Question: Please answer the second picture based off of the first pictures questions Bal Clinton reportedly was paid $15,0 mition to wrise his book My LAe.

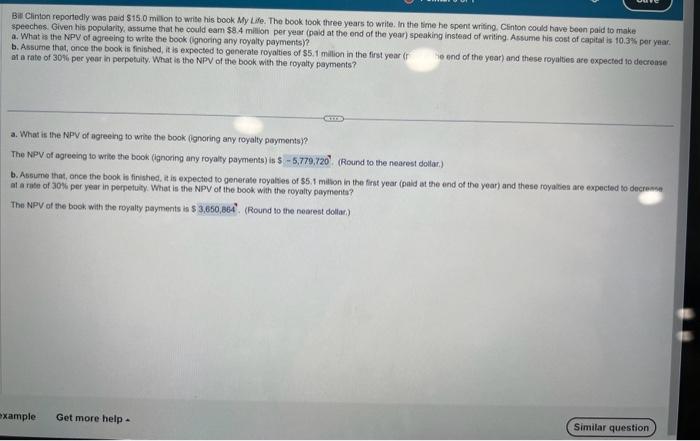

Bal Clinton reportedly was paid \$15,0 mition to wrise his book My LAe. The book took three years to write, in the time he spent writing. CSinton could have beon paid to make speechos. Given his popularity, assume that he could eam $8.4 millon peryear (pald at the ond of the year) speaking instead of writing. Assume his cost of capital is 10.3\%4 por year. a. What is the NPV of agreeing to write the book (lignoring any royalty payments)? b. Assume that, once the book is finished, it is expocted to gonerate royalties of $5. 1 million in the first year (I It a rate of 30%6 per year in perpotuity, What is the NPV of the book with the roynlty payments? ie end of the yoar) and these royalties are expected to decrense a. What is the NPVV of agreeing to white the book (ignoring any royalty poyments)? The NPV of agreeing to wite the book (ignoring any royalty payments) is ? (Round to the nearest dollar.) b. Assume that, ance the book is finshed, it is expected to generale toyathes of $5.1 mallon in the first year (paid at the end of the year) and these royabes are expected to decrewse at a rute of 30 so per year in perpetuity. What is the NPV of the book with the royalty paythenta? The NPV of the baok, with the royalty thayments in 5 (Round to the nearest dollan) Bil Clirice reportediy was paid $15.0m ilion to write his book M, Life. The book took three years to wiise. In the time he spent writing, Clinton could tiwie been paid tro make specches. Given his popularity, assume that he could cam $8.3 millon per year (poid at the end of the year) speaking instead of writing. Assume his cost of capital is 9.6% per year a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? b. Assume that, once the book is finished, is is expocted to genecale royalties of $5.1 million in the first year (paid at the end of the year) and these royallies are expected to decrease at a tate of 30% per year in perpetuity. What is the NPV of the book with the royaty payments? a. What is the NPV of agreeing to write the book (ignoeing any royaty payments)? The NPV of agreeing to write the bcok (-gnoring any royaly payments) is s (Round to the nearest dolar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts