Question: please answer the question Problem 2, (25 Pts) Alternatives 1, 2, and 3 have lives of 3, 4, and 6 years, respectively. Their net cash

please answer the question

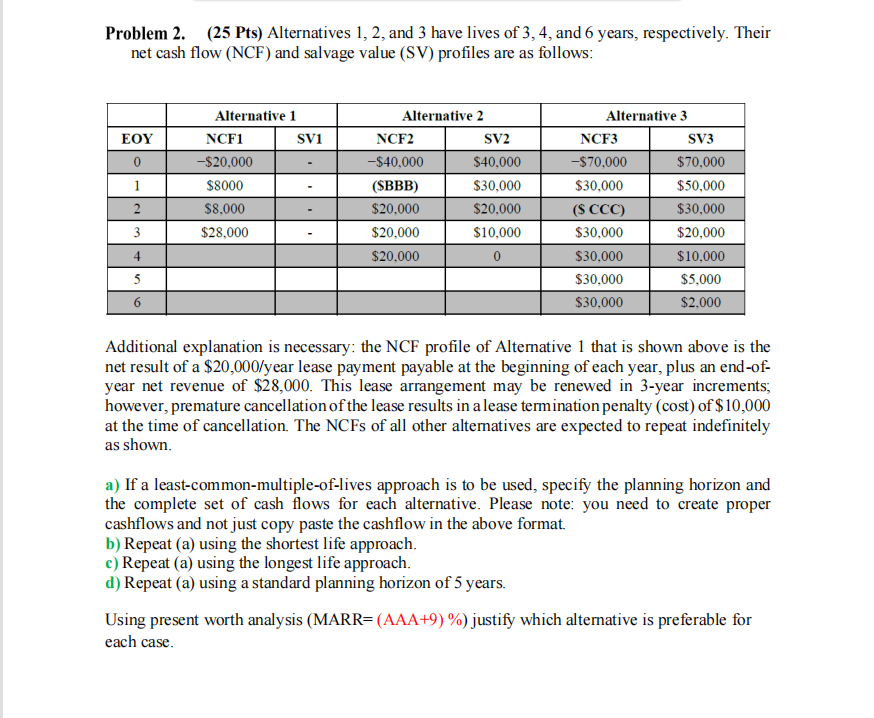

Problem 2, (25 Pts) Alternatives 1, 2, and 3 have lives of 3, 4, and 6 years, respectively. Their net cash flow (NCFJ and salvage value (5V) proles are as follows: Alternative 1 Alternative 2 Alternative 3 --M n ammo moon moo - ll- Additional explanation is necessary: the NCF prole of Alternative 1 that is shown above is the net result of a $20,00Wyear lease payment payable at the beginning of each year, plus an end-of- year net revenue of $23,000. This lease arrangement may be renewed in 3-year increments; however, premature cancellationof the lease results in a lease termination penalty (cost) of$10,000 at the time of cancellation The NCFs of all other alternatives are expected to repeat indenitely as shown. a} Ifa least-commonmultiple-of-lives approach is to be used, specity the planning horizon and the complete set of cash ows for each alternative. Please note: you need to create proper cashowsand not just copy paste the cashow in the above format h} Repeat (a) using the shortest lite approach. c) Repeat (a) using the longest life approach. d} Repeat (a) using a standard planning horizon of 5 years Using present worth analysis (MARR= (MAW) 9'0] justify which altemative is preferable for each case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts