Question: PLEASE ANSWER THE QUESTIONS BELOW. THEY CANNOT BE SEPERATED. I NEED IT NOW PLEASE do not screenshot your excel. please help answering these questions. Before

PLEASE ANSWER THE QUESTIONS BELOW. THEY CANNOT BE SEPERATED. I NEED IT NOW PLEASE

do not screenshot your excel. please help answering these questions.

Before doing any calculations, can we rank the projects simply by inspecting the cash flows?

What analytical criteria can we use to rank the projects? How do you define each criterion? Put the numbers up on the board.

Which of the two projects, 7 or 8, is more attractive? How sensitive is our ranking to the use of high discount rates? Why do NPV and IRR disagree?

What rank should we assign to each project? Why do payback and NPV not agree completely? Why do average return on investment and NPV not agree completely? Which criterion is best?

Are those projects comparable on the basis of NPV? Because the projects have different lives, are we really measuring the net present value of the short-lived projects?

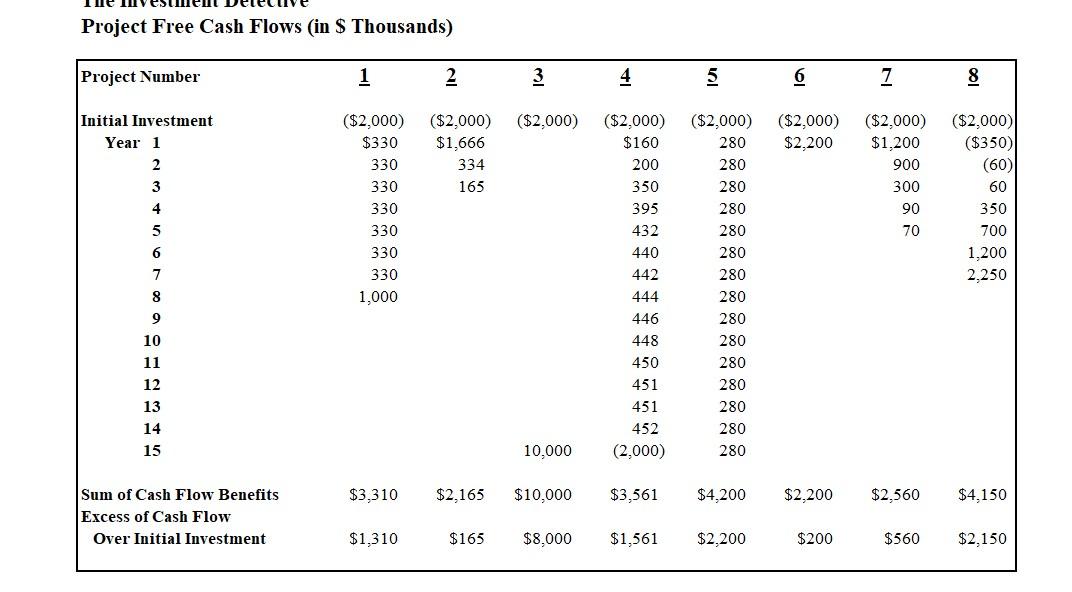

Project Free Cash Flows (in S Thousands)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts