Question: Please answer the questions with the required steps. Use the spreadsheet template shown below to complete the answer. 2. Business partners Baliva, Masi, and Romalati

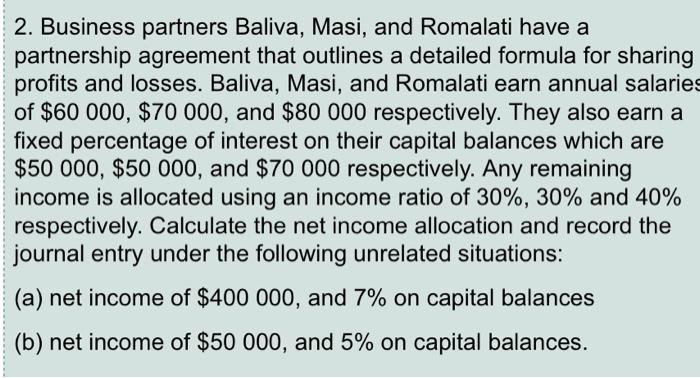

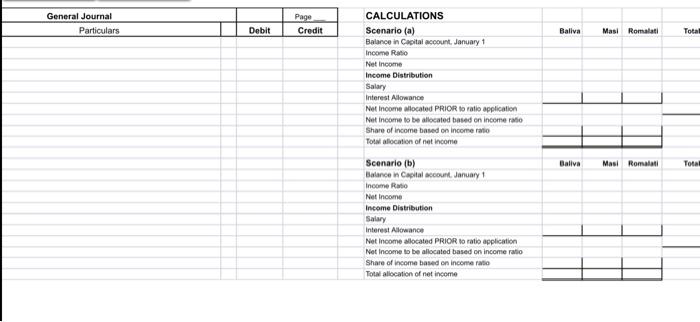

2. Business partners Baliva, Masi, and Romalati have a partnership agreement that outlines a detailed formula for sharing profits and losses. Baliva, Masi, and Romalati earn annual salaries of $60 000, $70 000, and $80 000 respectively. They also earn a fixed percentage of interest on their capital balances which are $50 000, $50 000, and $70 000 respectively. Any remaining income is allocated using an income ratio of 30%, 30% and 40% respectively. Calculate the net income allocation and record the journal entry under the following unrelated situations: (a) net income of $400 000, and 7% on capital balances (b) net income of $50 000, and 5% on capital balances. General Journal Particulars Page Credit Debit Baliva Masi Romalati Total CALCULATIONS Scenario (a) Balance in Capital account, January 1 Income Ratio Net Income Income Distribution Salary Interest Allowance Net Income located PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Tot allocation of net income Baliva Masl Romani Total Scenario (b) Balance in Capital count, January 1 Income Ratio Net Income Income Distribution Salary Interest Allowance Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts