Question: Please answer the question on the THIRD image. All accounts and formulas are the same. The only thing that changes are the numbers. P6.45A (L0

Please answer the question on the THIRD image. All accounts and formulas are the same. The only thing that changes are the numbers.

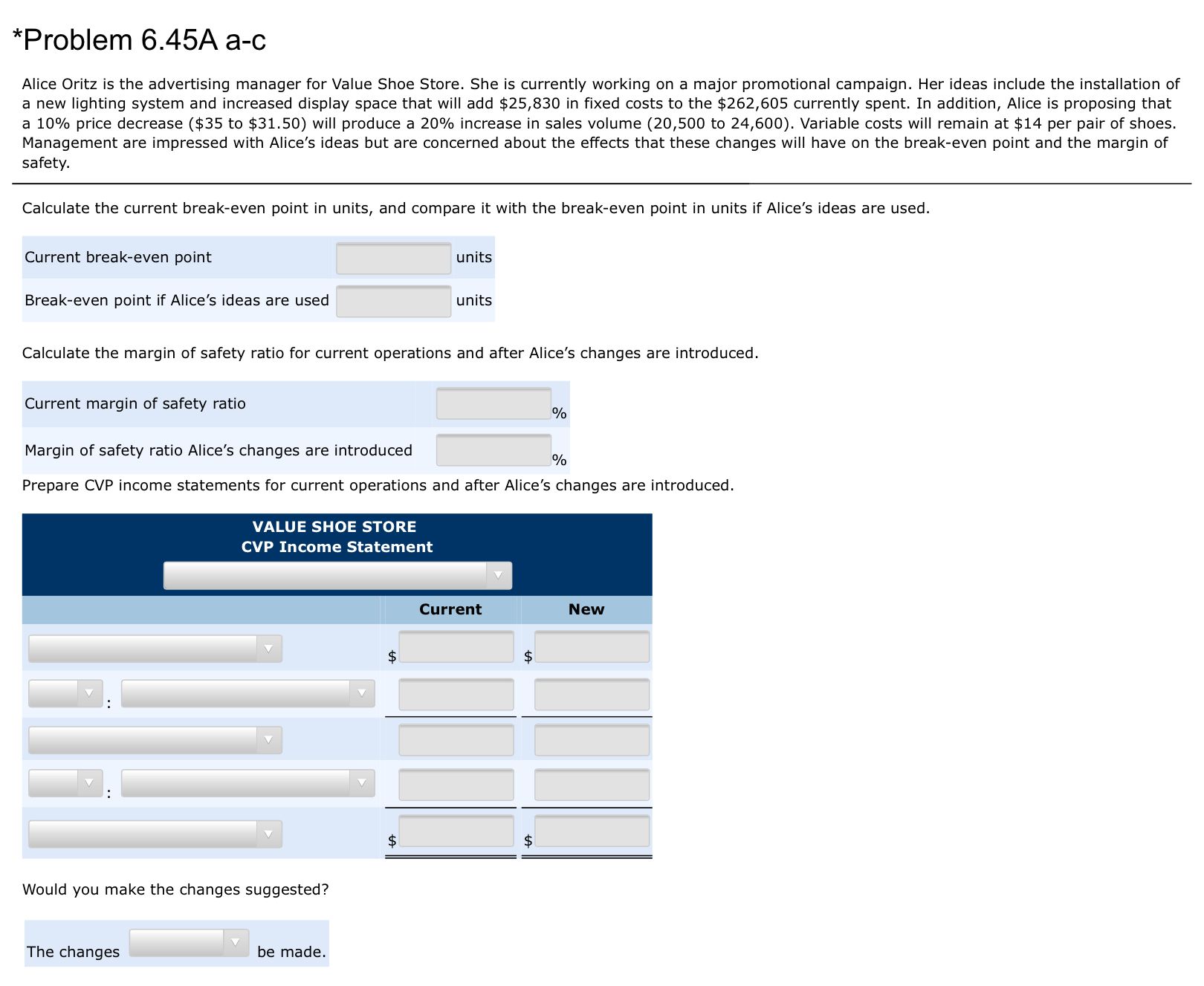

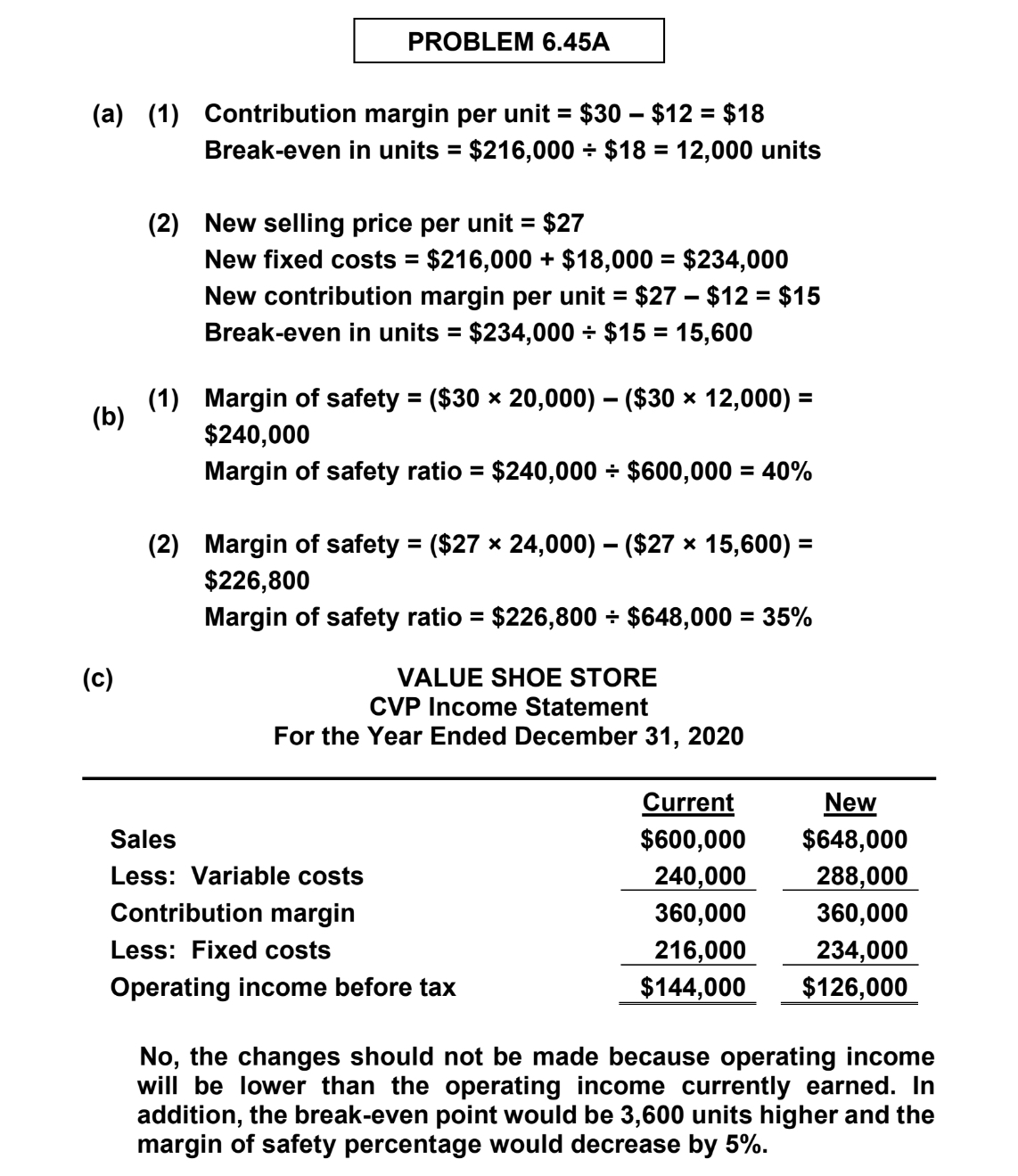

P6.45A (L0 1, 2, 3, 4) Alice Oritz is the advertising manager for Value Shoe Store. She is currently working on a major promotional campaign. Her ideas include the installation of a new lighting system and increased display space that will add $18,000 in fixed costs to the $216,000 currently spent. In addition, Alice is proposing that a 10% price decrease ($30 to $27) will produce a 20% increase in sales volume (20,000 to 24,000). Variable costs will remain at $12 per pair of shoes. Management are impressed with Alice's ideas but are concerned about the effects that these changes will have on the break-even point and the margin of safety. Calculate the break-even point and margin of safety ratio, and prepare a CVP income statement before and after changes in the business environment. Instructions a. Calculate the current break-even point in units, and compare it with the break-even point in units if Alice's ideas are used. b. Calculate the margin of safety ratio for current operations and after Alice's changes are introduced. (Round to nearest full percent.) Current margin of safety ratio = 40% c. Prepare CVP income statements for current operations and after Alice's changes are introduced. (Show for total amounts only.) Would you make the changes suggested? *Problem 6.45A a-c Alice Oritz is the advertising manager for Value Shoe Store. She is currently working on a major promotional campaign. Her ideas include the installation of a new lighting system and increased display space that will add $25,830 in xed costs to the $262,605 currently spent. In addition, Alice is proposing that a 10% price decrease ($35 to $31.50) will produce a 20% increase in sales volume (20,500 to 24,600). Variable costs will remain at $14 per pair of shoes. Management are impressed with Alice's ideas but are concerned about the effecls that these changes will have on the break-even point and the margin of safety. Calculate the current break-even point in units, and compare it with the brea k-even point in units if Alice's ideas are used. Current break-even point units Break-even point if Alice's ideas are used units Calculate the margin of safety ratio for current operations and after Alice's changes are introduced. Current margin of safety ratio % Margin of safety ratio Alice's changes are introduced % Prepare CVP income statements for current operations and after Alice's changes are introduced. VALUE SHOE STORE CVP Income Statement V $ $ \\/ \\J V V $ $ Would you make the changes suggested? \\ The changes - J be made. PROBLEM 6.45A (a) (1) Contribution margin per unit = $30 - $12 = $18 Break-even in units = $216,000 + $18 = 12,000 units (2) New selling price per unit = $27 New fixed costs = $216,000 + $18,000 = $234,000 New contribution margin per unit = $27 - $12 = $15 Break-even in units = $234,000 + $15 = 15,600 (1) Margin of safety = ($30 x 20,000) - ($30 x 12,000) = $240,000 Margin of safety ratio = $240,000 + $600,000 = 40% (b) (2) Margin of safety = ($27 x 24,000) ($27 x 15,600) = $226,800 Margin of safety ratio = $226,800 + $648,000 = 35% (c) VALUE SHOE STORE CVP Income Statement For the Year Ended December 31, 2020 Current Ne_w Sales $600,000 $648,000 Less: Variable costs 240,000 288 000 Contribution margin 360,000 360,000 Less: Fixed costs 216,000 234,000 Operating income before tax $144,000 $126,000 No, the changes should not be made because operating income will be lower than the operating income currently earned. In addition, the break-even point would be 3,600 units higher and the margin of safety percentage would decrease by 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts