Question: Please answer the question I need the following with step_by step_ calculations: There are two states of nature (s1, s2) with equal probabilities. Suppose there

Please answer the question

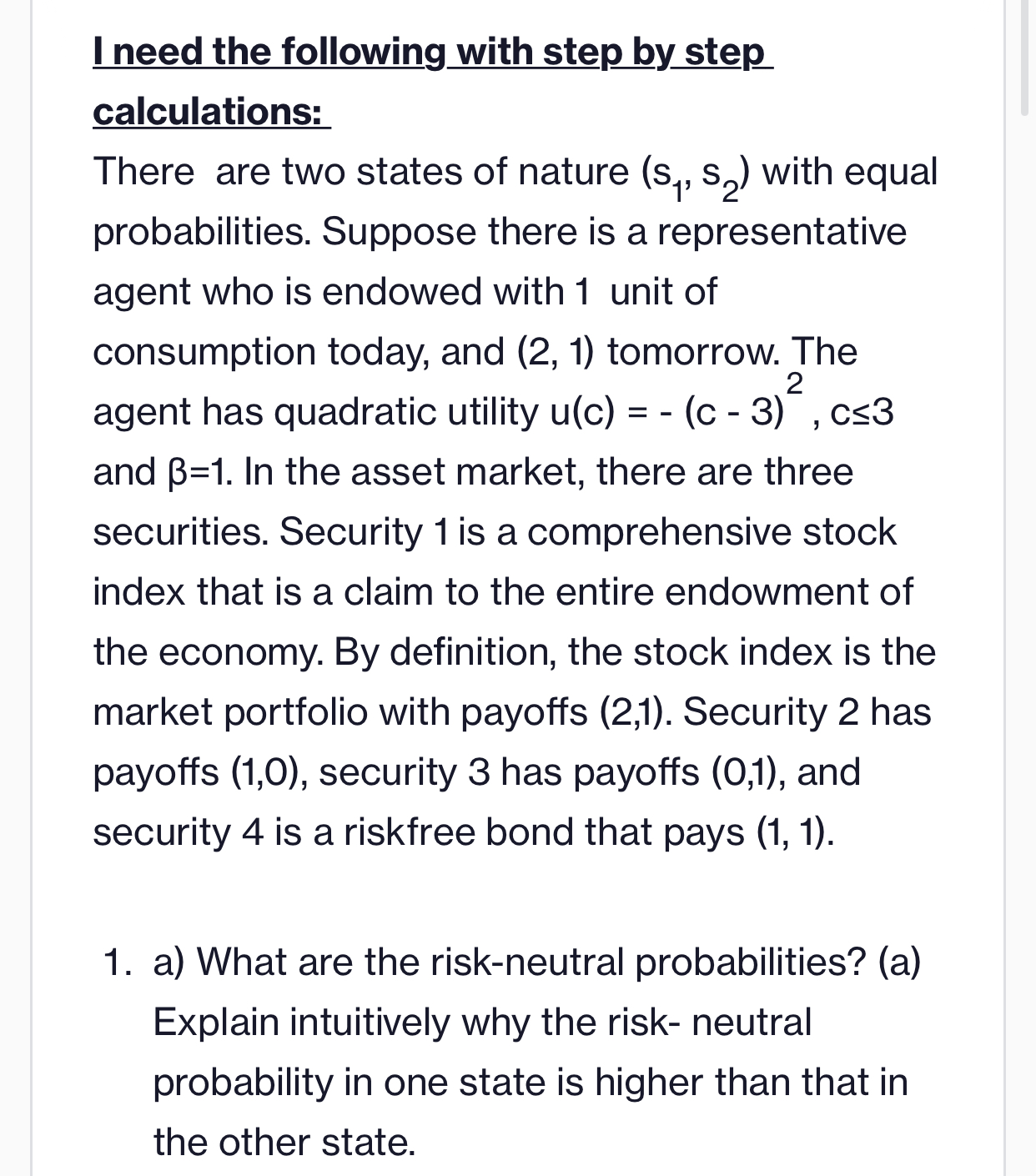

I need the following with step_by step_ calculations: There are two states of nature (s1, s2) with equal probabilities. Suppose there is a representative agent who is endowed with 1 unit of consumption today, and (2, 1) tomorrowl'he agent has quadratic utility u(c) = - (c - 3) ,053 and (3:1. In the asset market, there are three securities. Security 1 is a comprehensive stock index that is a claim to the entire endowment of the economy. By definition, the stock index is the market portfolio with payoffs (2,1). Security 2 has payoffs (1,0), security 3 has payoffs (0,1), and security 4 is a riskfree bond that pays (1, 1). 1. a) What are the risk-neutral probabilities? (a) Explain intuitively why the risk neutral probability in one state is higher than that in the other state

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts