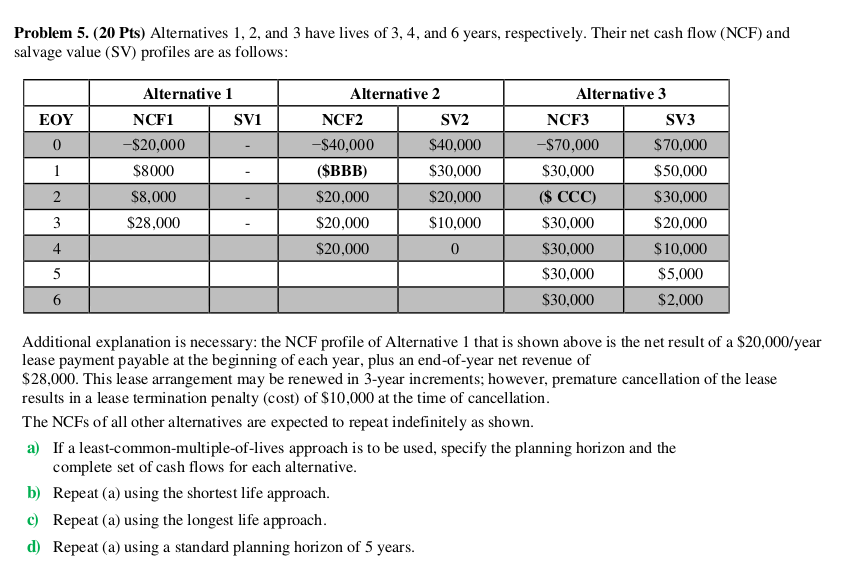

Question: BBB = $15556 CCC = $1991 Problem 5. (20 Pts) Alternatives 1, 2, and 3 have lives of 3, 4, and 6 years, respectively. Their

BBB = $15556

CCC = $1991

Problem 5. (20 Pts) Alternatives 1, 2, and 3 have lives of 3, 4, and 6 years, respectively. Their net cash flow (NCF) and salvage value (SV) profiles are as follows Alternative 3 Alternative 1 NCF1 S20,000 $8000 $8,000 $28,000 Alternative 2 SV1 SV3 $70,000 $50,000 $30,000 $20,000 $10,000 $5,000 $2,000 EOY SV2 $40,000 $30,000 $20,000 $10,000 NCF3 $70,000 $30,000 s CCC) $30,000 $30,000 $30,000 $30,000 NCF2 $40,000 $20,000 $20,000 $20,000 Additional explanation is necessary: the NCF profile of Alternative 1 that is shown above is the net result of a $20,000/year lease payment payable at the beginning of each year, plus an end-of-year net revenue of $28,000. This lease arrangement may be renewed in 3-year increments; however, premature cancellation of the lease results in a lease termination penalty (cost) of $10,000 at the time of cancellation The NCFs of all other alternatives are expected to repeat indefinitely as shown a) If a least-common-multiple-of lives approach is to be used, specify the planning horizon and the b) c) d) complete set of cash flows for each alternative Repeat (a) using the shortest life approach Repeat (a) using the longest life approach Repeat (a) using a standard planning horizon of 5 years Problem 5. (20 Pts) Alternatives 1, 2, and 3 have lives of 3, 4, and 6 years, respectively. Their net cash flow (NCF) and salvage value (SV) profiles are as follows Alternative 3 Alternative 1 NCF1 S20,000 $8000 $8,000 $28,000 Alternative 2 SV1 SV3 $70,000 $50,000 $30,000 $20,000 $10,000 $5,000 $2,000 EOY SV2 $40,000 $30,000 $20,000 $10,000 NCF3 $70,000 $30,000 s CCC) $30,000 $30,000 $30,000 $30,000 NCF2 $40,000 $20,000 $20,000 $20,000 Additional explanation is necessary: the NCF profile of Alternative 1 that is shown above is the net result of a $20,000/year lease payment payable at the beginning of each year, plus an end-of-year net revenue of $28,000. This lease arrangement may be renewed in 3-year increments; however, premature cancellation of the lease results in a lease termination penalty (cost) of $10,000 at the time of cancellation The NCFs of all other alternatives are expected to repeat indefinitely as shown a) If a least-common-multiple-of lives approach is to be used, specify the planning horizon and the b) c) d) complete set of cash flows for each alternative Repeat (a) using the shortest life approach Repeat (a) using the longest life approach Repeat (a) using a standard planning horizon of 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts