Question: Please answer the question and explain by using excel. 10.3.a. Refer to Exhibit 10.2. (see below for a slightly revised table instead of x 10.2)

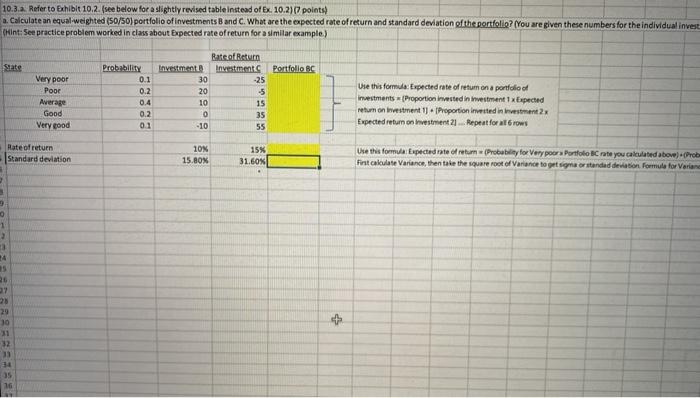

10.3.a. Refer to Exhibit 10.2. (see below for a slightly revised table instead of x 10.2) (7 points a. Calculate an equal weighted (50/50) portfolio of investments Band C. What are the expected rate of return and standard deviation of the portfolio? (You are given these numbers for the individual invest (Hint:See practice problem worked in class about Expected rate of return for a similar example) State Portfolio AC Very poor Poor Average Good Very good Probability 0.1 0.2 0.4 0.2 0.1 Rate of Return Investment Investments 30 -25 20 -5 10 15 0 35 -10 55 Use this formula: Expected rate of return on a portfolio of investments Proportion invested in investment 1 x Expected return on investment 1. Proportion invested investment 2x Expected return on investment 21... Repeat for at rows 10% Rate ofreturn Standard deviation 15% 31.60% 15.BOX Use this formula Expected rate of return (Probability for Very poors Portfolio Crate you calculated above) (Prob first calculate Variance, then take the square foot of Variance to get some or standad deviation formula for Varian 2 1 15 26 29 30 31 + 33 35 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts