Question: Please answer the question without using Excel spreadsheet ( write out all the calculations) 4. Consider a bond with a face value of ( $

Please answer the question without using Excel spreadsheet ( write out all the calculations)

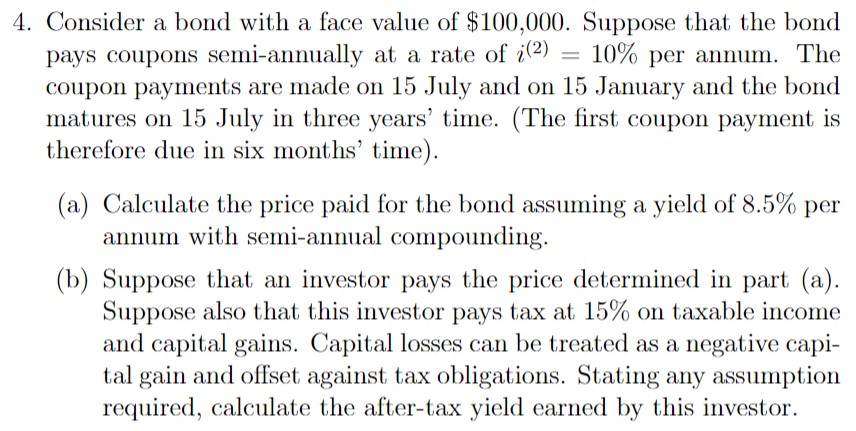

4. Consider a bond with a face value of \\( \\$ 100,000 \\). Suppose that the bond pays coupons semi-annually at a rate of \i(2)=10 per annum. The coupon payments are made on 15 July and on 15 January and the bond matures on 15 July in three years' time. (The first coupon payment is therefore due in six months' time). (a) Calculate the price paid for the bond assuming a yield of \8.5 per annum with semi-annual compounding. (b) Suppose that an investor pays the price determined in part (a). Suppose also that this investor pays tax at \15 on taxable income and capital gains. Capital losses can be treated as a negative capital gain and offset against tax obligations. Stating any assumption required, calculate the after-tax yield earned by this investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts