Question: please answer the second question Q4. This question concerns the following binomial model for the 1-year LIBOR rate. The current rate is r(0, 1) =r=

please answer the second question

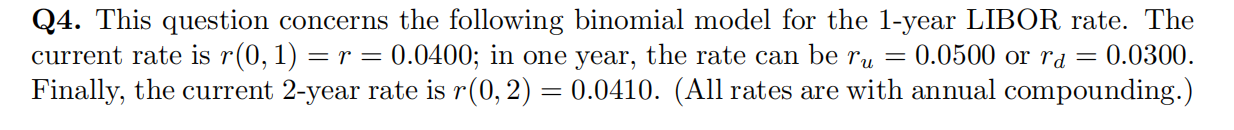

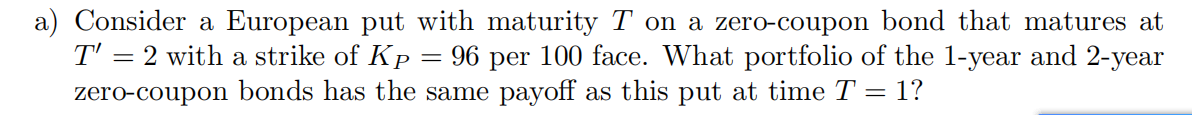

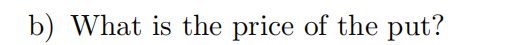

Q4. This question concerns the following binomial model for the 1-year LIBOR rate. The current rate is r(0, 1) =r= 0.0400; in one year, the rate can be ru = 0.0500 or rd = 0.0300. Finally, the current 2-year rate is r(0, 2) = 0.0410. (All rates are with annual compounding.) = a) Consider a European put with maturity T on a zero-coupon bond that matures at T' = 2 with a strike of Kp = 96 per 100 face. What portfolio of the 1-year and 2-year zero-coupon bonds has the same payoff as this put at time T = 1? b) What is the price of the put? Q4. This question concerns the following binomial model for the 1-year LIBOR rate. The current rate is r(0, 1) =r= 0.0400; in one year, the rate can be ru = 0.0500 or rd = 0.0300. Finally, the current 2-year rate is r(0, 2) = 0.0410. (All rates are with annual compounding.) = a) Consider a European put with maturity T on a zero-coupon bond that matures at T' = 2 with a strike of Kp = 96 per 100 face. What portfolio of the 1-year and 2-year zero-coupon bonds has the same payoff as this put at time T = 1? b) What is the price of the put

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts