Question: Please answer the question clearly step by step, if there is a handwritten answer on paper, write it so it can be viewed clearly. This

Please answer the question clearly step by step, if there is a handwritten answer on paper, write it so it can be viewed clearly. This is a complete question, i just coppied from the Assignment.

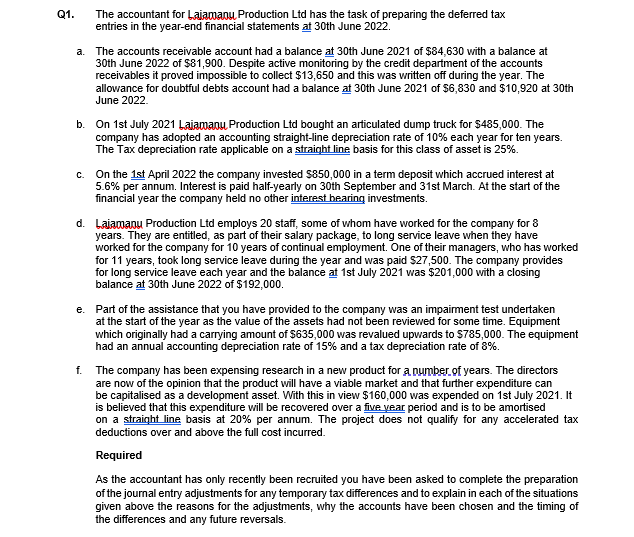

Q1. The accountant for Laiapoanu Production Ltd has the task of preparing the deferred tax entries in the year-end financial statements at 30 th June 2022. a. The accounts receivable account had a balance at 30 th June 2021 of $84,630 with a balance at 30th June 2022 of $81,900. Despite active monitoring by the credit department of the accounts receivables it proved impossible to collect $13,650 and this was written off during the year. The allowance for doubtful debts account had a balance at 30 th June 2021 of $6,830 and $10,920 at 30 th June 2022 . b. On 1st July 2021 baiamanu Production Ltd bought an articulated dump truck for $485,000. The company has adopted an accounting straight-line depreciation rate of 10% each year for ten years. The Tax depreciation rate applicable on a straight line basis for this class of asset is 25%. c. On the 1st April 2022 the company invested $850,000 in a term deposit which accrued interest at 5.6% per annum. Interest is paid half-yearly on 30 th September and 31st March. At the start of the financial year the company held no other interest hearing investments. d. Laiamanu Production Ltd employs 20 staff, some of whom have worked for the company for 8 years. They are entitled, as part of their salary package, to long service leave when they have worked for the company for 10 years of continual employment. One of their managers, who has worked for 11 years, took long service leave during the year and was paid $27,500. The company provides for long service leave each year and the balance at 1st July 2021 was $201,000 with a closing balance at 30 th June 2022 of $192,000. e. Part of the assistance that you have provided to the company was an impairment test undertaken at the start of the year as the value of the assets had not been reviewed for some time. Equipment which originally had a carrying amount of $635,000 was revalued upwards to $785,000. The equipment had an annual accounting depreciation rate of 15% and a tax depreciation rate of 8%. f. The company has been expensing research in a new product for a number of years. The directors are now of the opinion that the product will have a viable market and that further expenditure can be capitalised as a development asset. With this in view $160,000 was expended on 1st July 2021. It is believed that this expenditure will be recovered over a five year period and is to be amortised on a straiqht line basis at 20% per annum. The project does not qualify for any accelerated tax deductions over and above the full cost incurred. Required As the accountant has only recently been recruited you have been asked to complete the preparation of the journal entry adjustments for any temporary tax differences and to explain in each of the situations given above the reasons for the adjustments, why the accounts have been chosen and the timing of the differences and any future reversals. Q1. The accountant for Laiapoanu Production Ltd has the task of preparing the deferred tax entries in the year-end financial statements at 30 th June 2022. a. The accounts receivable account had a balance at 30 th June 2021 of $84,630 with a balance at 30th June 2022 of $81,900. Despite active monitoring by the credit department of the accounts receivables it proved impossible to collect $13,650 and this was written off during the year. The allowance for doubtful debts account had a balance at 30 th June 2021 of $6,830 and $10,920 at 30 th June 2022 . b. On 1st July 2021 baiamanu Production Ltd bought an articulated dump truck for $485,000. The company has adopted an accounting straight-line depreciation rate of 10% each year for ten years. The Tax depreciation rate applicable on a straight line basis for this class of asset is 25%. c. On the 1st April 2022 the company invested $850,000 in a term deposit which accrued interest at 5.6% per annum. Interest is paid half-yearly on 30 th September and 31st March. At the start of the financial year the company held no other interest hearing investments. d. Laiamanu Production Ltd employs 20 staff, some of whom have worked for the company for 8 years. They are entitled, as part of their salary package, to long service leave when they have worked for the company for 10 years of continual employment. One of their managers, who has worked for 11 years, took long service leave during the year and was paid $27,500. The company provides for long service leave each year and the balance at 1st July 2021 was $201,000 with a closing balance at 30 th June 2022 of $192,000. e. Part of the assistance that you have provided to the company was an impairment test undertaken at the start of the year as the value of the assets had not been reviewed for some time. Equipment which originally had a carrying amount of $635,000 was revalued upwards to $785,000. The equipment had an annual accounting depreciation rate of 15% and a tax depreciation rate of 8%. f. The company has been expensing research in a new product for a number of years. The directors are now of the opinion that the product will have a viable market and that further expenditure can be capitalised as a development asset. With this in view $160,000 was expended on 1st July 2021. It is believed that this expenditure will be recovered over a five year period and is to be amortised on a straiqht line basis at 20% per annum. The project does not qualify for any accelerated tax deductions over and above the full cost incurred. Required As the accountant has only recently been recruited you have been asked to complete the preparation of the journal entry adjustments for any temporary tax differences and to explain in each of the situations given above the reasons for the adjustments, why the accounts have been chosen and the timing of the differences and any future reversals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts