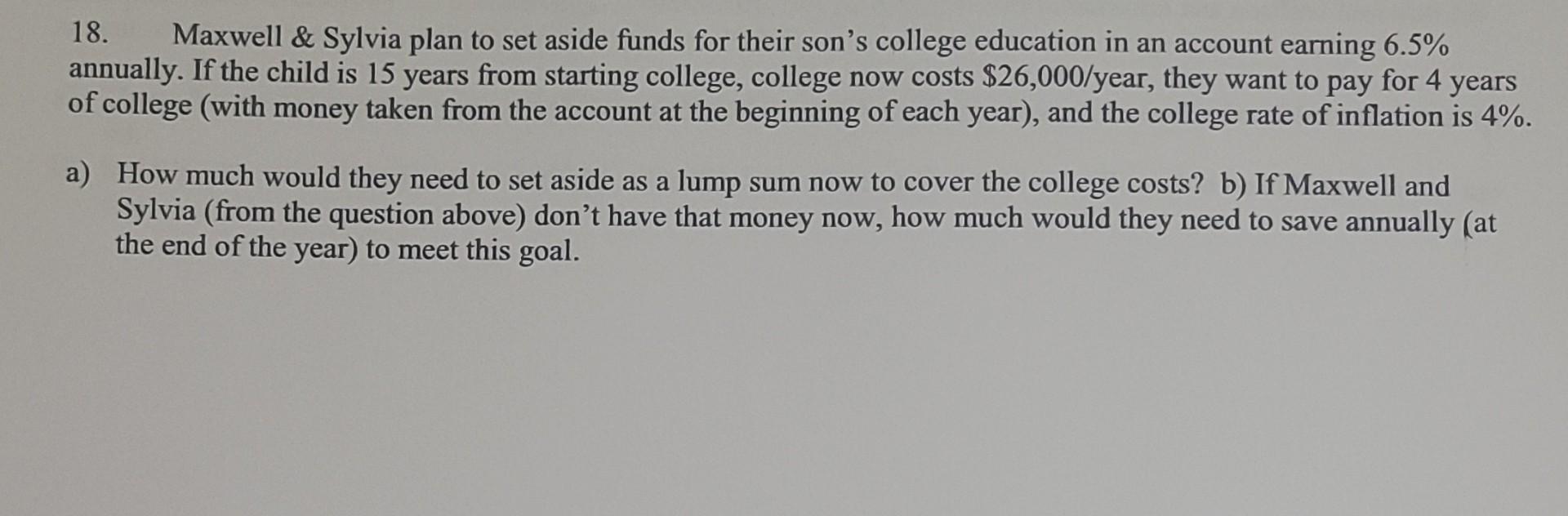

18. Maxwell \& Sylvia plan to set aside funds for their son's college education in an account earning 6.5% annually. If the child is 15 years from starting college, college now costs $26,000/year, they want to pay for 4 years of college (with money taken from the account at the beginning of each year), and the college rate of inflation is 4%. a) How much would they need to set aside as a lump sum now to cover the college costs? b) If Maxwell and Sylvia (from the question above) don't have that money now, how much would they need to save annually (at the end of the year) to meet this goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts