Question: Please Answer the question and round correctly. the x boxes were incorrect as per my previous post. please fill in the boxes with the correct

Please Answer the question and round correctly. the x boxes were incorrect as per my previous post. please fill in the boxes with the correct answers!!

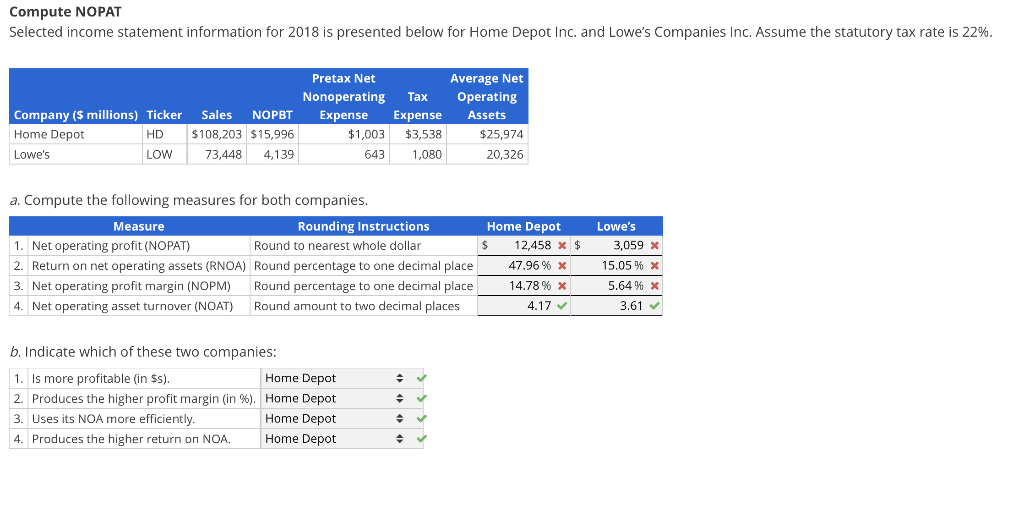

Compute NOPAT Selected income statement information for 2018 is presented below for Home Depot Inc. and Lowe's Companies Inc. Assume the statutory tax rate is 22%. Company ($ millions) Ticker Home Depot HD Lowe's LOW Sales NOPBT $ 108,203 $15,996 73,448 4,139 Pretax Net Nonoperating Expense $1,003 643 Tax Expense $3,538 1,080 Average Net Operating Assets $25,974 20,326 a. Compute the following measures for both companies. Measure Rounding Instructions 1. Net operating profit (NOPAT) Round to nearest whole dollar 2. Return on net operating assets (RNOA) Round percentage to one decimal place 3. Net operating profit margin (NOPM) Round percentage to one decimal place 4. Net operating asset turnover (NOAT) Round amount to two decimal places Home Depot 12,458 x $ 47.96 % x 14.78% x 4.17 Lowe's 3,059 X 15.05% x 5.64 % X 3.61 b. Indicate which of these two companies: 1. Is more profitable (in $s). Home Depot 2. Produces the higher profit margin (in %). Home Depot 3. Uses its NOA more efficiently. Home Depot 4. Produces the higher return on NOA, Home Depot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts