Question: PLEASE ANSWER THE QUESTION CLEAR AND SIMPLE iii)Brothers Corp expects to earn $6 per share next year. The firm's ROE is 15% and its plowback

PLEASE ANSWER THE QUESTION CLEAR AND SIMPLE

PLEASE ANSWER THE QUESTION CLEAR AND SIMPLE

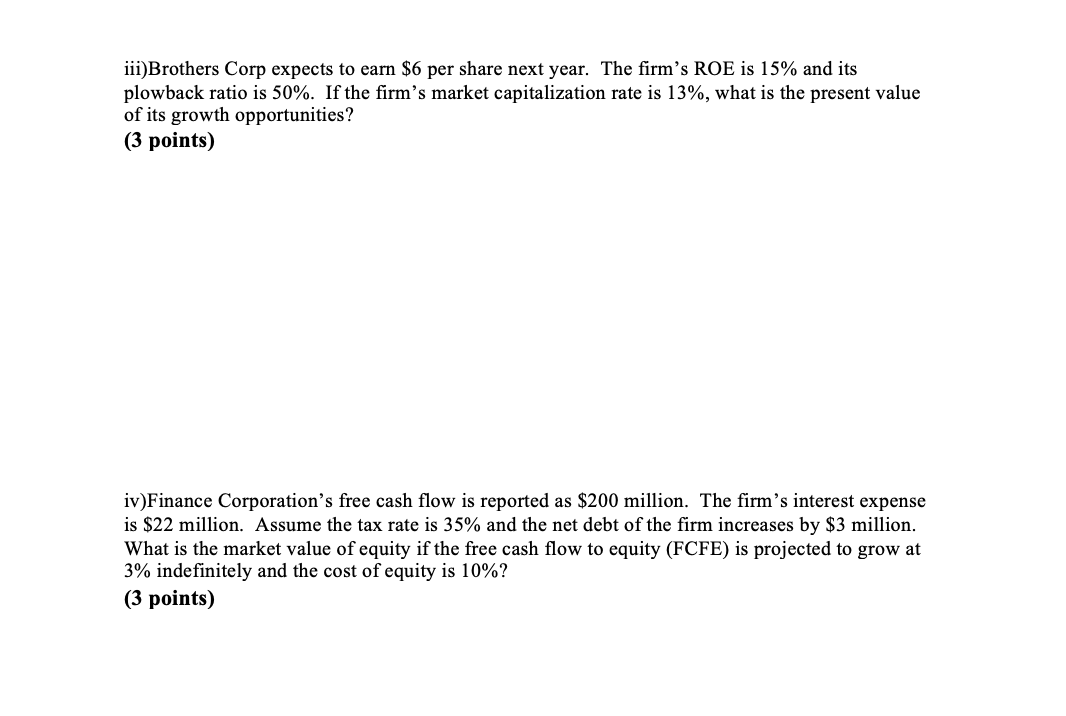

iii)Brothers Corp expects to earn $6 per share next year. The firm's ROE is 15% and its plowback ratio is 50%. If the firm's market capitalization rate is 13%, what is the present value of its growth opportunities? (3 points) iv)Finance Corporation's free cash flow is reported as $200 million. The firm's interest expense is $22 million. Assume the tax rate is 35% and the net debt of the firm increases by $3 million. What is the market value of equity if the free cash flow to equity (FCFE) is projected to grow at 3% indefinitely and the cost of equity is 10%? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts