Question: please answer the second question Large owned 80% of Small, In Year 1, Large sold land with a book value of $500,000 to Small. The

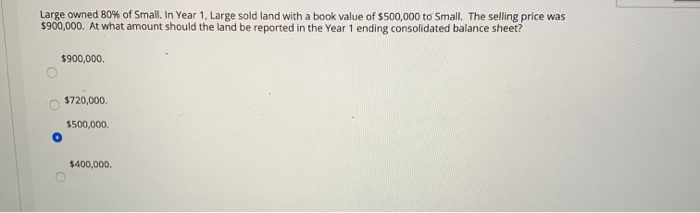

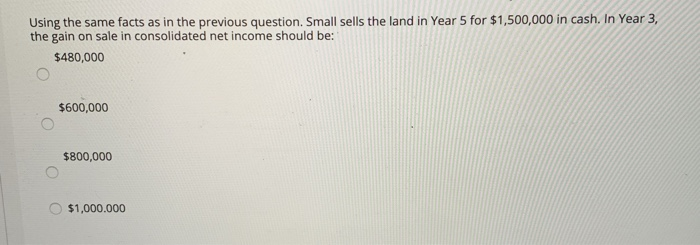

Large owned 80% of Small, In Year 1, Large sold land with a book value of $500,000 to Small. The selling price was $900,000. At what amount should the land be reported in the Year 1 ending consolidated balance sheet? $900,000 $720,000 $500,000 $400,000 Using the same facts as in the previous question. Small sells the land in Year 5 for $1,500,000 in cash. In Year 3, the gain on sale in consolidated net income should be: $480,000 $600,000 $800,000 $1.000.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts