Question: please answer the questions immediately thankyou Statement 1: When a partner sells an interest to a new partner at an amount that exceeds the carrying

please answer the questions immediately thankyou

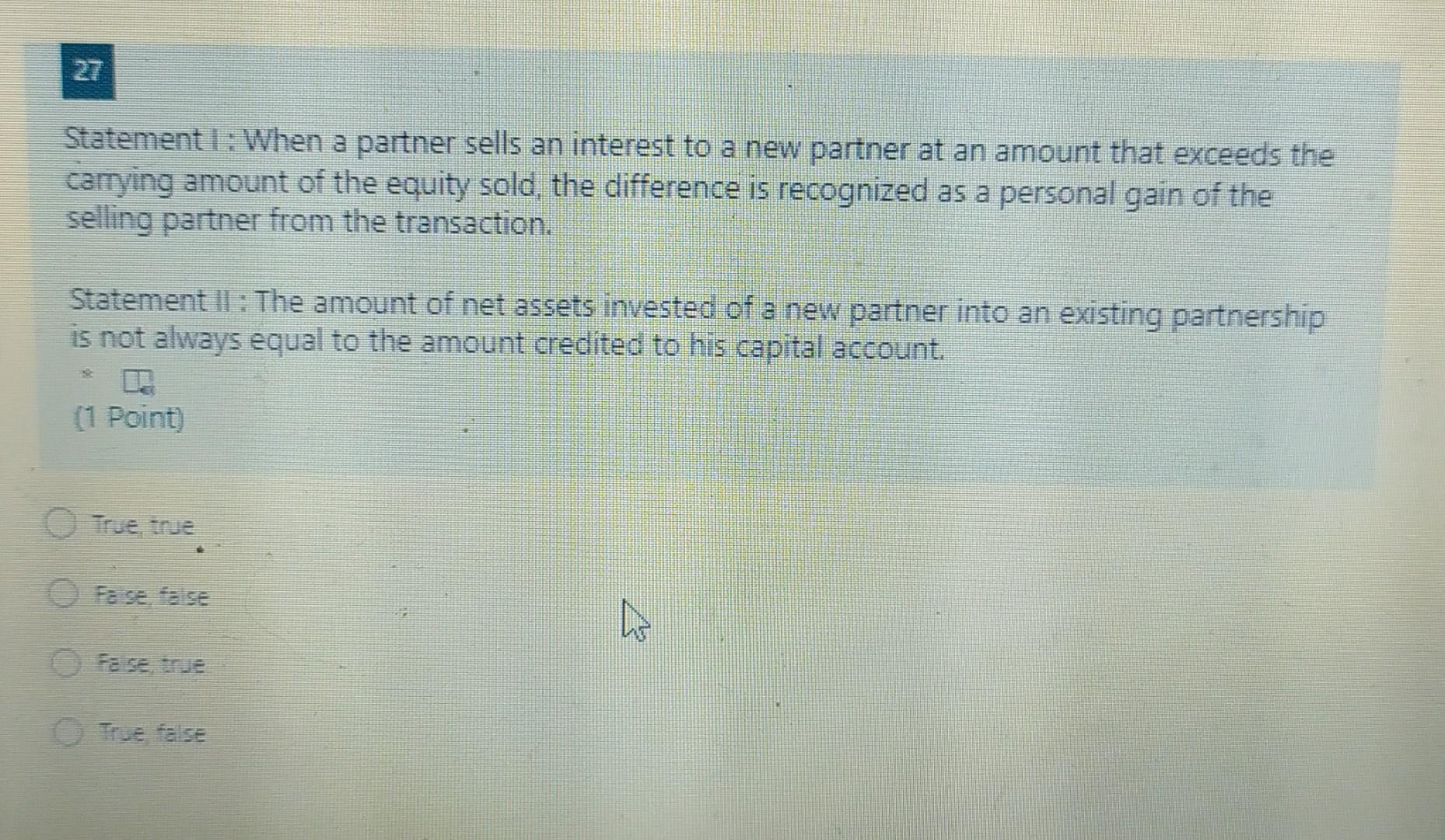

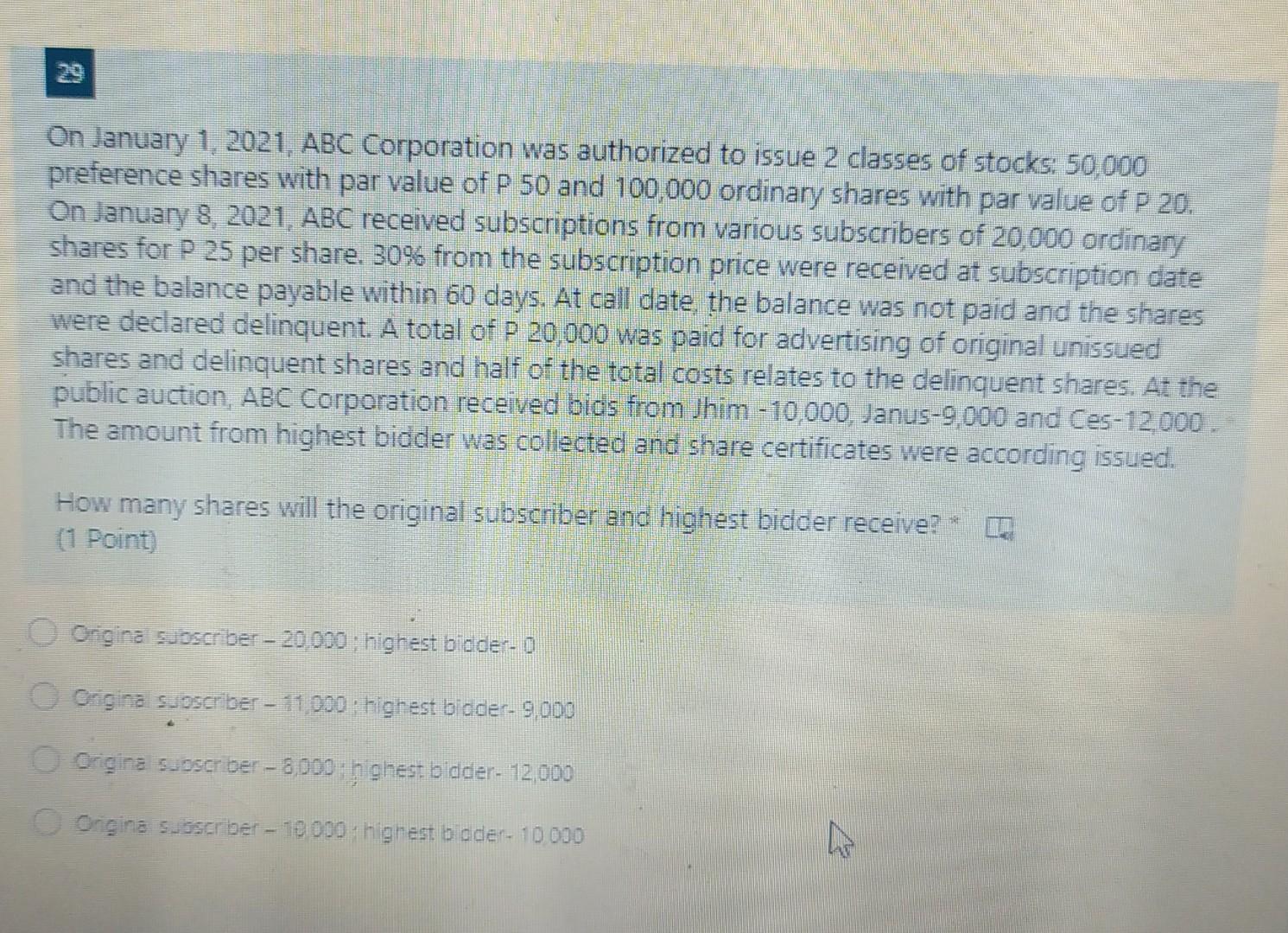

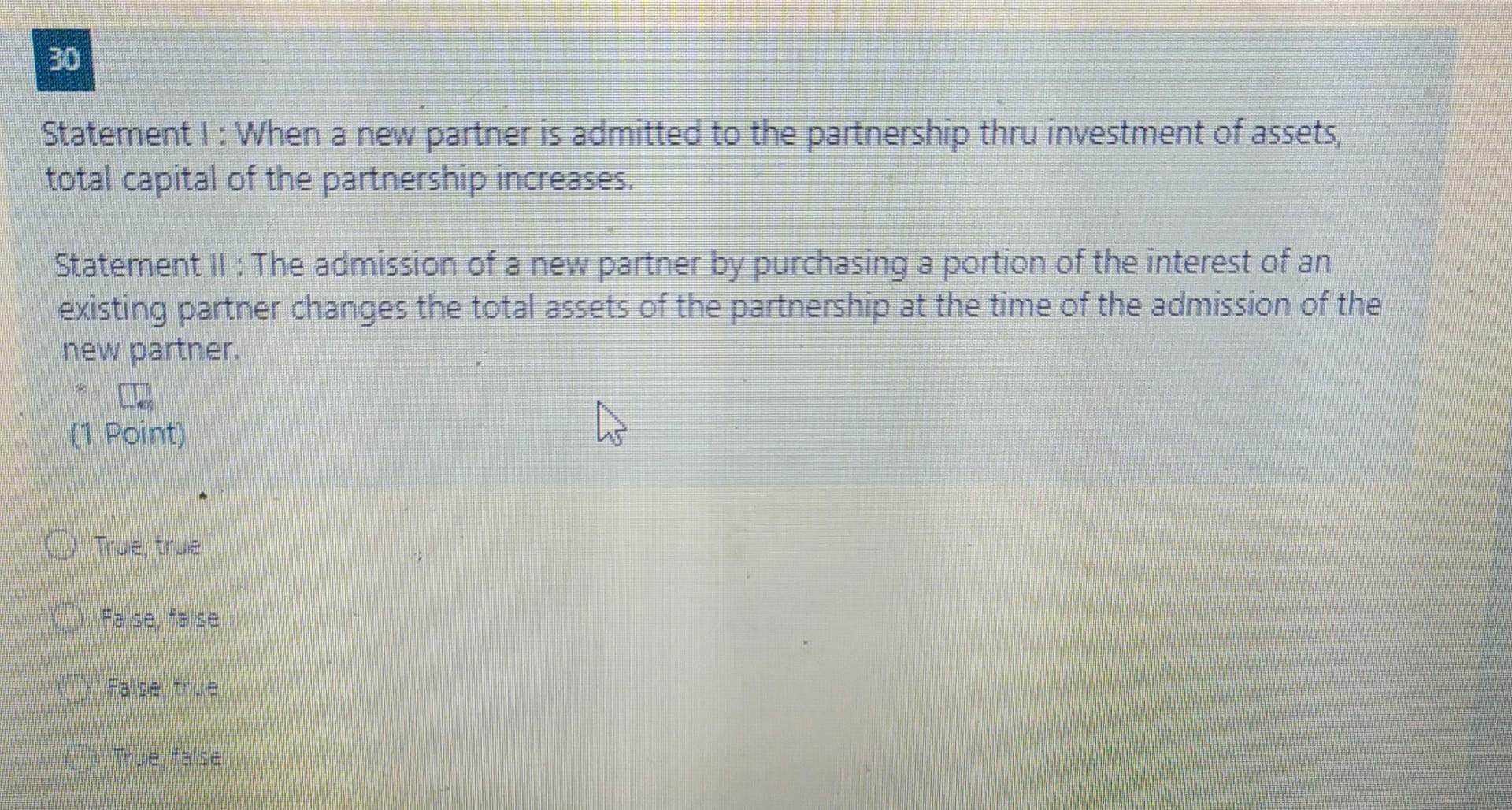

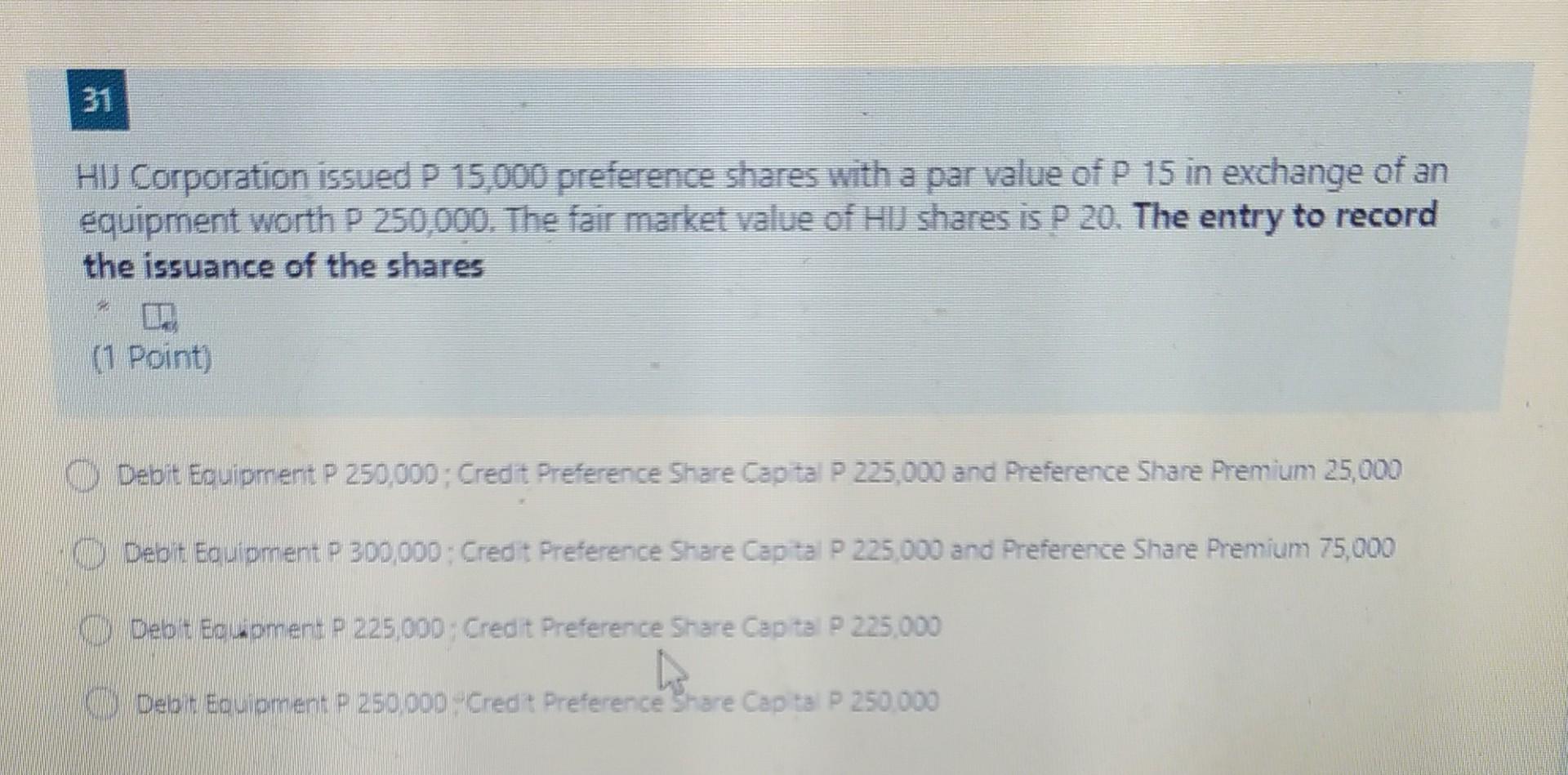

Statement 1: When a partner sells an interest to a new partner at an amount that exceeds the carrying amount of the equity sold, the difference is recognized as a personal gain of the selling partner from the transaction. Statement il : The amount of net assets invested of a new partner into an existing partnership is not always equal to the amount credited to his capital account. (1 Point True true On January 1, 2021. ABC Corporation was authorized to issue 2 classes of stocks: 50,000 preference shares with par value of P 50 and 100,000 ordinary shares with par value of P 20. On January 8, 2021. ABC received subscriptions from various subscribers of 20,000 ordinary shares for P 25 per share. 30% from the subscription price were received at subscription date and the balance payable within 60 days. At call date, the balance was not paid and the shares were declared delinquent. A total of P 20,000 was paid for advertising of original unissued shares and delinquent shares and half of the total costs relates to the delinquent shares. At the public auction, ABC Corporation received bios from Jhim -10,000, Janus-9,000 and Ces-12.000. The amount from highest bidder was collected and share certificates were according issued. How many shares will the original subscriber and highest bidder receive? (1 Point) O Origina suscriber - 20.000 : highest bidder- 0 Origine Suscriber - 11000 highest bidder- 9.000 Origina suoscriber - 8000: highest bidder- 12.000 Ongine subscriber - 10000 highest boden. 10 000 Statement I: When a new partner is admitted to the partnership thru investment of assets, total capital of the partnership increases. Statement || : The admission of a new partner by purchasing a portion of the interest of an existing partner changes the total assets of the partnership at the time of the admission of the new partner 11 Point) True true Felse, felse we leerde Cerarse 31 HIJ Corporation issued P 15,000 preference shares with a par value of P 15 in exchange of an equipment worth P 250,000. The fair market value of HU shares is P 20. The entry to record the issuance of the shares (1 Point) (Debit Equipment P 250,000 : Credit Preference Share Captal P 225.000 and Preference Share Premium 25,000 Depit Equipment P300,000: Credit Preference Share Capital P 225 000 and Preference Share Premium 75,000 Debit Equipment p 225,000 Credit Preference Share Cap te P 225.000 h Debt Boulement p 250 000 -Credit Preference Share Capital P 250.000 In the issuance of shares in exchange of non-cash assets, the non- cash asset is recorded in the books of the corporation at the (11 Point) ar market veue of the shares even if the fair market value of the non-cash asse: is determinable Par market ve ue of the non-casi essets or the far market value of the shares whichever is determinade para e o tres are whichever is over bet: entre a mereva ve ci the non-cadresses are the far market value of the shares If A is the total capital of the partnership before the admission of a new partner, B is the total capital of the partnership after the investment of a new partzer, C is the amount of the new partner's investment, and D is the amount of capital credit to the new partner then there is (1 Point) A bonus to the new partnerit B = A - C and D A bor us to the partner + 8 = A - Cand Dsc. Botha and are correct Beth and are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts