Question: PLEASE ANSWER THE QUESTION ASKED. THIS IS THE THIRD TIME THAT I AM POSTING THE SAME QUESTION BECAUSE NO ONE IS ANSWERING WHAT WAS ASKED.

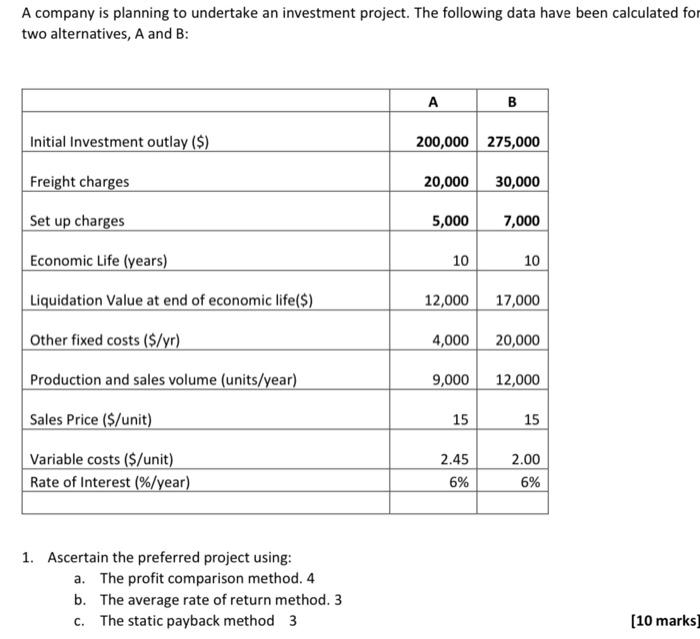

A company is planning to undertake an investment project. The following data have been calculated for two alternatives, A and B: A B Initial Investment outlay ($) 200,000 275,000 Freight charges 20,000 30,000 Set up charges 5,000 7,000 Economic Life (years) 10 10 Liquidation Value at end of economic life($) 12,000 17,000 Other fixed costs ($/yr) 4,000 20,000 Production and sales volume (units/year) 9,000 12,000 Sales Price ($/unit) 15 15 Variable costs ($/unit) Rate of Interest (%/year) 2.45 6% 2.00 6% 1. Ascertain the preferred project using: a. The profit comparison method. 4 b. The average rate of return method. 3 C. The static payback method 3 (10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts