Question: PLEASE ANSWER THE SECOND QUESTION ASAP!!! During 2020 , Rafael Corp. produced 46,700 units and sold 37,360 for $17 per unit. Variable manufacturing costs were

PLEASE ANSWER THE SECOND QUESTION ASAP!!!

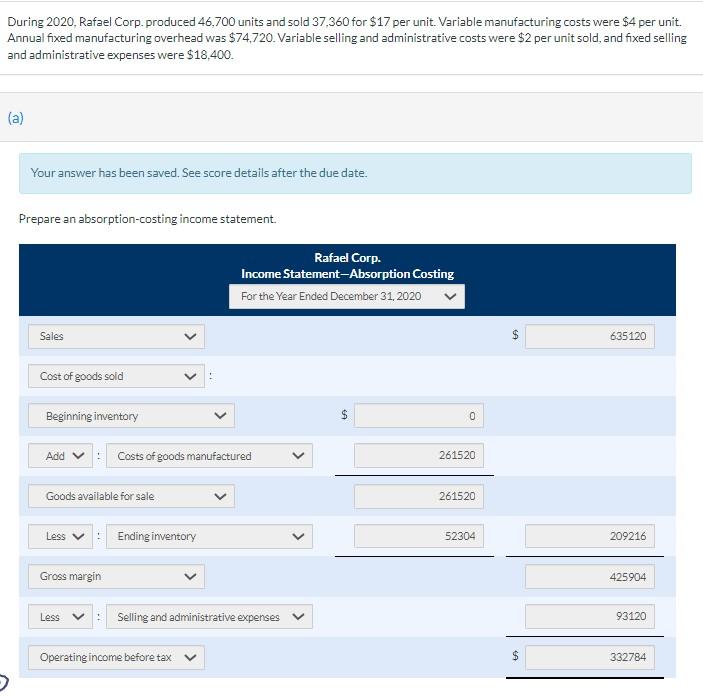

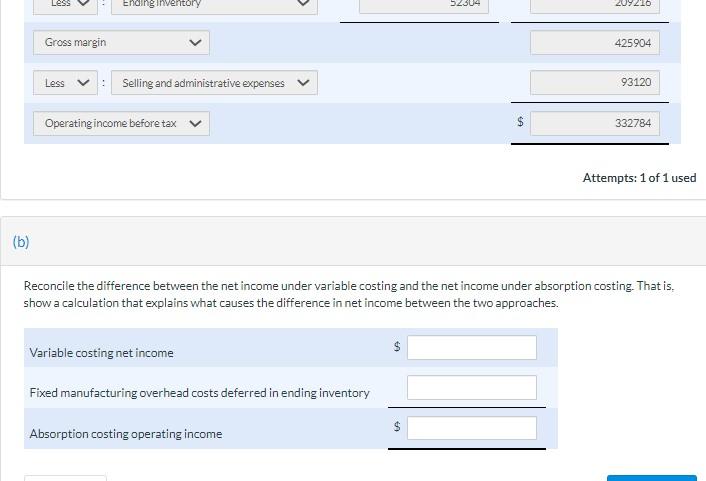

During 2020 , Rafael Corp. produced 46,700 units and sold 37,360 for $17 per unit. Variable manufacturing costs were $4 per unit. Annual fixed manufacturing overhead was $74,720. Variable selling and administrative costs were $2 per unit sold, and fixed selling and administrative expenses were $18,400. (a) Your answer has been saved. See score details after the due date. Prepare an absorotion-costing income statement. Reconcile the difference between the net income under variable costing and the net income under absorption costing. That is, show a calculation that explains what causes the difference in net income between the two approaches

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts