Question: Please answer the second question using the table of information above showing all work. Thanks Use the following information for questions 1 and 2 Borrower

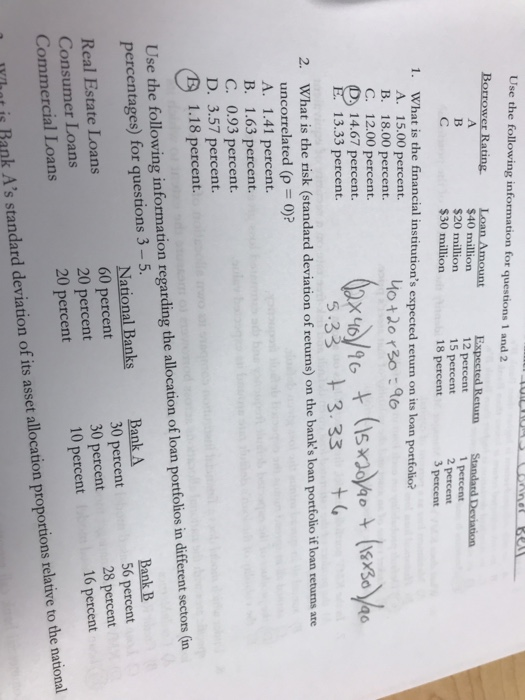

Use the following information for questions 1 and 2 Borrower Rating. $40 million $20 million $30 million Expested Retum Standard Deviation 12 percent 15 percent 18 percent 1 percent 2 percent 3 percent 1. What is the financial institution's expected return on its loan portfolio? A. 15.00 percent. B. 18.00 percent. C. 12.00 percent. 14.67 percent. 13.33 percent. 40 t 20 r30:96 5.33 3.33 + What is the risk (standard deviation of returns) on the bank's loan portfolio if loan returns ate uncorrelated (p 0)? A. 1.41 percent. B. 1.63 percent. C. 0.93 percent. D. 3.57 percent. 1.18 percent. Use the following information regarding the allocation of loan portfolios in different sectors (n percentages) for questions 3-5. National Banks 60 percent 20 percent 20 percent Bank B 56 percent 28 percent 16 percent 30 percent Real Estate Loans Consumer Loans Commercial Loans 30 percent 10 percent is Bank A's standard deviation of its asset allocation proportions relative to the national whet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts