Question: Please answer the questions from the given text . Thank you. Procter & Gambles mission statement is: We will provide branded products and services of

Please answer the questions from the given text. Thank you.

- Procter & Gambles mission statement is:

We will provide branded products and services of superior quality and value that improve the lives of the worlds consumers, now and for generations to come. As a result, consumers will reward us with leadership sales, profit, and value creation, allowing our people, our shareholders and the communities in which we live and work to prosper.

Is this supported in the case? Explain.

- Comment on P&Gs working capital position between from 2015 to 2018.

- What does Lafley mean by Less will be more?

- What reason(s) can you give for large disparity between the revenue generated by the firm and low level of net income?

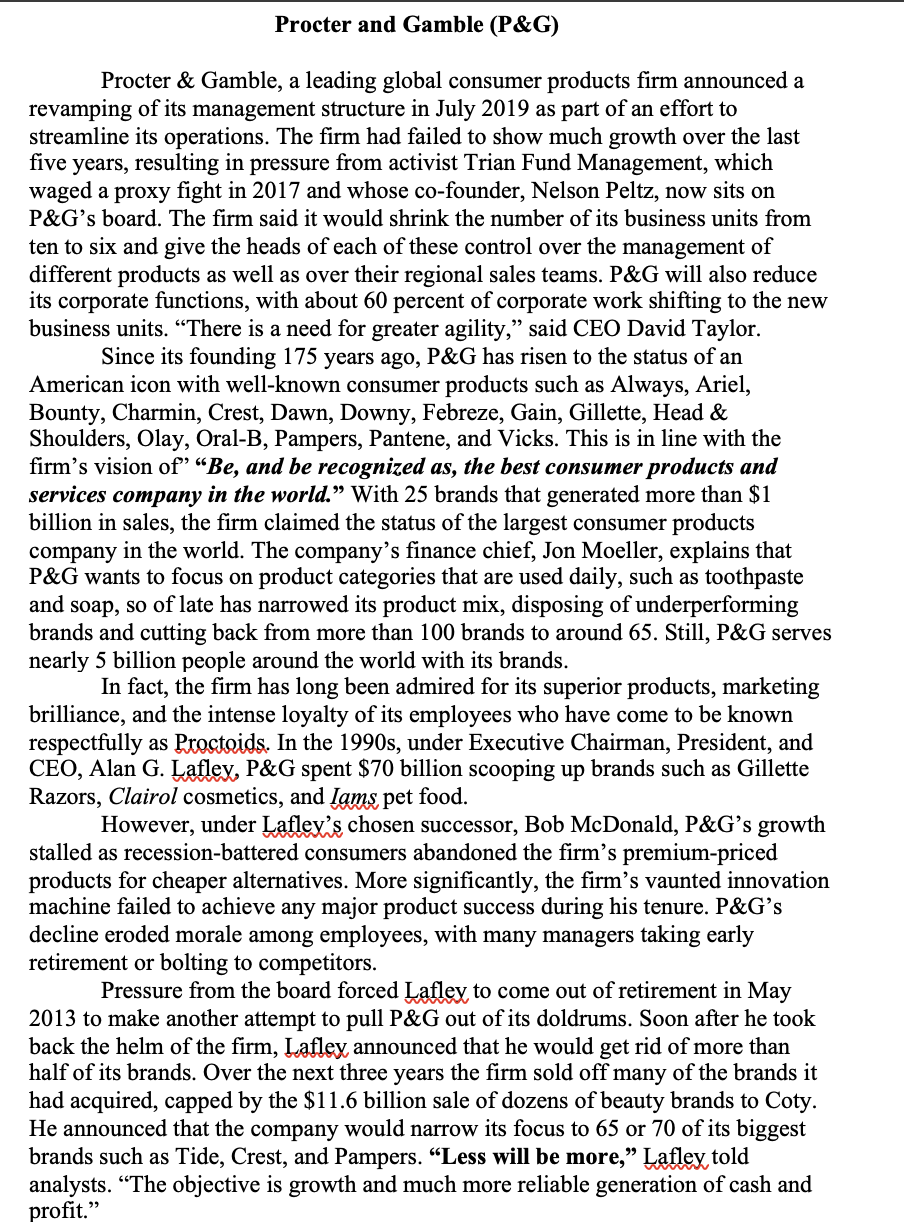

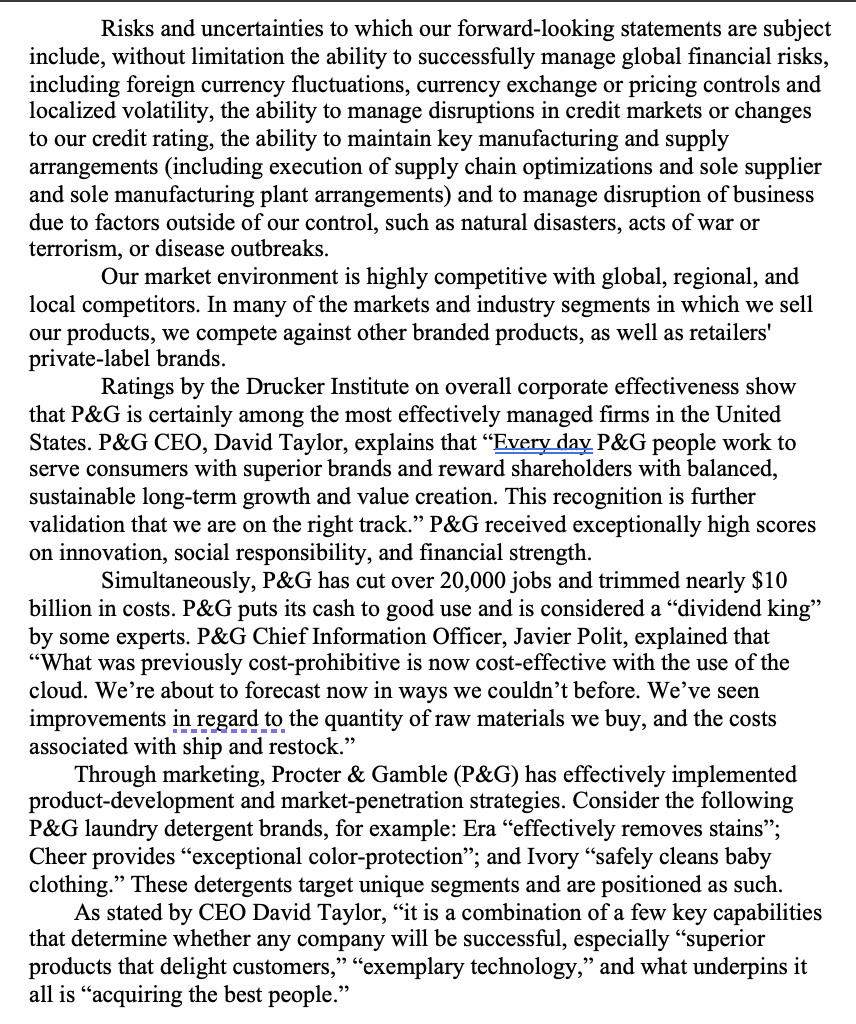

Procter and Gamble (P&G) Procter & Gamble, a leading global consumer products firm announced a revamping of its management structure in July 2019 as part of an effort to streamline its operations. The firm had failed to show much growth over the last five years, resulting in pressure from activist Trian Fund Management, which waged a proxy fight in 2017 and whose co-founder, Nelson Peltz, now sits on P&G's board. The firm said it would shrink the number of its business units from ten to six and give the heads of each of these control over the management of different products as well as over their regional sales teams. P&G will also reduce its corporate functions, with about 60 percent of corporate work shifting to the new business units. There is a need for greater agility, said CEO David Taylor. Since its founding 175 years ago, P&G has risen to the status of an American icon with well-known consumer products such as Always, Ariel, Bounty, Charmin, Crest, Dawn, Downy, Febreze, Gain, Gillette, Head & Shoulders, Olay, Oral-B, Pampers, Pantene, and Vicks. This is in line with the firm's vision of Be, and be recognized as, the best consumer products and services company in the world. With 25 brands that generated more than $1 billion in sales, the firm claimed the status of the largest consumer products company in the world. The company's finance chief, Jon Moeller, explains that P&G wants to focus on product categories that are used daily, such as toothpaste and soap, so of late has narrowed its product mix, disposing of underperforming brands and cutting back from more than 100 brands to around 65. Still, P&G serves nearly 5 billion people around the world with its brands. In fact, the firm has long been admired for its superior products, marketing brilliance, and the intense loyalty of its employees who have come to be known respectfully as Proctoids. In the 1990s, under Executive Chairman, President, and CEO, Alan G. Lafley, P&G spent $70 billion scooping up brands such as Gillette Razors, Clairol cosmetics, and lams pet food. However, under Laflex's chosen successor, Bob McDonald, P&G's growth stalled as recession-battered consumers abandoned the firm's premium-priced products for cheaper alternatives. More significantly, the firm's vaunted innovation machine failed to achieve any major product success during his tenure. P&G's decline eroded morale among employees, with many managers taking early retirement or bolting to competitors. Pressure from the board forced Lafley to come out of retirement in May 2013 to make another attempt to pull P&G out of its doldrums. Soon after he took back the helm of the firm, Lafley announced that he would get rid of more than half of its brands. Over the next three years the firm sold off many of the brands it had acquired, capped by the $11.6 billion sale of dozens of beauty brands to Coty. He announced that the company would narrow its focus to 65 or 70 of its biggest brands such as Tide, Crest, and Pampers. Less will be more, Lafley told analysts. The objective is growth and much more reliable generation of cash and profit." Risks and uncertainties to which our forward-looking statements are subject include, without limitation the ability to successfully manage global financial risks, including foreign currency fluctuations, currency exchange or pricing controls and localized volatility, the ability to manage disruptions in credit markets or changes to our credit rating, the ability to maintain key manufacturing and supply arrangements (including execution of supply chain optimizations and sole supplier and sole manufacturing plant arrangements) and to manage disruption of business due to factors outside of our control, such as natural disasters, acts of war or terrorism, or disease outbreaks. Our market environment is highly competitive with global, regional, and local competitors. In many of the markets and industry segments in which we sell our products, we compete against other branded products, as well as retailers' private-label brands. Ratings by the Drucker Institute on overall corporate effectiveness show that P&G is certainly among the most effectively managed firms in the United States. P&G CEO, David Taylor, explains that Every day P&G people work to serve consumers with superior brands and reward shareholders with balanced, sustainable long-term growth and value creation. This recognition is further validation that we are on the right track. P&G received exceptionally high scores on innovation, social responsibility, and financial strength. Simultaneously, P&G has cut over 20,000 jobs and trimmed nearly $10 billion in costs. P&G puts its cash to good use and is considered a "dividend king by some experts. P&G Chief Information Officer, Javier Polit, explained that What was previously cost-prohibitive is now cost-effective with the use of the cloud. We're about to forecast now in ways we couldn't before. We've seen improvements in regard to the quantity of raw materials we buy, and the costs associated with ship and restock. Through marketing, Procter & Gamble (P&G) has effectively implemented product-development and market-penetration strategies. Consider the following P&G laundry detergent brands, for example: Era effectively removes stains; Cheer provides exceptional color-protection; and Ivory safely cleans baby clothing. These detergents target unique segments and are positioned as such. As stated by CEO David Taylor, it is a combination of a few key capabilities that determine whether any company will be successful, especially superior products that delight customers, exemplary technology, and what underpins it all is acquiring the best people. Exhibit 1: Abridged Statement of Income (amount in $000) Year Ending June 30, 2018 June 30, 2017 June 30, 2016 June 30, 2015 Revenue $66,832 $65,058 $65,299 $70.749 Operating Income 13,711 13.955 13,441 11,049 EBIT 13,326 13,257 11,012 13,369 10,604 Net Income 9.861 15,411 7,144 Exhibit 2: Abridged Balance Sheet (amount in $000) Year Ending June 30, 2018 June 30, 2017 June 30, 2016 June 30, 2015 $ 23,320 $ 26,494 $ 33,782 $ 29,646 Current Assets Total Assets Current Liabilities 118,310 120,406 127,136 129,495 28,237 30,210 30,770 29,790 Total Liabilities 65,427 64,628 69,153 66,445 Stockholder Equity 52,883 55,778 57,983 63,050 Procter and Gamble (P&G) Procter & Gamble, a leading global consumer products firm announced a revamping of its management structure in July 2019 as part of an effort to streamline its operations. The firm had failed to show much growth over the last five years, resulting in pressure from activist Trian Fund Management, which waged a proxy fight in 2017 and whose co-founder, Nelson Peltz, now sits on P&G's board. The firm said it would shrink the number of its business units from ten to six and give the heads of each of these control over the management of different products as well as over their regional sales teams. P&G will also reduce its corporate functions, with about 60 percent of corporate work shifting to the new business units. There is a need for greater agility, said CEO David Taylor. Since its founding 175 years ago, P&G has risen to the status of an American icon with well-known consumer products such as Always, Ariel, Bounty, Charmin, Crest, Dawn, Downy, Febreze, Gain, Gillette, Head & Shoulders, Olay, Oral-B, Pampers, Pantene, and Vicks. This is in line with the firm's vision of Be, and be recognized as, the best consumer products and services company in the world. With 25 brands that generated more than $1 billion in sales, the firm claimed the status of the largest consumer products company in the world. The company's finance chief, Jon Moeller, explains that P&G wants to focus on product categories that are used daily, such as toothpaste and soap, so of late has narrowed its product mix, disposing of underperforming brands and cutting back from more than 100 brands to around 65. Still, P&G serves nearly 5 billion people around the world with its brands. In fact, the firm has long been admired for its superior products, marketing brilliance, and the intense loyalty of its employees who have come to be known respectfully as Proctoids. In the 1990s, under Executive Chairman, President, and CEO, Alan G. Lafley, P&G spent $70 billion scooping up brands such as Gillette Razors, Clairol cosmetics, and lams pet food. However, under Laflex's chosen successor, Bob McDonald, P&G's growth stalled as recession-battered consumers abandoned the firm's premium-priced products for cheaper alternatives. More significantly, the firm's vaunted innovation machine failed to achieve any major product success during his tenure. P&G's decline eroded morale among employees, with many managers taking early retirement or bolting to competitors. Pressure from the board forced Lafley to come out of retirement in May 2013 to make another attempt to pull P&G out of its doldrums. Soon after he took back the helm of the firm, Lafley announced that he would get rid of more than half of its brands. Over the next three years the firm sold off many of the brands it had acquired, capped by the $11.6 billion sale of dozens of beauty brands to Coty. He announced that the company would narrow its focus to 65 or 70 of its biggest brands such as Tide, Crest, and Pampers. Less will be more, Lafley told analysts. The objective is growth and much more reliable generation of cash and profit." Risks and uncertainties to which our forward-looking statements are subject include, without limitation the ability to successfully manage global financial risks, including foreign currency fluctuations, currency exchange or pricing controls and localized volatility, the ability to manage disruptions in credit markets or changes to our credit rating, the ability to maintain key manufacturing and supply arrangements (including execution of supply chain optimizations and sole supplier and sole manufacturing plant arrangements) and to manage disruption of business due to factors outside of our control, such as natural disasters, acts of war or terrorism, or disease outbreaks. Our market environment is highly competitive with global, regional, and local competitors. In many of the markets and industry segments in which we sell our products, we compete against other branded products, as well as retailers' private-label brands. Ratings by the Drucker Institute on overall corporate effectiveness show that P&G is certainly among the most effectively managed firms in the United States. P&G CEO, David Taylor, explains that Every day P&G people work to serve consumers with superior brands and reward shareholders with balanced, sustainable long-term growth and value creation. This recognition is further validation that we are on the right track. P&G received exceptionally high scores on innovation, social responsibility, and financial strength. Simultaneously, P&G has cut over 20,000 jobs and trimmed nearly $10 billion in costs. P&G puts its cash to good use and is considered a "dividend king by some experts. P&G Chief Information Officer, Javier Polit, explained that What was previously cost-prohibitive is now cost-effective with the use of the cloud. We're about to forecast now in ways we couldn't before. We've seen improvements in regard to the quantity of raw materials we buy, and the costs associated with ship and restock. Through marketing, Procter & Gamble (P&G) has effectively implemented product-development and market-penetration strategies. Consider the following P&G laundry detergent brands, for example: Era effectively removes stains; Cheer provides exceptional color-protection; and Ivory safely cleans baby clothing. These detergents target unique segments and are positioned as such. As stated by CEO David Taylor, it is a combination of a few key capabilities that determine whether any company will be successful, especially superior products that delight customers, exemplary technology, and what underpins it all is acquiring the best people. Exhibit 1: Abridged Statement of Income (amount in $000) Year Ending June 30, 2018 June 30, 2017 June 30, 2016 June 30, 2015 Revenue $66,832 $65,058 $65,299 $70.749 Operating Income 13,711 13.955 13,441 11,049 EBIT 13,326 13,257 11,012 13,369 10,604 Net Income 9.861 15,411 7,144 Exhibit 2: Abridged Balance Sheet (amount in $000) Year Ending June 30, 2018 June 30, 2017 June 30, 2016 June 30, 2015 $ 23,320 $ 26,494 $ 33,782 $ 29,646 Current Assets Total Assets Current Liabilities 118,310 120,406 127,136 129,495 28,237 30,210 30,770 29,790 Total Liabilities 65,427 64,628 69,153 66,445 Stockholder Equity 52,883 55,778 57,983 63,050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts