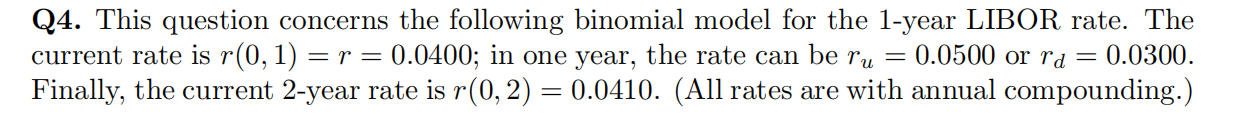

Question: Q4. This question concerns the following binomial model for the 1-year LIBOR rate. The current rate is r(0, 1) =r= 0.0400; in one year, the

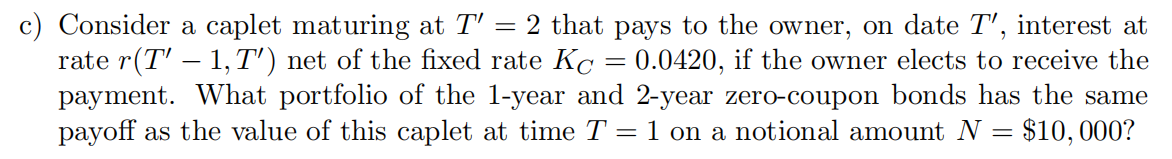

Q4. This question concerns the following binomial model for the 1-year LIBOR rate. The current rate is r(0, 1) =r= 0.0400; in one year, the rate can be ru = 0.0500 or rd = 0.0300. Finally, the current 2-year rate is r(0, 2) = 0.0410. (All rates are with annual compounding.) = = c) Consider a caplet maturing at T' = 2 that pays to the owner, on date T', interest at rate r(T' 1,T') net of the fixed rate Kc = 0.0420, if the owner elects to receive the payment. What portfolio of the 1-year and 2-year zero-coupon bonds has the same payoff as the value of this caplet at time T =1 on a notional amount N = $10,000? = Q4. This question concerns the following binomial model for the 1-year LIBOR rate. The current rate is r(0, 1) =r= 0.0400; in one year, the rate can be ru = 0.0500 or rd = 0.0300. Finally, the current 2-year rate is r(0, 2) = 0.0410. (All rates are with annual compounding.) = = c) Consider a caplet maturing at T' = 2 that pays to the owner, on date T', interest at rate r(T' 1,T') net of the fixed rate Kc = 0.0420, if the owner elects to receive the payment. What portfolio of the 1-year and 2-year zero-coupon bonds has the same payoff as the value of this caplet at time T =1 on a notional amount N = $10,000? =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts