Question: Please answer the question number C 2. GameOn Credit Union has to pay $1,000 after 2 years and $2,000 after 4 years. The current market

Please answer the question number C

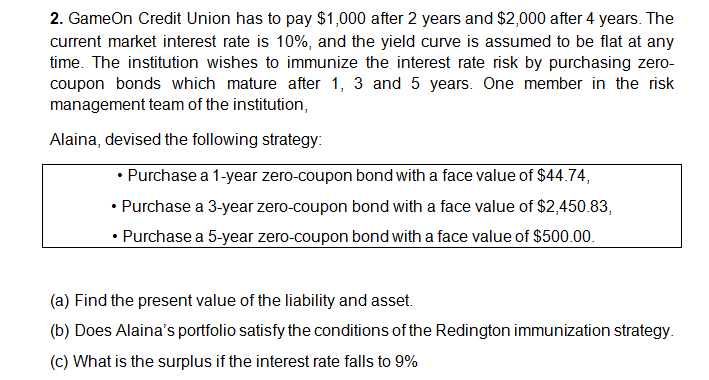

2. GameOn Credit Union has to pay $1,000 after 2 years and $2,000 after 4 years. The current market interest rate is 10%, and the yield curve is assumed to be flat at any time. The institution wishes to immunize the interest rate risk by purchasing zero- coupon bonds which mature after 1, 3 and 5 years. One member in the risk management team of the institution, Alaina, devised the following strategy Purchase a 1-year zero-coupon bond with a face value of $44.74, Purchase a 3-year zero-coupon bond with a face value of $2,450.83, Purchase a 5-year zero-coupon bond with a face value of $500.00 (a) Find the present value of the liability and asset. (b) Does Alaina's portfolio satisfy the conditions of the Redington immunization strategy. (C) What is the surplus if the interest rate falls to 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts